Hangzhou Alltest Biotech Co., Ltd. (SHSE:688606) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 16% in that time.

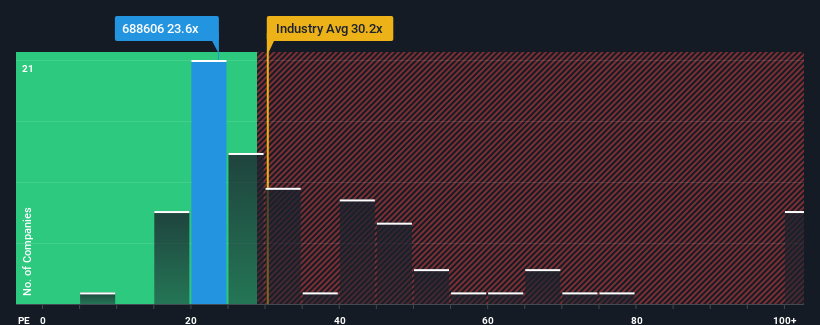

Although its price has dipped substantially, Hangzhou Alltest Biotech may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 23.6x, since almost half of all companies in China have P/E ratios greater than 32x and even P/E's higher than 60x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen at a steady rate over the last year for Hangzhou Alltest Biotech, which is generally not a bad outcome. It might be that many expect the respectable earnings performance to degrade, which has repressed the P/E. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

Hangzhou Alltest Biotech's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Hangzhou Alltest Biotech's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 4.7%. However, this wasn't enough as the latest three year period has seen an unpleasant 82% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 38% shows it's an unpleasant look.

In light of this, it's understandable that Hangzhou Alltest Biotech's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Key Takeaway

Hangzhou Alltest Biotech's recently weak share price has pulled its P/E below most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Hangzhou Alltest Biotech revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Hangzhou Alltest Biotech (2 are a bit unpleasant) you should be aware of.

You might be able to find a better investment than Hangzhou Alltest Biotech. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.