Chinasoft International (HKG:354) has had a rough three months with its share price down 16%. We, however decided to study the company's financials to determine if they have got anything to do with the price decline. Long-term fundamentals are usually what drive market outcomes, so it's worth paying close attention. Specifically, we decided to study Chinasoft International's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Chinasoft International is:

6.1% = CN¥713m ÷ CN¥12b (Based on the trailing twelve months to December 2023).

The 'return' refers to a company's earnings over the last year. That means that for every HK$1 worth of shareholders' equity, the company generated HK$0.06 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don't share these attributes.

Chinasoft International's Earnings Growth And 6.1% ROE

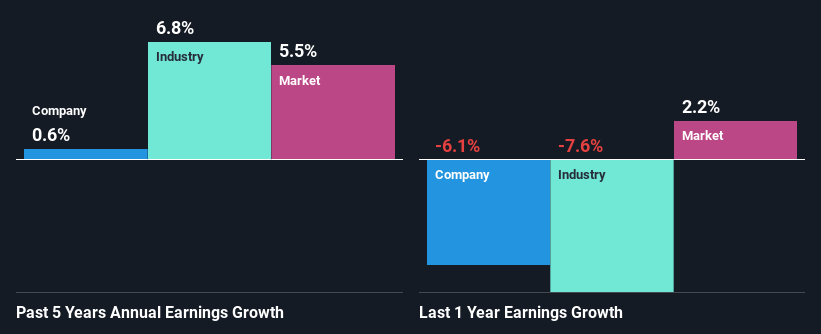

At first glance, Chinasoft International's ROE doesn't look very promising. However, given that the company's ROE is similar to the average industry ROE of 7.1%, we may spare it some thought. Still, Chinasoft International has seen a flat net income growth over the past five years. Remember, the company's ROE is not particularly great to begin with. So that could also be one of the reasons behind the company's flat growth in earnings.

As a next step, we compared Chinasoft International's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 6.8% in the same period.

Earnings growth is an important metric to consider when valuing a stock. It's important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Chinasoft International's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Chinasoft International Making Efficient Use Of Its Profits?

Chinasoft International's low three-year median payout ratio of 6.5% (implying that the company keeps94% of its income) should mean that the company is retaining most of its earnings to fuel its growth and this should be reflected in its growth number, but that's not the case.

In addition, Chinasoft International has been paying dividends over a period of seven years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to rise to 30% over the next three years. Regardless, the future ROE for Chinasoft International is speculated to rise to 9.6% despite the anticipated increase in the payout ratio. There could probably be other factors that could be driving the future growth in the ROE.

Summary

In total, we're a bit ambivalent about Chinasoft International's performance. While the company does have a high rate of profit retention, its low rate of return is probably hampering its earnings growth. That being so, the latest analyst forecasts show that the company will continue to see an expansion in its earnings. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.