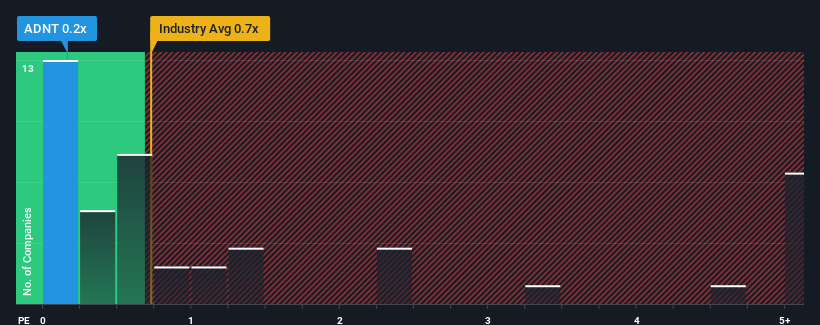

You may think that with a price-to-sales (or "P/S") ratio of 0.2x Adient plc (NYSE:ADNT) is a stock worth checking out, seeing as almost half of all the Auto Components companies in the United States have P/S ratios greater than 0.7x and even P/S higher than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Adient Has Been Performing

Recent times haven't been great for Adient as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Adient.How Is Adient's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Adient's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 3.0%. Revenue has also lifted 18% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 1.0% per annum during the coming three years according to the ten analysts following the company. That's shaping up to be materially lower than the 19% per annum growth forecast for the broader industry.

With this information, we can see why Adient is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Adient's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Adient's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 2 warning signs for Adient (1 is potentially serious!) that we have uncovered.

If you're unsure about the strength of Adient's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.