Key Insights

- FSM Holdings' Annual General Meeting to take place on 3rd of June

- CEO Tiong-Hock Toe's total compensation includes salary of S$396.0k

- The total compensation is 189% higher than the average for the industry

- FSM Holdings' EPS grew by 38% over the past three years while total shareholder return over the past three years was 2.7%

Under the guidance of CEO Tiong-Hock Toe, FSM Holdings Limited (HKG:1721) has performed reasonably well recently. As shareholders go into the upcoming AGM on 3rd of June, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

How Does Total Compensation For Tiong-Hock Toe Compare With Other Companies In The Industry?

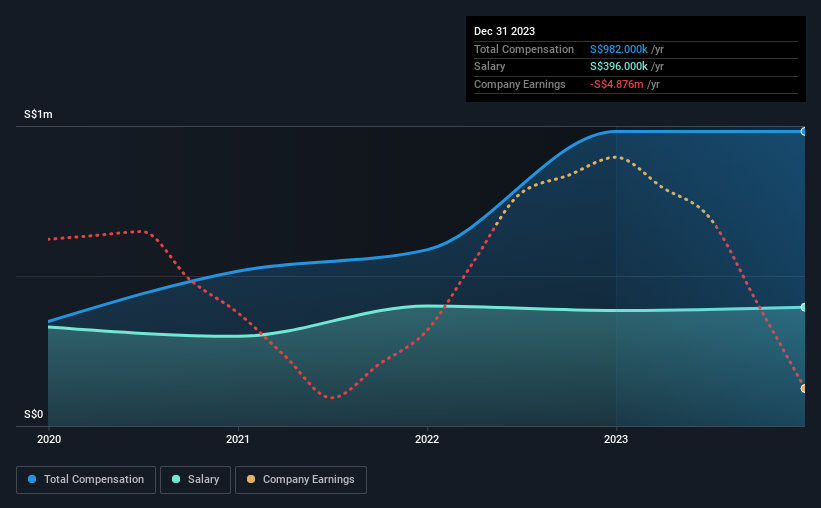

Our data indicates that FSM Holdings Limited has a market capitalization of HK$380m, and total annual CEO compensation was reported as S$982k for the year to December 2023. This was the same amount the CEO received in the prior year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at S$396k.

In comparison with other companies in the Hong Kong Machinery industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was S$340k. This suggests that Tiong-Hock Toe is paid more than the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | S$396k | S$385k | 40% |

| Other | S$586k | S$597k | 60% |

| Total Compensation | S$982k | S$982k | 100% |

On an industry level, roughly 77% of total compensation represents salary and 23% is other remuneration. FSM Holdings pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

On an industry level, roughly 77% of total compensation represents salary and 23% is other remuneration. FSM Holdings pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at FSM Holdings Limited's Growth Numbers

FSM Holdings Limited has seen its earnings per share (EPS) increase by 38% a year over the past three years. It saw its revenue drop 31% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has FSM Holdings Limited Been A Good Investment?

FSM Holdings Limited has generated a total shareholder return of 2.7% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 2 warning signs (and 1 which is a bit concerning) in FSM Holdings we think you should know about.

Switching gears from FSM Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.