The Guizhou Zhongyida Co., Ltd (SHSE:600610) share price has fared very poorly over the last month, falling by a substantial 31%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 69% loss during that time.

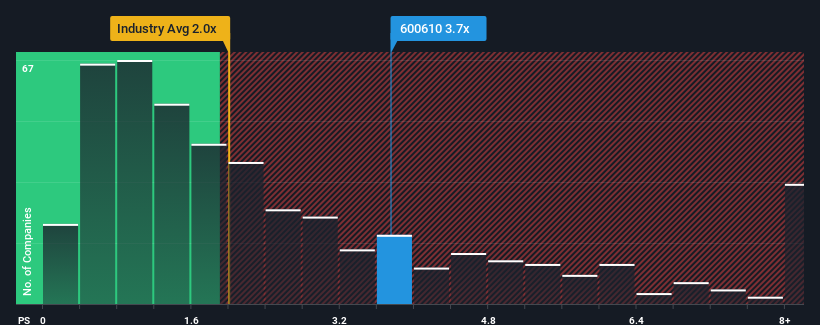

Although its price has dipped substantially, you could still be forgiven for thinking Guizhou Zhongyida is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.7x, considering almost half the companies in China's Chemicals industry have P/S ratios below 2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

How Has Guizhou Zhongyida Performed Recently?

For example, consider that Guizhou Zhongyida's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Guizhou Zhongyida, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Guizhou Zhongyida's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to deliver 23% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Guizhou Zhongyida is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Guizhou Zhongyida's P/S Mean For Investors?

Despite the recent share price weakness, Guizhou Zhongyida's P/S remains higher than most other companies in the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Guizhou Zhongyida revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Before you settle on your opinion, we've discovered 1 warning sign for Guizhou Zhongyida that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.