AIM Vaccine Co., Ltd. (HKG:6660) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 87% share price decline.

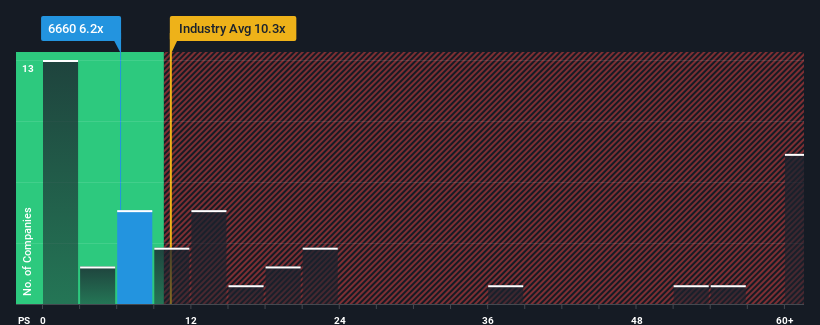

Since its price has dipped substantially, AIM Vaccine may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 6.2x, considering almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios greater than 10.3x and even P/S higher than 34x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has AIM Vaccine Performed Recently?

AIM Vaccine hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AIM Vaccine.How Is AIM Vaccine's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as AIM Vaccine's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 6.1% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 28% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 187% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 27%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that AIM Vaccine's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On AIM Vaccine's P/S

AIM Vaccine's recently weak share price has pulled its P/S back below other Biotechs companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems AIM Vaccine currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for AIM Vaccine that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.