[Focus on hot topics]

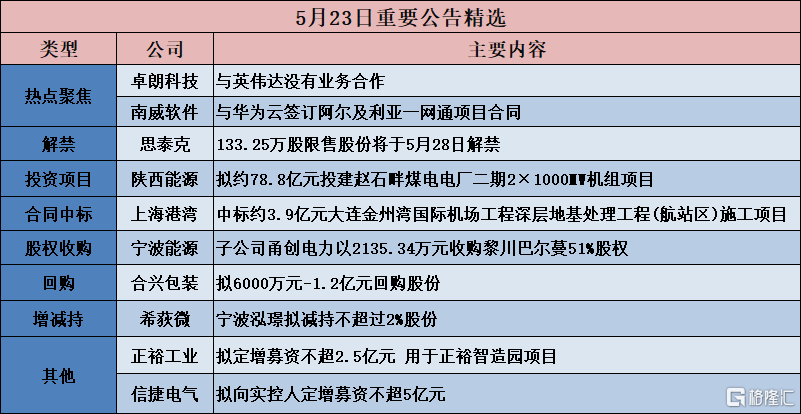

Zhuolang Technology (600225.SH): No business partnership with Nvidia

Zhuolang Technology (600225.SH) announced a stock trading risk warning notice. According to relevant media information, the company was listed as an Nvidia concept stock. After self-inspection, the company had no business cooperation with NVIDIA (NVIDIA).

Nanwei Software (603636.SH): Signed a Netcom project contract with HUAWEI CLOUD in Algeria

Nanwei Software (603636.SH) announced that in order to accelerate the implementation of the company's globalization strategy and better expand overseas business, the company signed a Netcom project contract with HUAWEI CLOUD Computing Technology Co., Ltd. (“HUAWEI CLOUD”) in Algeria. The total amount of the contract signed this time was RMB 53.6876 million (tax included), accounting for 3.20% of the company's audited revenue in 2023.

[Investment projects]

[Investment projects]

Olay New Materials (688530.SH): Plans to increase capital of 50 million yuan to Hefei Ole for high-end sputtering target production base project (Phase I)

Ole New Materials (688530.SH) announced that in order to successfully advance the construction of the company's fund-raising project, the company plans to increase capital by 50 million yuan to its wholly-owned subsidiary Hefei Ole Advanced Materials Co., Ltd. (“Hefei Ole”) for the high-end sputtering target production base project (Phase I), using raised capital of 37.5799 million yuan and using its own capital of 124.201 million yuan; at the same time, it also plans to increase capital by 95 million yuan to the wholly-owned subsidiary Guangdong Oulai New Metal Materials Co., Ltd. (“Ole Metal”) for the high-purity oxygen-free copper production base construction project. The capital was 918.494 million yuan, using own capital of 3.156,600 yuan. After the capital increase is completed, the registered capital of Hefei Ole will increase to 80 million yuan, which is still a wholly-owned subsidiary of the company; Ole Metal's registered capital will increase to 145 million yuan, which is still a wholly-owned subsidiary of the company.

Shaanxi Energy (001286.SZ): Plans to invest about 7.88 billion yuan to build the Zhaoshipan Coal Power Plant Phase II 2×1000MW unit project

Shaanxi Energy (001286.SZ) announced that the company plans to fund the construction of the second phase 2×1000MW ultra-supercritical air-cooled coal-fired generator set for the Zhaoshipan Power Plant. The project is intended to be used as a supporting power source for the transmission channel from Shaanxi to Henan. The project has a dynamic investment of about 7.88 billion yuan, of which the project capital accounts for 20%, and the rest of the project is funded through loans. The project plans to build a 2×1000MW ultra-supercritical air cooling unit and simultaneously construct a limestone-gypsum wet desulfurization facility and denitrification device. The proposed site for the project is located on the west side of Zhaoshipan Jingtian in the southern district of Yuheng Mining Area in Yulin, Shaanxi. The west side is close to the Baomao Expressway and the south side is close to the Zhaoshipan coal mine industrial site.

[Contract won the bid]

Shanghai Port (605598.SH): Won a bid of about 390 million yuan for the Dalian Jinzhou Bay International Airport Project Deep Foundation Treatment Project (Terminal Area) construction project

Shanghai Port (605598.SH) announced that recently, the company, China Construction Eighth Engineering Bureau Co., Ltd. and China Construction Infrastructure Co., Ltd. formed a consortium to participate in the bidding for the Dalian Jinzhouwan International Airport Project Deep Foundation Treatment Project (Terminal Area) construction project (“this project” for short). According to the bid evaluation, the consortium was the winning bidder for this project, and the winning bid amount was about 390 million yuan.

