Small-cap stock indicator, csi midcap 200 index related etf, rises against the trend.

On the last trading day before the Dragon Boat Festival, the stock market rose and fell, and many heavy-weight stocks fell sharply. Regulatory voices tried to calm the mood, and small-cap stocks rose against the trend.

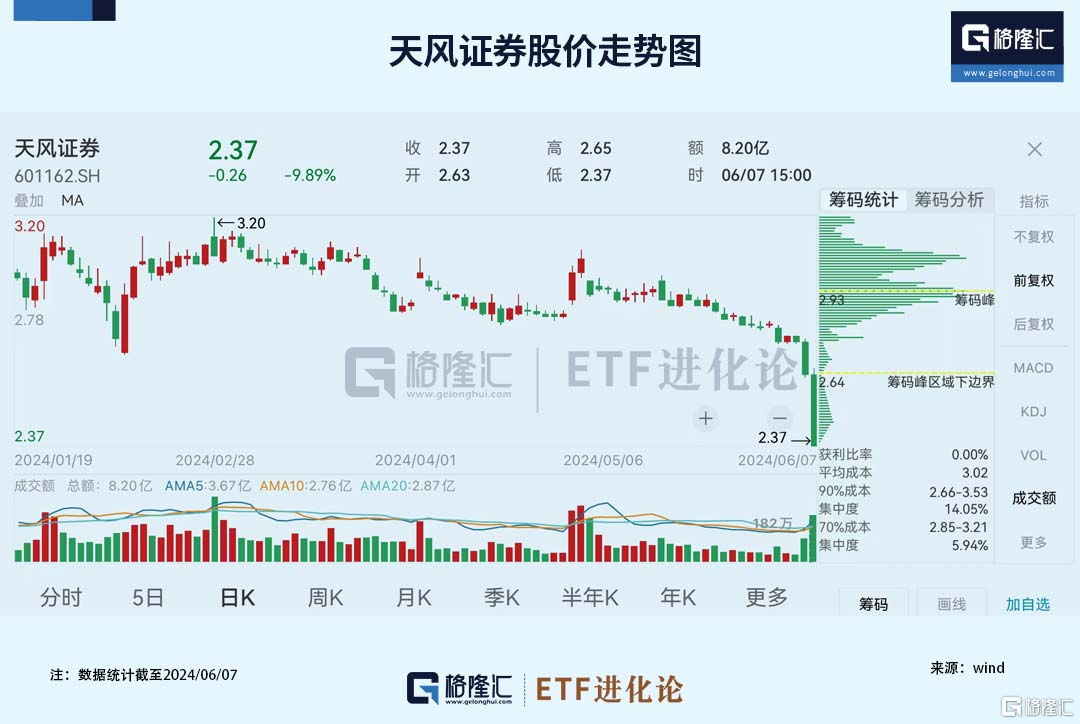

A sudden rumor caused the stock price of Tianfeng Securities to flash crash, with trading volume hitting the limit down and the stock price hitting a new historical low.

According to media reports, some analysts believe that this may be mainly due to the market's concerns about Tianfeng Securities' debt issue. Recently, Tianfeng Securities announced that it will again provide financing guarantee for its overseas subsidiaries.

The market capitalization of global stock king Nvidia has dropped below $3 trillion, with Apple regaining the second highest market value among listed companies worldwide.

1

The total short position for Nvidia is nearly equal to the combined total for Apple and Tesla, due to the increase in short positions against Nvidia.

There are rumors that American regulators are launching an AI antitrust action and targeting the three giants.

According to Bloomberg, two US antitrust agencies have reached an agreement on launching separate antitrust investigations into the AI industry. The Federal Trade Commission will investigate the relationship between Microsoft and OpenAI, while the Department of Justice will investigate Nvidia's dominant position in the AI chip market and continue to monitor Google, which is owned by Alphabet.

