As an investor, mistakes are inevitable. But really bad investments should be rare. So spare a thought for the long term shareholders of Changchun High-Tech Industry (Group) Co., Ltd. (SZSE:000661); the share price is down a whopping 73% in the last three years. That'd be enough to cause even the strongest minds some disquiet. And the ride hasn't got any smoother in recent times over the last year, with the price 32% lower in that time.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, Changchun High-Tech Industry (Group) actually managed to grow EPS by 11% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

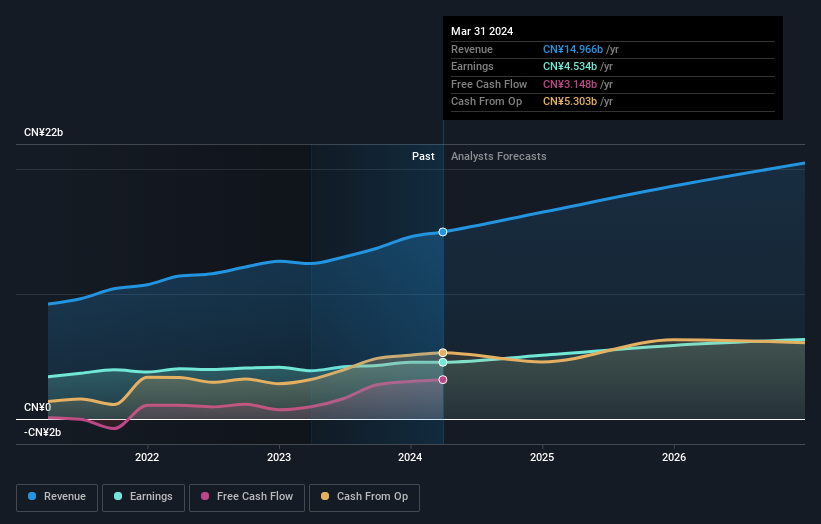

Revenue is actually up 15% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Changchun High-Tech Industry (Group) further; while we may be missing something on this analysis, there might also be an opportunity.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling Changchun High-Tech Industry (Group) stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We regret to report that Changchun High-Tech Industry (Group) shareholders are down 30% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 7.4%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Keeping this in mind, a solid next step might be to take a look at Changchun High-Tech Industry (Group)'s dividend track record. This free interactive graph is a great place to start.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.