Investors are understandably disappointed when a stock they own declines in value. But no-one can make money on every call, especially in a declining market. The Shanghai Chinafortune Co., Ltd. (SHSE:600621) is down 20% over three years, but the total shareholder return is -18% once you include the dividend. That's better than the market which declined 21% over the last three years. The falls have accelerated recently, with the share price down 11% in the last three months.

After losing 5.3% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

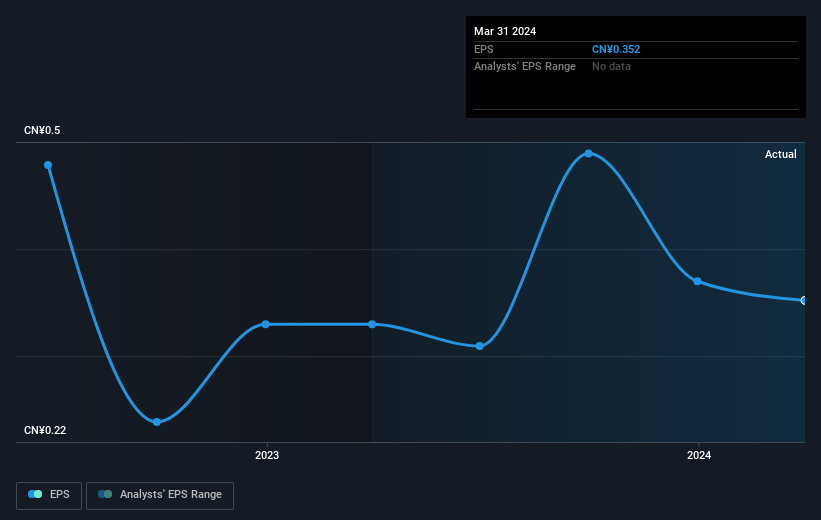

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Shanghai Chinafortune saw its EPS decline at a compound rate of 19% per year, over the last three years. This fall in the EPS is worse than the 7% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Shanghai Chinafortune's key metrics by checking this interactive graph of Shanghai Chinafortune's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Shanghai Chinafortune, it has a TSR of -18% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Shanghai Chinafortune shareholders have received a total shareholder return of 21% over one year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 1.8% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Shanghai Chinafortune (1 is concerning) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.