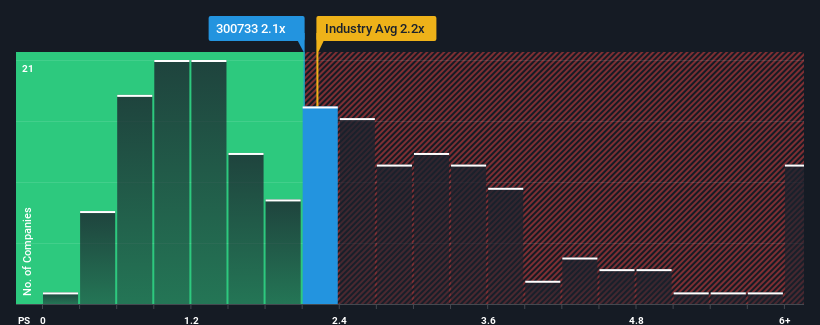

It's not a stretch to say that Chengdu Xiling Power Science & Technology Incorporated Company's (SZSE:300733) price-to-sales (or "P/S") ratio of 2.1x right now seems quite "middle-of-the-road" for companies in the Auto Components industry in China, where the median P/S ratio is around 2.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does Chengdu Xiling Power Science & Technology's Recent Performance Look Like?

Chengdu Xiling Power Science & Technology certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chengdu Xiling Power Science & Technology.Is There Some Revenue Growth Forecasted For Chengdu Xiling Power Science & Technology?

In order to justify its P/S ratio, Chengdu Xiling Power Science & Technology would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 34% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 166% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 46% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 26% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Chengdu Xiling Power Science & Technology's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Chengdu Xiling Power Science & Technology's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Chengdu Xiling Power Science & Technology with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.