Ciwen Media Co.,Ltd. (SZSE:002343) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 30% share price drop.

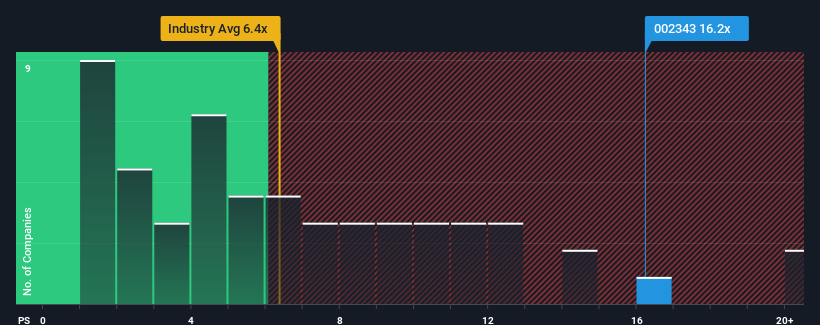

Even after such a large drop in price, Ciwen MediaLtd may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 16.2x, when you consider almost half of the companies in the Entertainment industry in China have P/S ratios under 6.4x and even P/S lower than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has Ciwen MediaLtd Performed Recently?

Ciwen MediaLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Ciwen MediaLtd will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Ciwen MediaLtd?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Ciwen MediaLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's top line. As a result, revenue from three years ago have also fallen 67% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 196% during the coming year according to the only analyst following the company. That's shaping up to be materially higher than the 27% growth forecast for the broader industry.

With this information, we can see why Ciwen MediaLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

A significant share price dive has done very little to deflate Ciwen MediaLtd's very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Ciwen MediaLtd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Ciwen MediaLtd (of which 1 makes us a bit uncomfortable!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.