Hefei Metalforming Intelligent Manufacturing Co., Ltd. (SHSE:603011) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Longer-term shareholders would now have taken a real hit with the stock declining 8.6% in the last year.

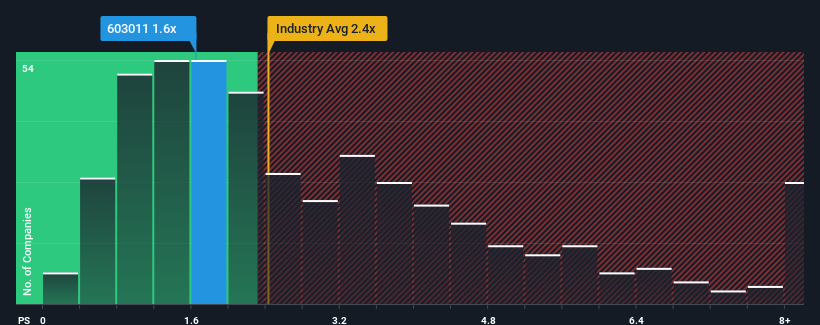

In spite of the heavy fall in price, Hefei Metalforming Intelligent Manufacturing's price-to-sales (or "P/S") ratio of 1.6x might still make it look like a buy right now compared to the Machinery industry in China, where around half of the companies have P/S ratios above 2.4x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Hefei Metalforming Intelligent Manufacturing's P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for Hefei Metalforming Intelligent Manufacturing, which is generally not a bad outcome. One possibility is that the P/S ratio is low because investors think this good revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Hefei Metalforming Intelligent Manufacturing, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Hefei Metalforming Intelligent Manufacturing would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 4.8% gain to the company's revenues. The latest three year period has also seen an excellent 88% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 24% shows it's about the same on an annualised basis.

With this information, we find it odd that Hefei Metalforming Intelligent Manufacturing is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What We Can Learn From Hefei Metalforming Intelligent Manufacturing's P/S?

The southerly movements of Hefei Metalforming Intelligent Manufacturing's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Hefei Metalforming Intelligent Manufacturing currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Hefei Metalforming Intelligent Manufacturing (2 are a bit unpleasant) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.