The Anhui Genuine NewMaterials Co.,Ltd. (SHSE:603429) share price has fared very poorly over the last month, falling by a substantial 26%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 50% loss during that time.

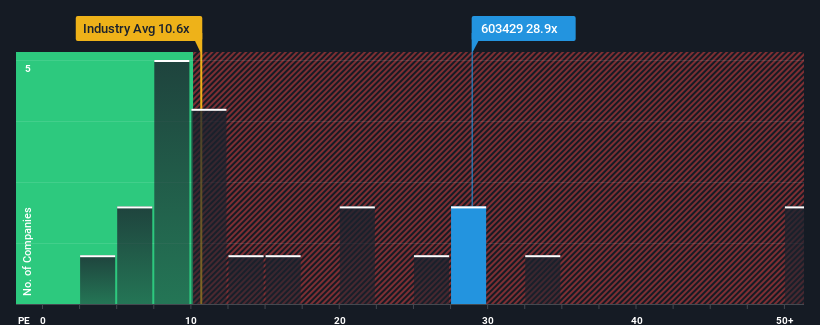

In spite of the heavy fall in price, there still wouldn't be many who think Anhui Genuine NewMaterialsLtd's price-to-earnings (or "P/E") ratio of 28.9x is worth a mention when the median P/E in China is similar at about 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For instance, Anhui Genuine NewMaterialsLtd's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Anhui Genuine NewMaterialsLtd's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 49%. The last three years don't look nice either as the company has shrunk EPS by 21% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 38% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Anhui Genuine NewMaterialsLtd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

With its share price falling into a hole, the P/E for Anhui Genuine NewMaterialsLtd looks quite average now. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Anhui Genuine NewMaterialsLtd currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Anhui Genuine NewMaterialsLtd (1 is significant) you should be aware of.

Of course, you might also be able to find a better stock than Anhui Genuine NewMaterialsLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.