Benign Growth For Qingdao Tianneng Heavy Industries Co.,Ltd (SZSE:300569) Underpins Its Share Price

Benign Growth For Qingdao Tianneng Heavy Industries Co.,Ltd (SZSE:300569) Underpins Its Share Price

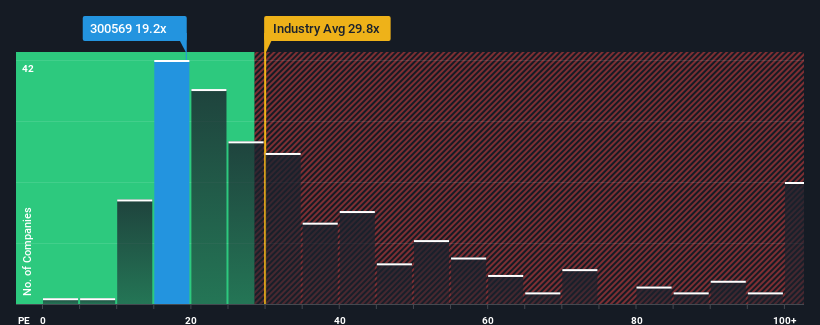

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may consider Qingdao Tianneng Heavy Industries Co.,Ltd (SZSE:300569) as an attractive investment with its 19.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Qingdao Tianneng Heavy IndustriesLtd's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Qingdao Tianneng Heavy IndustriesLtd would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 68% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 38% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Qingdao Tianneng Heavy IndustriesLtd's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Qingdao Tianneng Heavy IndustriesLtd maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Qingdao Tianneng Heavy IndustriesLtd (1 makes us a bit uncomfortable!) that we have uncovered.

You might be able to find a better investment than Qingdao Tianneng Heavy IndustriesLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.