Wall Street is preparing for a series of interest rate cuts from the Bank of Canada as the Canadian dollar weakens. Earlier, the Bank of Canada became the first central bank in the G7 to ease monetary policy in this round.

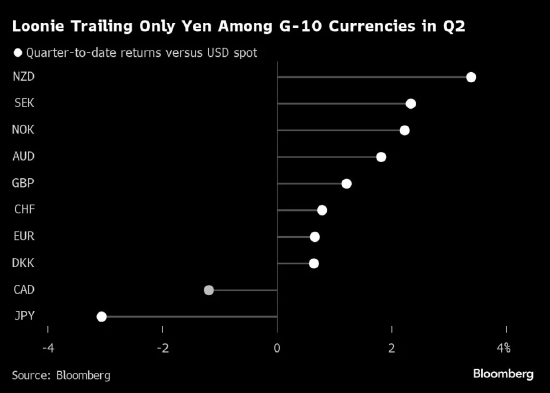

After the Bank of Canada lowered the benchmark lending rate by 25 basis points to 4.75% on Wednesday, the Canadian dollar against the US dollar fell to its lowest level since May 23 - 1.3741 per 1 US dollar. As of 1 pm in Ottawa, the benchmark two-year Canadian government bond yield fell more than 10 basis points to 3.95%, expanding the gap with the US Treasury yield.

Veronica Clark, an economist at Citigroup Inc., wrote after the Fed’s decision: “This decision is much milder than we expected, and the threshold for another interest rate cut seems to be lower than we imagined before today's comment.” Citigroup currently expects the Bank of Canada to cut interest rates by 25 basis points at each meeting this year, in part due to spill-over effects from weak US economic data.

Bank of Canada Governor Poloz said at a press conference after the decision: "The message is very clear." "We will make interest rate decisions at a meeting. If the economy continues to develop as widely expected, and if we continue to see inflationary pressures ease, then we have reason to expect further interest rate cuts."

The following are the views of others in Wall Street:

Claire Fan is an economist at the Royal Bank of Canada.

"The Bank of Canada's interest rate cut today marks the first step in a loosening cycle, and interest rates will return to 'normal' levels. This is good news for Canadian households who have been struggling with high borrowing costs."

Tiffany Wilding, economist at Pacific Investment Management Co.: "If the Fed cuts interest rates once or less this year, the Fed's policy path and the overall strength of the US economy will become more and more important. Differences in interest rates between the US and Canada may reach 100 basis points in the fourth quarter due to depreciation of the Canadian dollar, which will bring additional pressure on inflation."

Howard Du, foreign exchange strategist at Bank of America Corp.: "Interest rate cuts have been realized, and forward guidance is mild ('there is reason to expect further interest rate cuts'). If US employment data proves to be resilient, we may see the USD/CAD continue to rebound to 1.38."

"Given that there are many short positions in the Canadian dollar, we expect the USD/CAD rally to be relatively moderate." Instead, we expect the USD/CAD to slowly move towards 1.39 in the next quarter, which is consistent with the slow reappraisal of the greater divergence between the People's Bank of China and the Federal Reserve in the second half of the year."

CIBC Capital Markets strategist Luis Hurtado and Jeremy Stretch said: "Given the large number of short positions in the Canadian dollar, we expect the USD/CAD rise to be relatively moderate." Instead, we expect the USD/CAD to slowly move towards 1.39 in the next quarter, which is consistent with the slow reappraisal of the greater divergence between the People's Bank of China and the Federal Reserve in the second half of the year."

Monex Canada's foreign exchange analysis director Harvey said: "We believe that the Bank of Canada will cut interest rates at least once before the Fed meeting on September 18, making the Canadian dollar susceptible to further widening interest rate differentials."

"From a market perspective, this seems to be a 'cautious' interest rate cut, which is more moderate than the 'hawkish' interest rate cut, which may require more aggressive language to suspend rate hikes after the interest rate cut in June." James Knightley and Francesco Pesole of the Netherlands International Group said.

Monex Canada's Head of Forex Analysis, Harvey, said.

"We believe that the Bank of Canada will cut interest rates at least once before the Federal Reserve meeting on September 18, making the Canadian dollar vulnerable to further interest rate spreads."

"From a market perspective, this seems to be a 'cautious' interest rate cut, which is more moderate than the 'hawkish' interest rate cut, which may require more aggressive language to suspend rate hikes after the June interest rate cut."