Top 3 Energy Stocks That Could Blast Off This Month

Top 3 Energy Stocks That Could Blast Off This Month

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

能源板块中最过度卖出的股票为买入低估公司提供机会。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指标是一种动量指标,它比较了股票在价格上涨时的强度与在价格下跌时的强度。与股票的价格走势进行比较,可以给交易者更好的了解股票短期内表现的良好程度。当RSI低于30时,资产通常被认为是超卖的,根据Benzinga Pro的数据。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行业板块最近的主要超卖股票列表,RSI接近或低于30。

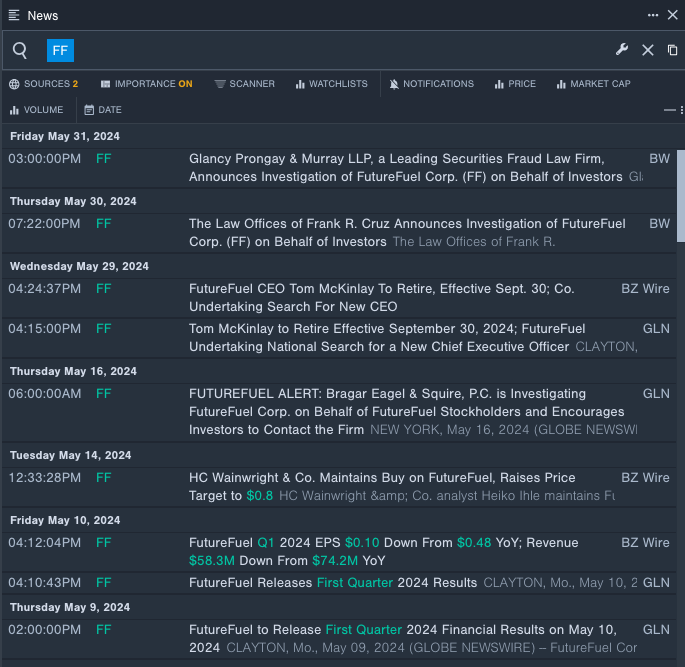

FutureFuel Corp. (NYSE:FF)

FutureFuel股票(NYSE:FF)

- On May 29, FutureFuel said its CEO Tom McKinlay will retire, effective Sept. 30. The company's stock fell around 10% over the past five days and has a 52-week low of $4.26.

- RSI Value: 24.57

- FF Price Action: Shares of FutureFuel closed at $4.28 on Friday.

- 5月29日,FutureFuel宣布其首席执行官Tom McKinlay将于9月30日退休。过去5天,公司股票下跌了约10%,52周低点为4.26美元。

- RSI值:24.57

- FF价格表现:FutureFuel股票周五收盘价为4.28美元。

- Benzinga Pro's real-time newsfeed alerted to latest FutureFuel news.

- Benzinga Pro的实时新闻提醒了最新的FutureFuel消息。

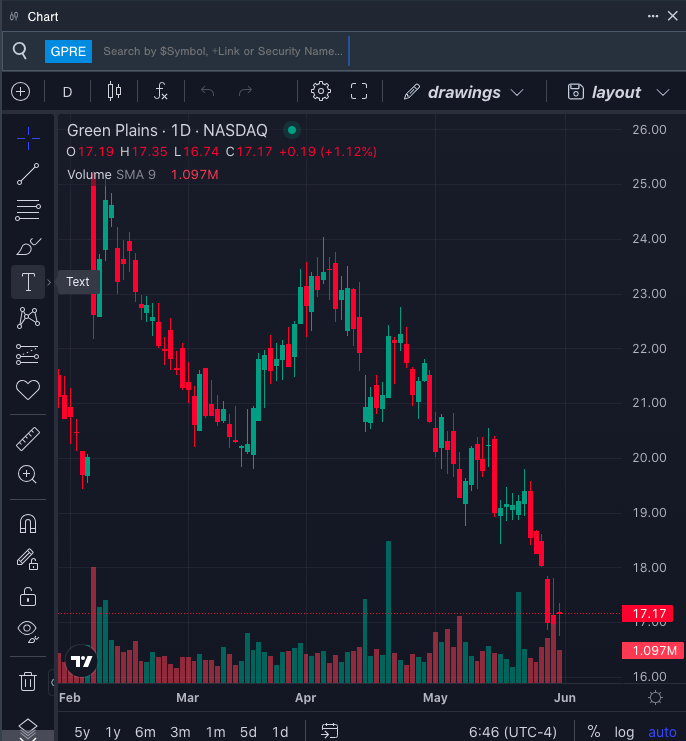

Green Plains Inc. (NASDAQ:GPRE)

绿色平原能源股票 (NASDAQ:GPRE)

- On May 3, Green Plains posted weaker-than-expected quarterly sales. "Margins in the first quarter were weaker across our product mix and we were impacted by industry oversupply during a mild winter leading to stock builds and lower prices realized, though margins have improved from the first quarter lows, and compared to this time frame in prior years the forward curve looks better for the rest of the year," said Todd Becker, President and Chief Executive Officer. The company's stock fell around 15% over the past month. It has a 52-week low of $16.74.

- RSI Value: 28.67

- GPRE Price Action: Shares of Green Plains gained 1.1% to close at $17.17 on Friday.

- Benzinga Pro's charting tool helped identify the trend in GPRE's stock.

- 5月3日,Green Plains发布了低于预期的季度销售额。公司总裁兼首席执行官Todd Becker表示:“第一季度的利润率在我们的产品组合中更弱,而且在寒冷的冬天期间受到行业过度供应的影响,导致库存增加和实现的价格较低,尽管较第一季度的低点已有所改善,并且与往年同期相比,本年度的前瞻曲线看起来更好。” 过去一个月,该公司股票下跌了约15%,52周低点为16.74美元。

- RSI值:28.67

- GPRE价格表现:绿色平原能源股票周五上涨1.1%,收于17.17美元。

- Benzinga Pro的图表工具有助于确定GPRE股票的趋势。

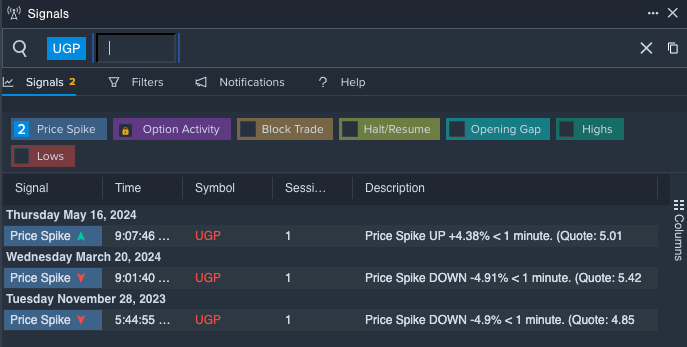

Ultrapar Participações S.A. (NYSE:UGP)

Ultrapar Participações S.A.股票(NYSE:UGP)

- The company's stock fell around 17% over the past month and has a 52-week low of $3.40.

- RSI Value: 28.19

- UGP Price Action: Shares of Ultrapar Participações fell 3.5% to close at $4.43 on Friday.

- Benzinga Pro's signals feature notified of a potential breakout in Ultrapar Participações shares.

- 过去一个月,该公司的股票下跌了约17%,52周低点为3.40美元。

- RSI值:28.19

- UGP价格表现:Ultrapar Participações股票周五下跌3.5%,收于4.43美元。

- Benzinga Pro的信号功能通知了Ultrapar Participações股票潜在的突破。

Read More: Investor Optimism Improves; US Stocks Record Gains For May

更多阅读:投资者乐观情绪提高,美股5月录得收益。