Guangzheng Eye Hospital Group Co.,Ltd. (SZSE:002524) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

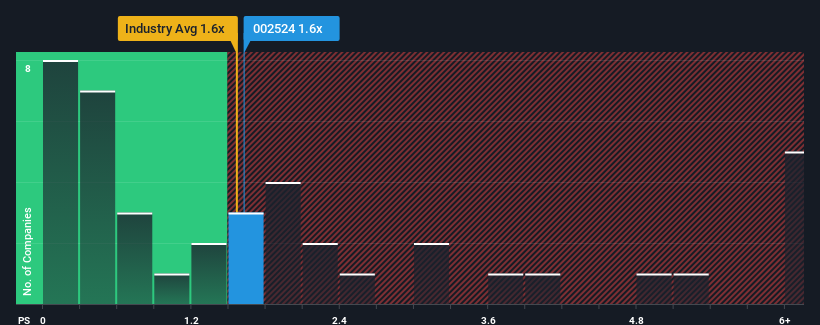

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Guangzheng Eye Hospital GroupLtd's P/S ratio of 1.6x, since the median price-to-sales (or "P/S") ratio for the Healthcare industry in China is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does Guangzheng Eye Hospital GroupLtd's Recent Performance Look Like?

Recent times have been quite advantageous for Guangzheng Eye Hospital GroupLtd as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. Those who are bullish on Guangzheng Eye Hospital GroupLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Guangzheng Eye Hospital GroupLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Guangzheng Eye Hospital GroupLtd would need to produce growth that's similar to the industry.

In order to justify its P/S ratio, Guangzheng Eye Hospital GroupLtd would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 33%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

This is in contrast to the rest of the industry, which is expected to grow by 16% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Guangzheng Eye Hospital GroupLtd's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Guangzheng Eye Hospital GroupLtd's P/S?

With its share price dropping off a cliff, the P/S for Guangzheng Eye Hospital GroupLtd looks to be in line with the rest of the Healthcare industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Guangzheng Eye Hospital GroupLtd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Before you take the next step, you should know about the 1 warning sign for Guangzheng Eye Hospital GroupLtd that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.