[[Share acquisition]

Ningbo Energy (600982.SH): Subsidiary Yongchuang Electric Power acquired 51% of Lichuan Balman's shares for 21.3534 million yuan

Ningbo Energy (600982.SH) announced that in order to further expand the green heating business and help the company achieve its industrial transformation and upgrading goals, Yongchuang Electric Power, a holding subsidiary of the company, acquired 51% of Lichuan Balman's shares held by Shanghai Huazhibang at a price of 21.353,400 yuan through capital increase and share expansion. Lichuan Balman's main business is to develop biomass centralized heating in the Lichuan County Industrial Park in Jiangxi Province. This transaction will help Yongchuang Electric Power improve its operating capacity and core competitiveness, help the company further expand its green heating business, and achieve the goal of industrial transformation and upgrading.

Chlor-Alkali Chemical (600618.SH): Proposed acquisition of 40% shares in Guangxi Chlor-Alkali

Chlor-Alkali Chemical (600618.SH) announced that the company's subsidiary Guangxi Chlor-Alkali invested in the construction of 300,000 tons/year caustic soda and 400,000 tons/year polyvinyl chloride project (“Guangxi Qinzhou Project”) in Qinzhou, Guangxi in 2019. During the construction of the project, due to the company's limited capital, Shanghai Huayi, the controlling shareholder of the company, co-funded the construction with the company. In November 2022, the Guangxi Qinzhou project was completed and put into operation. In order to increase the profits of listed companies and increase shareholder returns of listed companies, the company plans to acquire 40% of Guangxi chlor-alkali shares in cash to achieve 100% ownership of Guangxi chlor-alkali. The company and Shanghai Huayi plan to sign a share transfer agreement in the near future. The company used its own capital of RMB 68,5082 million to acquire 40% of Shanghai Huayi's shares. The transaction was based on the valuation value of RMB 1712.705 million of Guangxi's 100% shares on the evaluation reference date of December 31, 2023 (ultimately based on the valuation value confirmed by the State-owned Assets Administration Department). After the above share acquisition is completed, the company will hold 100% of Guangxi Chlor-Alkali's shares, and Guangxi Chlor-Alkali will become a wholly-owned subsidiary of the company. Up to now, Shanghai Huayi has invested a total of 621.0778 million yuan in Guangxi chlor-alkali. The acquisition of 40% of the Guangxi chlor-alkali shares held by Shanghai Huayi has not yet been paid 63.28,000 yuan. After this share acquisition, the company will fulfill its actual payment obligations.

Yifei Laser (688646.SH): Plans to acquire 51% of Xinjuli's shares

Yifei Laser (688646.SH) announced that on May 23, 2024, the company signed an “Equity Transfer Agreement” with counterparty Zhao Laigen and other existing shareholders of Xinjuli. The company plans to use its own capital of RMB 30 million to purchase 51% of the target company's shares held by Zhao Laigen (corresponding registered capital of RMB 31.22,300, of which the paid-in registered capital is RMB 1,2273 million), and assumes the obligation to pay the unpaid contributions in the underlying shares after transferring the shares. After the transaction is completed, Xinjuli will become the company's holding subsidiary. Xinjuli is an EPC-level smart logistics system solution service provider integrating planning and design, software development, digital twins, equipment manufacturing, engineering implementation, and after-sales service. Its products are widely used in new energy batteries, semiconductors, consumer electronics, healthcare and other industries. Xinjuli's main products include complete logistics systems for new energy battery plants, semiconductor CIM software, semiconductor AMHS equipment, intelligent warehousing and logistics systems, automated transportation and sorting systems, digital factory visualization platform systems, smart factory information management systems, and logistics line core equipment supply services.

Xinguang Optoelectronics (688011.SH): Plans to transfer 12.5% of Zhongjiu Shinkong's shares

Xinguang Optoelectronics (688011.SH) announced that according to the company's development strategy, in order to make full use of the comprehensive resource advantages of the subsidiary Zhongjiu Xinguang shareholder, to further support the better and faster development of Zhongjiu Xinguang, to promote the continuous advancement, development and practical application of laser technology, and create better investment returns for all shareholders, the company plans to transfer 12.5% of the holding subsidiary Zhongjiu Shinkong's shares to Nakaku Shinko at a transaction price of 1,605,437.50 yuan. Proceeds will be used for the company's daily production and operation activities.

[Ban lifted]

Steck (301568.SZ): The ban on 1.332,500 restricted shares will be lifted on May 28

Steck (301568.SZ) announced an indicative announcement regarding the initial public offering of restricted shares for offline placement. The total number of shareholders whose restrictions have been lifted is 6,880. The number of shares that have been lifted is 1,3324.98 million shares, accounting for 1.29% of the total share capital. The sales restriction period is 6 months from the date of the company's initial public offering and listing; the listing and circulation date for the shares that have been lifted is May 28, 2024 (Tuesday).

