AMD Grabs 33% of Server CPU Market and Prepares for Major Processor Launch: Report

AMD Grabs 33% of Server CPU Market and Prepares for Major Processor Launch: Report

Advanced Micro Devices, Inc (NASDAQ:AMD) claims it holds a 33% share in the server CPU market as it prepares to launch its next-gen "Turin" processors and unveils a GPU roadmap following the MI300 product line, the Register reports.

Register報道,Advanced Micro Devices, Inc(納斯達克股票代碼:AMD)聲稱其在服務器CPU市場佔有33%的份額,因爲該公司準備推出下一代 “都靈” 處理器,並公佈了遵循 MI300 產品系列的GPU路線圖。

During the JP Morgan Global Technology, Media, and Communications conference, Jean Hu, AMD's CFO, highlighted the company's growth in servers, CPUs, and GPUs. The stock is trading higher on Tuesday.

在摩根大通全球科技、媒體和通信會議上,AMD 首席財務官 Jean Hu 強調了該公司在服務器、CPU 和 GPU 方面的增長。該股週二交易走高。

She noted AMD's partnerships, such as with Microsoft Corp (NASDAQ:MSFT) for virtual machine instances running AMD MI300X GPUs in Azure cloud, and AMD's success in achieving strong double-digit growth in server CPUs and desktop/laptop segments.

她指出了AMD的合作伙伴關係,例如與微軟公司(納斯達克股票代碼:MSFT)合作開發在Azure雲中運行AMD MI300X GPU的虛擬機實例,以及AMD在服務器CPU和臺式機/筆記本電腦領域成功實現強勁的兩位數增長。

Also Read: Supermicro and AMD Roll Out Multi-Node Servers To Enhance Cloud Computing

另請閱讀: Supermicro 和 AMD 推出多節點服務器以增強雲計算

Hu emphasized that AMD's strategic focus on power efficiency and cost-effectiveness makes it a compelling choice for enterprises facing power and space constraints. Notable clients like American Express Co (NYSE:AXP), Shell Plc (NYSE:SHEL), and STMicroelectronics N.V. (NYSE:STM) are transitioning to AMD-based infrastructure.

胡強調說,AMD 對能效和成本效益的戰略重點使其成爲面臨電力和空間限制的企業的絕佳選擇。美國運通公司(紐約證券交易所代碼:AXP)、殼牌公司(紐約證券交易所代碼:SHEL)和意法半導體(紐約證券交易所代碼:STM)等知名客戶正在過渡到基於AMD的基礎設施。

Hu announced plans for a next-generation AI PC to launch in the second half of the year, which could significantly refresh the PC market. She also mentioned the potential for AMD to re-enter the Arm Holdings Plc (NASDAQ:ARM) market, leveraging its existing capabilities and IP blocks to meet customer demands.

胡宣佈計劃在下半年推出下一代人工智能電腦,這可能會極大地刷新個人電腦市場。她還提到,AMD有可能重新進入Arm Holdings Plc(納斯達克股票代碼:ARM)市場,利用其現有能力和知識產權封鎖來滿足客戶需求。

AMD sees long-term growth potential in the embedded processor market, mainly through synergies with Xilinx.

AMD 看到了嵌入式處理器市場的長期增長潛力,主要是通過與 Xilinx 的協同效應。

Hu also highlighted AMD's robust performance in the desktop and laptop markets.

胡還強調了AMD在臺式機和筆記本電腦市場的強勁表現。

Analysts expect AMD and peers to drive semiconductor industry optimism after their earnings beat as inventory levels normalize and companies ship closer to consumption levels. However, analysts also cautioned against AMD's MI300 supply constraints, gaming segment weakness and aggressive pricing from Nvidia Corp (NASDAQ:NVDA).

分析師預計,隨着庫存水平正常化以及各公司出貨量接近消費水平,AMD及其同行將在盈利超過後推動半導體行業的樂觀情緒。但是,分析師也提醒注意AMD的 MI300 供應限制、遊戲領域的疲軟以及英偉達公司(納斯達克股票代碼:NVDA)的激進定價。

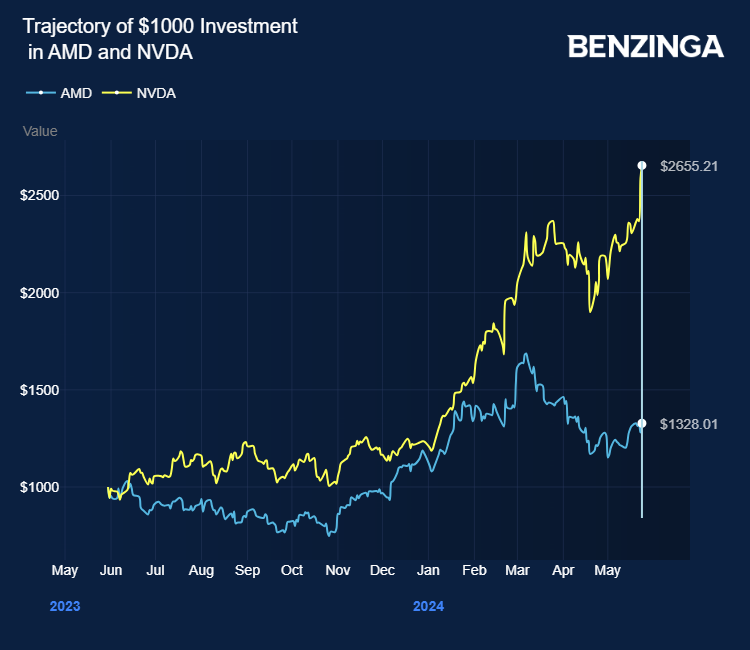

AMD stock gained 33% in the last 12 months. Investors can gain exposure to the stock via Spear Alpha ETF (NASDAQ:SPRX) and Pacer Funds Pacer Data And Digital Revolution ETF (NYSE:TRFK).

在過去的12個月中,AMD的股票上漲了33%。投資者可以通過Spear Alpha ETF(納斯達克股票代碼:SPRX)和Pacer Funds Pacer Data And Digital Revolution ETF(紐約證券交易所代碼:TRFK)獲得股票敞口。

Price Actions: AMD shares traded higher by 1.87% at $169.47 premarket at the last check on Tuesday.

價格走勢:AMD股價在週二的最後一次盤前交易中上漲1.87%,至169.47美元。

Also Read: AMD Unveils Cost-Effective EPYC 4004 Series CPUs For Small Businesses and IT Providers

另請閱讀: AMD 爲小型企業和 IT 提供商推出經濟實惠的 EPYC 4004 系列 CPU

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免責聲明: 該內容部分是在人工智能工具的幫助下製作的,並由Benzinga編輯審閱和發佈。

Photo courtesy of AMD

照片由 AMD 提供

Also Read: Supermicro and AMD Roll Out Multi-Node Servers To Enhance Cloud Computing

Also Read: Supermicro and AMD Roll Out Multi-Node Servers To Enhance Cloud Computing