Fewer Investors Than Expected Jumping On Zhuzhou Huarui Precision Cutting Tools Co.,Ltd. (SHSE:688059)

Fewer Investors Than Expected Jumping On Zhuzhou Huarui Precision Cutting Tools Co.,Ltd. (SHSE:688059)

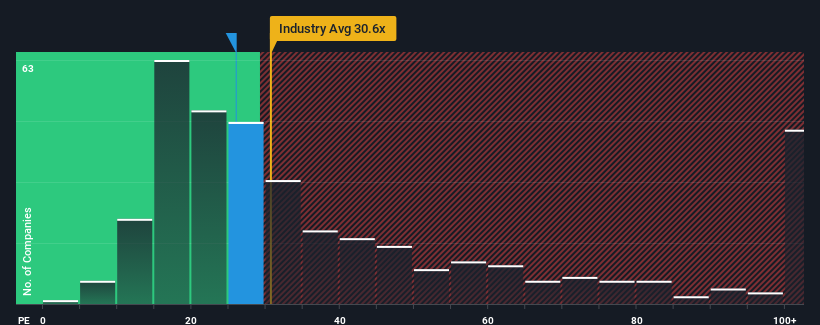

Zhuzhou Huarui Precision Cutting Tools Co.,Ltd.'s (SHSE:688059) price-to-earnings (or "P/E") ratio of 26x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 33x and even P/E's above 61x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent earnings growth for Zhuzhou Huarui Precision Cutting ToolsLtd has been in line with the market. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Zhuzhou Huarui Precision Cutting ToolsLtd's is when the company's growth is on track to lag the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. The longer-term trend has been no better as the company has no earnings growth to show for over the last three years either. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 52% over the next year. That's shaping up to be materially higher than the 38% growth forecast for the broader market.

In light of this, it's peculiar that Zhuzhou Huarui Precision Cutting ToolsLtd's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Zhuzhou Huarui Precision Cutting ToolsLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Zhuzhou Huarui Precision Cutting ToolsLtd is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If you're unsure about the strength of Zhuzhou Huarui Precision Cutting ToolsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.