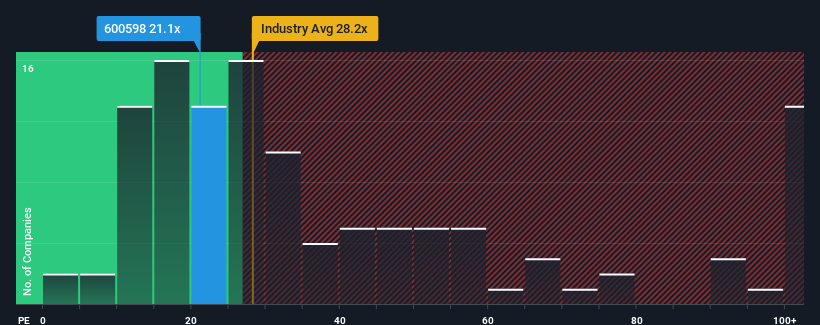

With a price-to-earnings (or "P/E") ratio of 21.1x Heilongjiang Agriculture Company Limited (SHSE:600598) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 32x and even P/E's higher than 60x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

There hasn't been much to differentiate Heilongjiang Agriculture's and the market's earnings growth lately. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Is There Any Growth For Heilongjiang Agriculture?

Heilongjiang Agriculture's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Regardless, EPS has managed to lift by a handy 9.6% in aggregate from three years ago, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 6.7% as estimated by the sole analyst watching the company. With the market predicted to deliver 38% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Heilongjiang Agriculture's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Heilongjiang Agriculture's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Heilongjiang Agriculture that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.