[Repurchase]

Hexing Packaging (002228.SZ): Plans to repurchase shares for 60 million yuan to 120 million yuan

Hexing Packaging (002228.SZ) announced that it plans to use its own funds to repurchase the company's shares through centralized bidding. The share repurchase amount is not less than RMB 60 million (inclusive) and not more than RMB 120 million (inclusive), and the repurchase price is not more than RMB 4.06 per share (not more than 150% of the average stock transaction price in the 30 trading days prior to the board's repurchase decision). Under the condition that the repurchase price does not exceed RMB 4.06 per share, the estimated number of shares to be repurchased is approximately 29,556,650 shares, accounting for about 2.42% of the company's current total share capital; based on the lower limit of the repurchase amount, the estimated number of shares to be repurchased is about 14,778,325 shares, accounting for about 1.21% of the company's current total share capital. The specific number of repurchases is based on the actual number of shares repurchased at the end of the repurchase period. The share repurchase period is 12 months from the date the board of directors reviewed and approved the share repurchase plan.

Crystal Integration (688249.SH): 2.00% of the company's shares have been cumulatively repurchased

Crystal Integration (688249.SH) announced that as of May 22, 2024, the company had repurchased a total of 40.156 million shares of the company's shares through centralized bidding transactions, accounting for 2.00% of the company's total share capital, an increase of 0.58% compared with the previous disclosure. The highest price of the repurchase transaction was 15.31 yuan/share, the lowest price was 12.97 yuan/share, and the total amount of capital paid was RMB 571 million.

[Increase or decrease holdings]

Hongying Intelligence (001266.SZ): Hantai Venture Capital plans to reduce its holdings by no more than 2.65%

Hongying Intelligence (001266.SZ) announced that the shareholders of Shanghai Taili Venture Capital Management Co., Ltd. - Shanghai Hantai Venture Capital Partnership (Limited Partnership) (“Hantai Venture Capital”), which holds 2,755,600 shares (2.66% of the company's total share capital), plan to reduce the company's total share holdings through bulk transactions or centralized bidding within 3 months after 3 trading days from the date of disclosure of the announcement (accounting for 2.65% of the company's total share capital).

Xidiwei (688173.SH): Ningbo Hongjing plans to reduce its shares by no more than 2%

Xidiwei (688173.SH) announced that on May 23, 2024, the company received the “Notice Letter on the Xidi Microelectronics Group Co., Ltd. Share Reduction Plan” issued by Ningbo Hongjing. Ningbo Hongjing continues to be optimistic about the company's prospects. In order to meet its own capital needs, it plans to reduce the total number of company shares held by no more than 8,195,014 shares through centralized bidding, accounting for no more than 2.00% of the total share capital of the company. No more than 1.00%. The holdings reduction period is within 3 months after the 15 trading days disclosed in this announcement; the holdings were reduced by no more than 4,097,507 shares through bulk transactions, accounting for no more than 1.00% of the total share capital of the company. The holdings reduction period is within 3 months after the 15 trading days disclosed in this announcement.

Ruineng Technology (603933.SH): The controlling shareholder Ruineng Industrial plans to reduce its holdings by no more than 0.9513%

Ruineng Technology (603933.SH) announced that the controlling shareholder, Ruineng Industrial, plans to reduce its holdings of the company's shares by no more than 2 million shares through centralized bidding, and the total number of reduced shares will not exceed 0.9513% of the total number of shares of the company.

[Other]

Chukyo Electronics (002579.SZ): Plans to raise no more than 300 million yuan in capital for the Chukyo New Energy Power and Energy Storage Battery FPC Application Module Project (Phase 1), etc.

Chukyo Electronics (002579.SZ) announced a plan to issue shares to specific targets using a simple procedure. The number of shares to be issued is determined by dividing the total amount of capital raised by the issuance price, and does not exceed 30% of the company's total share capital before this issuance. This offering uses a simple procedure to issue shares to specific targets. The distribution targets are no more than 35 specific targets (including 35), and all issuers subscribe in cash. The shares issued this time are not transferable for 6 months from the date of listing. The total capital raised in this issuance is no more than 300 million yuan (including capital), no more than 300 million yuan, and no more than 20% of the net assets at the end of the year. After deducting the issuance fee, 210 million yuan will be used for the Zhongjing New Energy Power and Energy Storage Battery FPC Application Module Project (Phase 1), 90,000 yuan to supplement working capital, and to repay bank loans.

Xinjie Electric (603416.SH): Plans to raise no more than 500 million yuan in capital from actual controllers

Xinjie Electric (603416.SH) announced plans to issue shares to specific targets in 2024. The target of this issuance is Mr. Li Xin, the actual controller of the company. The issuer subscribes to the shares issued in cash. The total capital raised in this release does not exceed 500 million yuan (including the number of copies). After deducting the issuance fee, it is intended to be used for the following projects: enterprise technology center phase II construction project, marketing network and product display center construction project, and supplementary working capital.

Zhengyu Industrial (603089.SH): Plans to raise no more than 250 million yuan in capital for the Zhengyu Smart Landscape Project

Zhengyu Industrial (603089.SH) announced a plan to issue shares to specific targets in 2024 using a simple procedure. The total amount of capital to be raised in this offering will not exceed 250 million yuan (inclusive). The net amount of the raised capital after deducting the issuance fee will be used for the Zhengyu Smart Landscaping Project.

【投资项目】

【投资项目】