The Shenzhen Urban Transport Planning Center Co., Ltd. (SZSE:301091) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 84%, which is great even in a bull market.

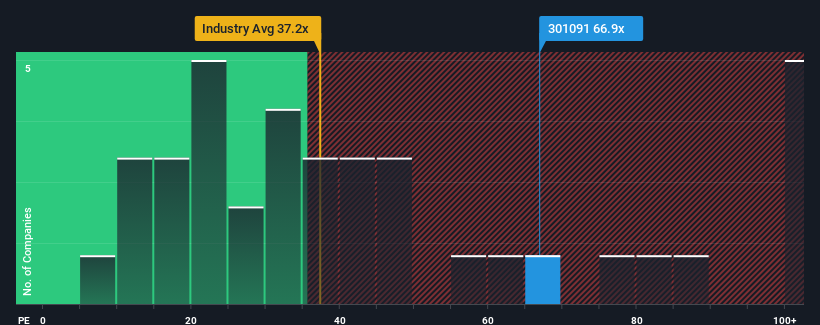

In spite of the heavy fall in price, Shenzhen Urban Transport Planning Center may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 66.9x, since almost half of all companies in China have P/E ratios under 31x and even P/E's lower than 19x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Shenzhen Urban Transport Planning Center hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Shenzhen Urban Transport Planning Center's to be considered reasonable.

There's an inherent assumption that a company should far outperform the market for P/E ratios like Shenzhen Urban Transport Planning Center's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 6.7%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 15% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 25% each year, which is noticeably more attractive.

In light of this, it's alarming that Shenzhen Urban Transport Planning Center's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Shenzhen Urban Transport Planning Center's P/E

Even after such a strong price drop, Shenzhen Urban Transport Planning Center's P/E still exceeds the rest of the market significantly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Shenzhen Urban Transport Planning Center currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 2 warning signs for Shenzhen Urban Transport Planning Center (1 makes us a bit uncomfortable!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.