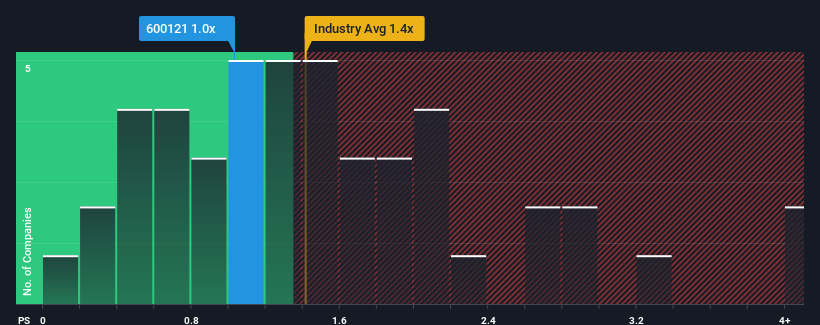

With a median price-to-sales (or "P/S") ratio of close to 1.4x in the Oil and Gas industry in China, you could be forgiven for feeling indifferent about Zhengzhou Coal Industry & Electric Power Co., Ltd.'s (SHSE:600121) P/S ratio of 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Zhengzhou Coal Industry & Electric Power Has Been Performing

For example, consider that Zhengzhou Coal Industry & Electric Power's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Zhengzhou Coal Industry & Electric Power, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Zhengzhou Coal Industry & Electric Power's Revenue Growth Trending?

In order to justify its P/S ratio, Zhengzhou Coal Industry & Electric Power would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.0%. Even so, admirably revenue has lifted 41% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 6.4% shows it's noticeably more attractive.

In light of this, it's curious that Zhengzhou Coal Industry & Electric Power's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Zhengzhou Coal Industry & Electric Power's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To our surprise, Zhengzhou Coal Industry & Electric Power revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Zhengzhou Coal Industry & Electric Power with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.