On the evening of May 27, the Shenzhen Stock Exchange and the Shanghai Stock Exchange respectively terminated the IPO reviews of Goerwei and Ola shares.

On May 27, the Shenzhen Stock Exchange terminated the review of Goerwei's initial public offering of shares and listing on the GEM. The reason for this is that Goertek and its sponsor withdrew its listing application. According to regulations, the Shenzhen Stock Exchange decided to terminate its listing review.

Not only Goertek, a chip design company acquired by Shuangcheng Pharmaceutical's actual controller, Ningbo Aola Semiconductor Co., Ltd. (Ola Shares for short) and its sponsor, Haitong Securities, have also terminated the IPO application for the Science and Technology Innovation Board.

A father and son with a pharmaceutical background “crossed the border” to acquire a chip team

According to the announcement on the Shanghai Stock Exchange's official website on May 27, the Shanghai Stock Exchange has terminated the issuance and listing review process for Ola shares.

According to the announcement on the Shanghai Stock Exchange's official website on May 27, the Shanghai Stock Exchange has terminated the issuance and listing review process for Ola shares.

It is worth noting that this is the third time in a week that Haitong Securities has withdrawn its IPO application on the Science and Technology Innovation Board. Previously, Haitong Securities withdrew Dapu Technology's listing application on May 21, and later withdrew Glenruo's listing application on May 22. The case of Ola Shares once again highlights the strict requirements of regulators for the quality of companies listed on the Science and Technology Innovation Board.

Despite the relatively small size of Ola shares, the most recent financial report disclosed when applying for listing showed net assets of only 409 million yuan. However, the company proposed a capital raising plan of up to 3 billion yuan. In response, the Shanghai Stock Exchange requested the company to clarify the compatibility between the scale of capital raised and the company's asset size, personnel size, stage of development, technical strength, and ability to obtain orders. At the same time, the Shanghai Stock Exchange is also concerned about the rationality of the company paying large dividends when undistributed profits are negative.

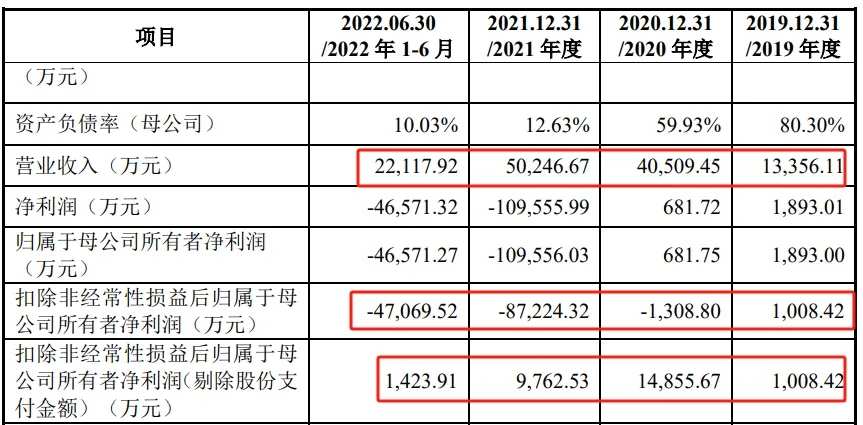

According to the prospectus, Ola shares focus on the development, design and sale of analog chips and digital-analog hybrid chips. During the reporting period, although the company achieved an increase in revenue, net profit continued to lose money. Even after deducting share payment costs associated with equity incentives, net profit fluctuates greatly.

During the reporting period, the company's net profit was 18.93 million yuan, 68,175 million yuan, -1,096 million yuan and -466 million yuan respectively. The cumulative uncompensated loss as of June 30, 2022 was -1,371 billion yuan. According to the company, the main reason was the implementation of equity incentives in 2020, which confirmed high share payment fees in installments.

In each period of the reporting period, the net cash flow from the company's operating activities was -11,188,900 yuan, -277.8818 million yuan and -1,694,400 yuan respectively; monetary fund balances at the end of each period were 18.946 million yuan, 151 million yuan, 625.194 million yuan and 52,194 million yuan, respectively, declining year by year since 2020; the current ratio and acceleration ratio for each period were far below the industry average.

Furthermore, the company faces risks such as high customer concentration, single product revenue structure, and high goodwill brought about by acquisitions.

First, the company's customer concentration is very high. Specifically, in 2019, 2020, 2021, and January-June 2022, revenue from the largest customer accounted for 85%, 92.26%, 84.41%, and 63.66% of revenue, respectively.

Second, the company's product revenue structure is single. The company's product revenue structure is highly concentrated on clock chips. During the reporting period (2019 to 2021 and the first half of 2022), the revenue contribution of clock chips in the high years can reach 97%, and in the low years it also reached 86%.

Third, the company's goodwill accounts for nearly 30% of total assets. By the end of half year 2022, the company's total assets were only 692 million yuan, and net assets were only 409 million yuan. Of these, goodwill assets formed from overseas acquisitions reached 198 million yuan, accounting for 28% of total assets.

Goertek's subsidiary “Goertek” was terminated by the Shenzhen Stock Exchange's IPO application

According to the prospectus, Goertek is a subsidiary of Goertek AG. Goertek products are widely used in consumer electronics fields such as smartphones, smart wireless headsets, tablets, smart wearables and smart homes, as well as in automotive electronics. The main end customers include Apple, Honor, Xiaomi, OPPO, Harman, Valeo, etc., and have established business relationships with Meta, NIO, and DJI.

Going back to Goertek's IPO process, the company entered the GEM “test room” in December 2021. The company held its IPO meeting in November 2022, and until the end of the IPO, the company did not enter the registration process. The company originally planned to raise 3.191 billion yuan in IPOs.

The actual controllers of Goerwei are Jiang Bin and Hu Shuangmei. The two are husband and wife. Jiang Bin and Hu Shuangmei are also actual controllers of Goertek shares. They indirectly control 85.9% of the company's shares through Goertek shares: at the same time, Jiang Bin indirectly controls 0.97% of the company's shares through Goertek Group. Jiang Bin and Hu Shuangmei together control 86.87% of the company's shares.

The market is paying a lot of attention to Goertek's IPO. Earlier, at Goertek's 2023 performance briefing, some investors asked, “Why can't Goertek go public yet?” The relevant person in charge of Goertek said that Goertek's listing is still in progress, so please keep an eye on future announcements. After an interval of more than a month, investors waited for news that Goerwei had terminated its listing.

根据上交所官网5月27日的公告,上交所已终止对奥拉股份的发行上市审核流程。

根据上交所官网5月27日的公告,上交所已终止对奥拉股份的发行上市审核流程。