Fear spreads to “problem stocks”

Recently, the market's attention to financial reporting issues has increased markedly.

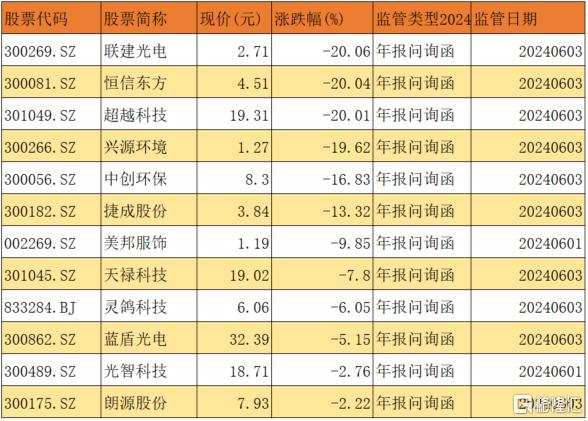

Today, the stock prices of a number of listed companies plummeted due to the receipt of an inquiry letter on their annual reports from the exchange.

As of press release, Lianjian Optoelectronics, Hengxin Oriental, Transcend Technology, and Xingyuan Environment fell to a halt by 20CM. Jebsen shares fell more than 13%, Meibang Apparel fell to a standstill, Tianlu Technology fell more than 7%, and Lingge Technology fell more than 6%.

As of press release, Lianjian Optoelectronics, Hengxin Oriental, Transcend Technology, and Xingyuan Environment fell to a halt by 20CM. Jebsen shares fell more than 13%, Meibang Apparel fell to a standstill, Tianlu Technology fell more than 7%, and Lingge Technology fell more than 6%.

Yesterday, the previous big bull stock Langyuan Co., Ltd. was also questioned by the Shenzhen Stock Exchange due to an annual report issue. The stock price quickly dived and directly fell to a halt by 20CM. Today, the stock price still plummeted by nearly 3%.

Previously, the stock hit a new high of 13.90 yuan/share on May 20, up more than 304% from the low of 3.44 yuan/share on April 16.

The financial reports of several companies were questioned

According to statistics, in June, 12 listed companies had already received an inquiry letter for their annual reports from the exchange. On June 3 alone, 10 companies were inquired.

Among them,Beyond technologyAfter less than three years of listing, it has been receiving annual report inquiries for two consecutive years. In 2023, Chaoyue Technology's revenue was 264 million yuan, up 24.86% year on year; net profit loss to mother was 120 million yuan, down 454.05% year on year.

The inquiry letter asked them to explain the reasons and rationality of the continuous sharp decline in performance after listing, the continued year-on-year decline in net cash flow from operating activities in the first quarter of this year, and abnormalities in gross profit margins, R&D expenses, accounts receivable, etc.

In 2023,Hengxin OrientalRevenue was 402 million yuan, a year-on-year decrease of 17.76%. Since 2020, Hengxin Oriental's net profit before and after deduction has been large for four consecutive years, and uncovered losses for three consecutive years have reached one-third of the total paid-up share capital.

The inquiry letter asked them to explain whether the company faces greater operating risks and whether there is significant uncertainty about its ability to continue operating.

Lianjian OptoelectronicsLosses have continued for many years since 2017. Revenue in 2023 was 981 million yuan, down 21.41% year on year, and net profit loss of 21 million yuan after deducting non-recurring profit and loss.

The inquiry letter asked them to explain the reasons for the continuous sharp loss in performance, whether the ability to continue to operate has changed, and unfulfilled performance commitments in accounts receivable, inventory, and mergers and acquisitions.

Xingyuan environmentThere were losses for four consecutive years, and net assets fell sharply from the beginning of the period. In 2023, revenue was 732 million yuan, down 45.97% year on year; net profit loss to mother was 990 million yuan, and the scale of losses increased significantly over the previous year.

The inquiry letter requested it to explain whether the downward trend in performance continues and whether the ability to continue to operate is facing major uncertainty, taking into account the situation where performance has continued to lose in recent years, the development status of its main business, and the operating situation in the first quarter of this year.

2021 to 2023,Zhongchuang EnvironmentalNet profit attributable to mother was -429 million yuan, -083 million yuan, and -160 million yuan respectively, with losses for many years.

The inquiry letter requested it to explain the reasons for the continuous loss of net profit over the past three years, as well as the sharp increase/decrease in the reporting period of the consolidated companies, monetary capital, liabilities, financing pledged by controlling shareholders, and impairment of goodwill resulting from acquisitions.

The market is concerned about the risk of delisting

The increase in market attention to financial reporting issues may be due to the following factors:

On the one hand,Evergrande fines for financial fraud settledIts auditor, PricewaterhouseCoopers, could face a hefty fine of at least $138 million.

Meanwhile, due to a crisis of trust, several listed companies decided to terminate/not renew PwC.

According to the data, a total of 107 A-share listed companies were audited by PricewaterhouseCoopers in 2023, with a total audit fee of 869 million yuan. More than 14 listed companies have announced that they will no longer hire PricewaterhouseCoopers or replace other accounting firms, involving audit costs as high as 160 million yuan.

On the other hand, after a sharp rebound in the early period, the market entered a period of adjustment. Market sentiment is sensitive, and any turbulence may trigger a sharp drop in stock prices. This has also led to the recent rapid collapse of the ST sector and micro market stocks.

According to statistics, since April 4 (the release of the new “National Nine Rules”), the stock prices of 57 listed companies have dropped by more than 50%, and ST shares and micro capitalization stocks account for the vast majority.

With the exception of Zitian Technology, Huawen Group, Bank of China Cashmere, Lingnan Co., Ltd., and Guao Technology, they are all ST companies.

Furthermore, since the publication of the new “National Nine Rules”, the regulatory level“Tighten financial delisting indicators” and “strictly enforce delisting, and strictly crack down on illegal acts such as financial fraud and market manipulation to maliciously avoid delisting.”

Among them, the minimum revenue standard for main board companies was raised from 100 million yuan to 300 million yuan. The original net profit condition was changed to a negative value of total profit, net profit, and net profit after deducting non-recurring profit and loss, whichever is lower, which will all step on the red line of financial delisting indicators.

Today, as soon as individual stocks are subject to financial inquiries from exchanges, stock prices fall, also because investors are concerned about potential delisting risks, and fears about the ST sector and micro market stocks have spread further to “problem stocks.”

截至发稿,联建光电、恒信东方、超越科技、兴源环境20CM跌停,捷成股份跌超13%,美邦服饰一字跌停,天禄科技跌超7%,灵鸽科技跌超6%。

截至发稿,联建光电、恒信东方、超越科技、兴源环境20CM跌停,捷成股份跌超13%,美邦服饰一字跌停,天禄科技跌超7%,灵鸽科技跌超6%。