TAT Technologies Ltd. (NASDAQ:TATT) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The annual gain comes to 128% following the latest surge, making investors sit up and take notice.

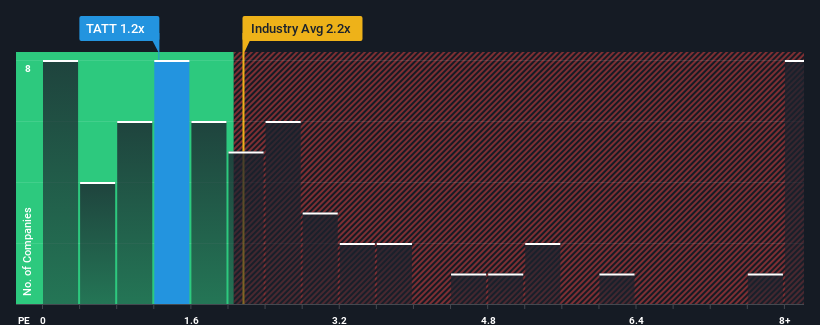

Even after such a large jump in price, TAT Technologies' price-to-sales (or "P/S") ratio of 1.2x might still make it look like a buy right now compared to the Aerospace & Defense industry in the United States, where around half of the companies have P/S ratios above 2.2x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does TAT Technologies' Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, TAT Technologies has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on TAT Technologies will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on TAT Technologies will help you shine a light on its historical performance.How Is TAT Technologies' Revenue Growth Trending?

In order to justify its P/S ratio, TAT Technologies would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. Pleasingly, revenue has also lifted 78% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to decline by 3.4% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that TAT Technologies' P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift TAT Technologies' P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at the figures, it's surprising to see TAT Technologies currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. One assumption would be that there are some underlying risks to revenue that are keeping the P/S from rising to match the its strong performance. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

You always need to take note of risks, for example - TAT Technologies has 1 warning sign we think you should be aware of.

If you're unsure about the strength of TAT Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.