Miko International Holdings Limited's (HKG:1247) Shares Climb 80% But Its Business Is Yet to Catch Up

Miko International Holdings Limited's (HKG:1247) Shares Climb 80% But Its Business Is Yet to Catch Up

The Miko International Holdings Limited (HKG:1247) share price has done very well over the last month, posting an excellent gain of 80%. The last 30 days bring the annual gain to a very sharp 62%.

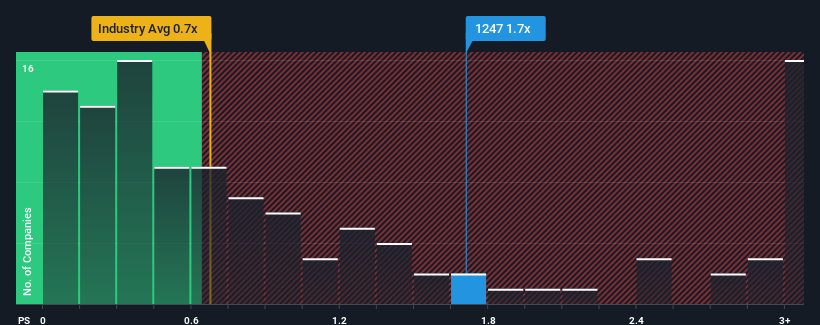

Following the firm bounce in price, you could be forgiven for thinking Miko International Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.7x, considering almost half the companies in Hong Kong's Luxury industry have P/S ratios below 0.7x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Miko International Holdings Has Been Performing

The recent revenue growth at Miko International Holdings would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Miko International Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Miko International Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Miko International Holdings would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.8%. The latest three year period has also seen an excellent 30% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 13% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Miko International Holdings is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

The large bounce in Miko International Holdings' shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Miko International Holdings currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Miko International Holdings, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.