The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Continental Aerospace Technologies Holding (HKG:232). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Fast Is Continental Aerospace Technologies Holding Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that Continental Aerospace Technologies Holding grew its EPS from HK$0.0055 to HK$0.017, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the one hand, Continental Aerospace Technologies Holding's EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

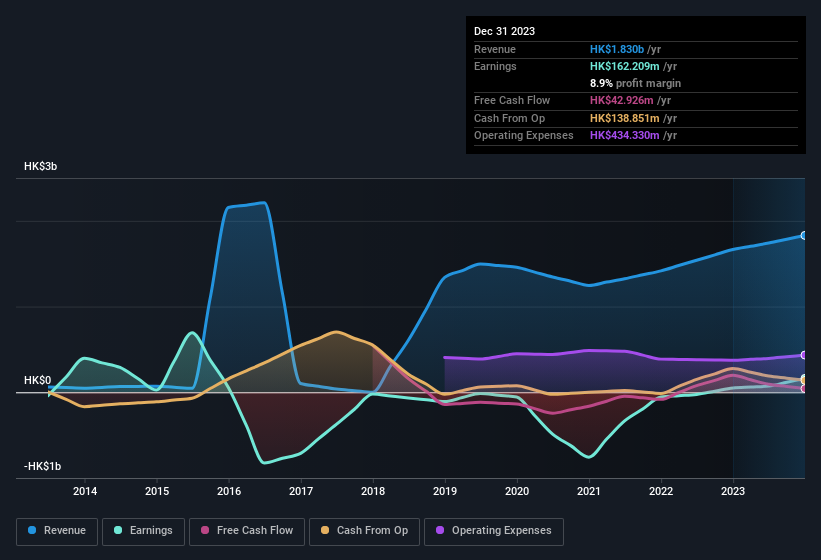

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Continental Aerospace Technologies Holding is no giant, with a market capitalisation of HK$1.7b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Continental Aerospace Technologies Holding Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Continental Aerospace Technologies Holding shareholders is that no insiders reported selling shares in the last year. Add in the fact that Xiaodong Yu, the CEO & Executive Director of the company, paid HK$94k for shares at around HK$0.075 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Continental Aerospace Technologies Holding.

Recent insider purchases of Continental Aerospace Technologies Holding stock is not the only way management has kept the interests of the general public shareholders in mind. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to Continental Aerospace Technologies Holding, with market caps between HK$781m and HK$3.1b, is around HK$2.7m.

Continental Aerospace Technologies Holding offered total compensation worth HK$1.8m to its CEO in the year to December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Continental Aerospace Technologies Holding Deserve A Spot On Your Watchlist?

Continental Aerospace Technologies Holding's earnings per share growth have been climbing higher at an appreciable rate. The company can also boast of insider buying, and reasonable remuneration for the CEO. It could be that Continental Aerospace Technologies Holding is at an inflection point, given the EPS growth. If so, then its potential for further gains probably merit a spot on your watchlist. Even so, be aware that Continental Aerospace Technologies Holding is showing 1 warning sign in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Continental Aerospace Technologies Holding, you'll probably love this curated collection of companies in HK that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.