According to insiders, the relevant agencies have reached a consensus after more than six months of negotiations. Some analysts have said this is the most powerful signal yet from US regulators on the upgraded AI antitrust investigation.

Yesterday, Nvidia's stock price crashed nearly 6% at the opening, closing down 1.18%, and its market value once again dropped below $3 trillion, ceding second place in the market value of global listed companies back to Apple.

(The content of this article is a list of objective data and information and does not constitute any investment advice)

On June 5th, Nvidia's market capitalization reached $3.01 trillion, entering the $3 trillion market cap club for the first time, surpassing Apple to become the second largest company in the US stock market value.

Nvidia's market cap has increased from $2 trillion to $3 trillion in just three months. Since the beginning of this year, Nvidia's stock price has risen by more than 144%, while its rise last year was 239%.

The driving force behind Nvidia's stock price surge comes from its monopoly in the AI chip market, with a market share of more than 90% in the global AI chip market.

As the stock price soars, the momentum to short Nvidia is growing, with the total short position for Nvidia nearly equal to the combined total for Apple and Tesla. According to a report released by S3 Partners on Thursday, the current open short position against Nvidia is about $34 billion, almost equivalent to the combined short position against Apple and Tesla.

If the US stock market continues to rise, this part of the funds will face the risk of being forced to cover positions. Since the beginning of this year, many analysts who were bearish on the US stock market have turned bullish, and the number of bears in the US stock market is shrinking.

Jim Chanos, the legendary bear who became famous for predicting the collapse of Enron, said, "Our hedge fund business is shrinking, people just don't want to invest. Investors (especially institutional investors) have given up the fact that short selling has excess returns."

Last year, Chanos announced that he would convert his hedge fund into a family office after nearly 40 years. He said that investors are not interested in bearish strategies, and the fund cannot pay management fees. Its asset has dropped from more than $6 billion dollars in 2008 to less than $200 million dollars.

2

Regulatory voices tried to calm the mood, and small-cap stocks rebounded against the trend of falling micro-cap stocks.

Recently, funds have been fleeing low-priced, small-caps with low market value, and over the counter (OTC) stocks have been losing ground. Some investors believe that this may be due to the presence of quantitative funds.

But Bin said that "how blame the quantitative (trading) unfoundedly" after some suggestions said that quantitative trading can be stopped. It is unfair to blame the market decline on quantitative trading from a fair perspective.

After reading some friends' comments on WeChat, Bin wrote that some people suggested stopping quantitative trading. From an interest perspective, turning off quantitative trading will definitely benefit the subjective long-only funds, but from a fair perspective, it is unfair to blame quantitative trading for the market's decline.

Dan Bin said: "I can boldly predict that even if the algo is stopped, the market will still fall. There is even a possibility that the decline caused by the attenuation of liquidity will be even greater!"

Last night, regulation soothed the market, and small-cap stocks rebounded today. The sector ETF related to the CSI2000 index of small-cap stocks defied the trend and turned red.

The China Securities Regulatory Commission responds to recent ST and delisting of listed companies:

Since the beginning of this year, 99 stocks of listed companies in Shanghai and Shenzhen have been ST or *ST; among them, 44 are ST companies and 55 are *ST companies. Compared with previous years, the number of such companies added from 2021 to 2023 in the same period of Shanghai and Shenzhen increased slightly to 117, 78, and 81 respectively. This year, there hasn't been much change so far.

So far, there are a total of 169 ST listed companies in Shanghai and Shenzhen; among them, there are 85 ST companies and 84 *ST companies, which is slightly less than the same period in 2021 (202 companies) and 2022 (184 companies), and slightly more than in 2023 (164 companies). According to market rules, after the announcement of the annual report on April 30 each year, the stocks of problematic companies will be ST or *ST for various reasons, including failure to meet financial standards, large funds being occupied by major shareholders, and major internal control defects, etc.

