Forced redemption triggered for convertible bonds.

Tibet Huayu Mining, a hot stock in the recent market, suddenly announced a major news!

Forced redemption triggered for convertible bonds.

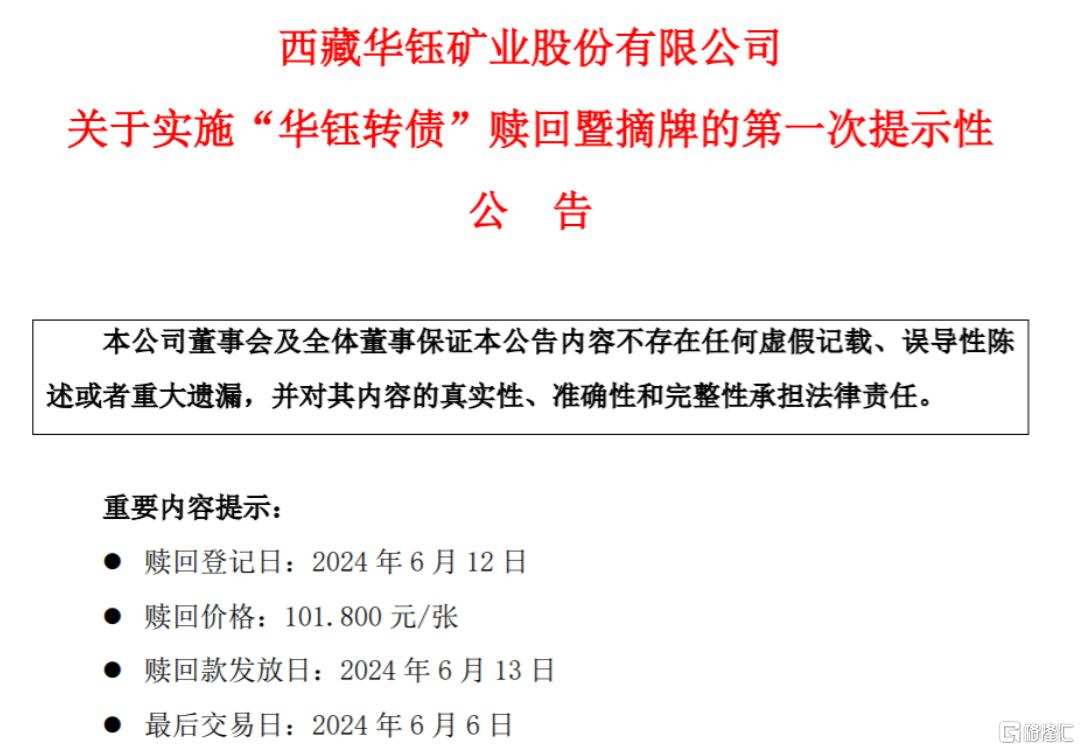

Yesterday, Tibet Huayu Mining, which combines the hot concepts of gold and antimony mines, announced that the company's convertible bond 'Huayu Convertible Bond' (113027) triggered the early redemption mechanism.

In recent times, the market has surged ahead of the Fed's rate cuts, bringing about a bull market with bulk commodities. Coupled with the continuous rise in antimony prices, the stock price of Tibet Huayu Mining has become a market "sweetheart".

Tibet Huayu Mining's stock price achieved three consecutive daily limit-ups this week, opening on Thursday and once rising to a new high of 18.79 yuan/share since October 2017. It then fell all the way and eventually closed down 6% at 16.03 yuan/share, with a total market value of 12.62 billion yuan.

Since April 24,Despite the Thursday's stock price decrease, the market's enthusiasm for Tibet Huayu Mining remained unabated. The daily capital flow list shows that 156 million yuan was bought into Tibet Huayu Mining.

Among them, the Shanghai-Hong Kong Stock Connect net bought 62.9739 million yuan, two overseas institutions net bought more than 102 million yuan, and one institution net sold 57.049 million yuan.

Tibet Huayu Mining announced that due to the stock price of the underlying stock from April 26 to May 21 meeting the condition of closing at a price not less than 130% of the current conversion price (i.e. 9.438 yuan/share) for at least fifteen trading days out of thirty consecutive trading days, the conditional redemption clause of the 'Huayu Convertible Bond' has been triggered.

Losses of more than 67%.

While the stock price of the underlying stock soared, the price of the 'Huayu Convertible Bond' also rose to a high of 300 yuan at one point.

While the stock price rose sharply, the price of Huayu convertible bonds also rose, reaching as high as 300 yuan.

However, the 'Huayu Convertible Bond' hit the 20% limit down on Thursday, leading the market and eventually fell 19.90% to 229.061 yuan.

Currently, investors who hold the 'Huayu Convertible Bond' have three options: 1) Sell on the secondary market by the closing of June 6; 2) Convert according to the conversion price of 7.26 yuan/share; 3) Failure to sell within the prescribed period will result in Tibet Huayu Mining forced redemption at the face value of 100 yuan/bond plus accrued interest for the current period (i.e. 101.8 yuan/bond).Sold through the secondary market at the closing on June 6th; 2)If the holder fails to sell in time and is forcefully redeemed according to the closing price of 229.061 yuan on Thursday, they may face a loss of more than 50%. Just think of investors who bought in at 309.78 yuan. If they are forcefully redeemed at 101.8 yuan, their investment loss will exceed 67%.Forcibly redeemed at the face value price of 100 yuan per share plus accrued interest (i.e., 101.8 yuan)..

Tibet Huayu Mining reminds that for those who hold the 'Huayu Convertible Bond,' if forced redemption occurs, they may face significant investment losses. Holders should be aware of converting or selling within the prescribed period to avoid potential investment losses.

Huayu Mining reminds that if the "Huayu convertible bond" is redeemed, holders may face significant investment losses. Holders should be aware of the need to convert or sell within the specified time frame to avoid possible investment losses.

Industry insiders also said that.As the debt-for-equity swaps of Tibet Huayu Mining will increase its outstanding shares, there will be some pressure on the stock and convertibles in the short term once an early redemption is triggered.