The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that YETI Holdings, Inc. (NYSE:YETI) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is YETI Holdings's Net Debt?

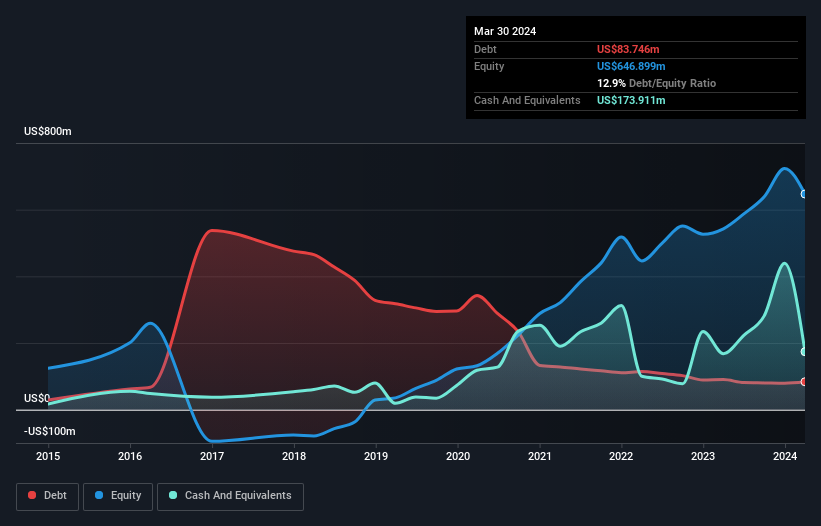

You can click the graphic below for the historical numbers, but it shows that YETI Holdings had US$83.7m of debt in March 2024, down from US$90.2m, one year before. However, it does have US$173.9m in cash offsetting this, leading to net cash of US$90.2m.

How Healthy Is YETI Holdings' Balance Sheet?

We can see from the most recent balance sheet that YETI Holdings had liabilities of US$298.8m falling due within a year, and liabilities of US$174.1m due beyond that. Offsetting this, it had US$173.9m in cash and US$108.4m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$190.6m.

Given YETI Holdings has a market capitalization of US$3.26b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, YETI Holdings also has more cash than debt, so we're pretty confident it can manage its debt safely.

Better yet, YETI Holdings grew its EBIT by 118% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine YETI Holdings's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While YETI Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, YETI Holdings's free cash flow amounted to 44% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing Up

We could understand if investors are concerned about YETI Holdings's liabilities, but we can be reassured by the fact it has has net cash of US$90.2m. And it impressed us with its EBIT growth of 118% over the last year. So is YETI Holdings's debt a risk? It doesn't seem so to us. Over time, share prices tend to follow earnings per share, so if you're interested in YETI Holdings, you may well want to click here to check an interactive graph of its earnings per share history.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.