According to the China Securities Regulatory Commission website, the Commission stated that if investors suffer losses due to illegal activities of listed companies, we support investors in safeguarding their legitimate rights and interests through litigation and other means in accordance with the law.

3

Foreign investors heavily increase shareholding of core assets.

This year, while small-cap stocks have fallen, core assets have repeatedly hit new highs.

Yesterday, the stock price of China Shenhua Energy broke through the 44 yuan mark, hitting another historic high. The closing price of China Yangtze Power's stock broke through the 28 yuan mark, continuing to hit new highs.

Foreign institutions increase holdings of Chinese assets, demonstrating their bullish outlook on China.

Following the northbound funds' net inflow of 16.577 billion yuan in May, as of June 6, northbound funds frequently appeared with a net purchase of 6 billion yuan in the first week of June. The total net purchase of northbound funds this year has reached 89 billion yuan, exceeding last year's annual level.

Recently, foreign giants have made a move again. Data disclosed by the Hong Kong Stock Exchange on June 5 showed that JPMorgan bought multiple Chinese stocks in the Hong Kong stock market, including CM Bank, HKEX, China Tourism Group Duty Free Corporation, and Bilibili, with a purchase amount exceeding 3.3 billion Hong Kong dollars.

Liu Mingdi, JPMorgan's chief Asia and China stock strategist, publicly stated that the bank has been optimistic about Chinese stocks since the end of October 2023.

Liu Mingdi pointed out that the proportion of foreign investment in mainland stocks is relatively low at present. Although the foreign investment has narrowed in April-May with the rise of the stock market, it is still at a low level. He believes that if the performance of Chinese companies improves in the future, foreign investment may further increase its allocation in Chinese stocks.

In addition, Liu Mingdi listed four types of Chinese stocks worth paying attention to: companies that increase their market share in the domestic market, leading companies in segmented industries, export-oriented companies with outstanding global competitiveness, and companies related to artificial intelligence.

In recent months, foreign investors have frequently expressed their optimism about Chinese assets.

Ray Dalio, founder of the world's largest hedge fund, Bridgewater Associates, stated in a post on social media in April of this year that the key issue is not whether to invest in China, but how much to invest.

At the Greenwich Economic Forum on June 6, the hedge fund giant spoke again and believed that Chinese asset pricing is very attractive.

Dalio reiterated that the challenges facing the Chinese economy can be controlled. He said: "There are signs that China is making efforts to achieve 'benign deleveraging.' Like all countries in history, they can restructure their financial systems to make their economies more productive. They can also deal well with political, geopolitical, natural, and technological forces."

Through the experience of investing in many countries, Dario emphasized the principle of "buying when the market is fearful." He believes that when everyone is afraid to invest, the market valuation is cheap enough and 'benign deleveraging' is more likely to occur, it is precisely the best time to invest. Dario pointed out that the current Chinese stock market meets these conditions.

In recent years, this global hedge fund giant has been active in the Chinese market. Public information shows that Bridgewater China has firmly held gold ETFs since mid-2022.

As of the end of the first quarter of this year, Bridgewater China's holdings in gold ETFs have reached a market value of 987 million yuan, earning more than 100 million yuan on gold ETFs in the first quarter of 2024 compared to a market value of 880 million yuan at the beginning of the year.

With the rise of gold, as of June 6th, 16.2 billion yuan flowed into gold-related ETFs in the A-share market since the beginning of the year.

Recently, the Bank of Canada announced an interest rate cut, becoming the first central bank among the G7 to start a loose cycle, driving the international gold price, which has been fluctuating and consolidating recently, to break through again.

Regarding the trend of gold, Daoyou Futures analysis said that whether the US economy can achieve a soft landing in the short term remains to be seen. The Federal Reserve's performance on interest rate cuts is hesitant, or it will continue to observe the performance of several relevant data in the short term, and it is difficult for gold and silver prices to return to the upward trend in the short term, or continue to be dominated by fluctuations.