The largest stock split in history is about to take effect. What does this mean for Nvie? Can the astonishing rise continue?

Starting with the opening of the market on Monday, June 10, Nvidia shares will be traded at a split adjusted price. Nvidia's overall value is not expected to change after the split, and a cheaper price per share will make it easier for investors to reach.

This stock split comes at a time when Nvidia's stock price has skyrocketed. Driven by the artificial intelligence boom, Nvidia has risen 205% in the past year, and the return rate for the past three years has been 580%.

Judging from historical experience, Nvidia's stock price may fluctuate after the stock split. Could this be a short-term top and a long-term bottom?

What does Nvidia's stock split mean?

Jay Woods, chief strategist at Freedom Capital Markets, believes that this split may be a precursor to Nvidia's inclusion in the Dow. Nvidia's stock price has reached the high level of the split announced in the past, and the stock split will make the stock price more attractive to be included in the Dow.

Nvidia is likely to replace Intel in the Dow and SPDR Dow funds, Woods said:

As a representative of the next wave of technological growth, artificial intelligence and chip maker Nvidia should have been selected by the Dow.

PremarketPrep predicted this stock split before the earnings report, and he also said it was logical for Nvidia to replace Intel in the Dow. PremarketPrep says:

I expect to announce in the summer that Nvidia's inclusion in the Dow is no longer a question of “whether”, but “when.”

Short-term top, long-term bottom?

This isn't Nvidia's first stock split, but the 10-1 split is the largest in the company's history.

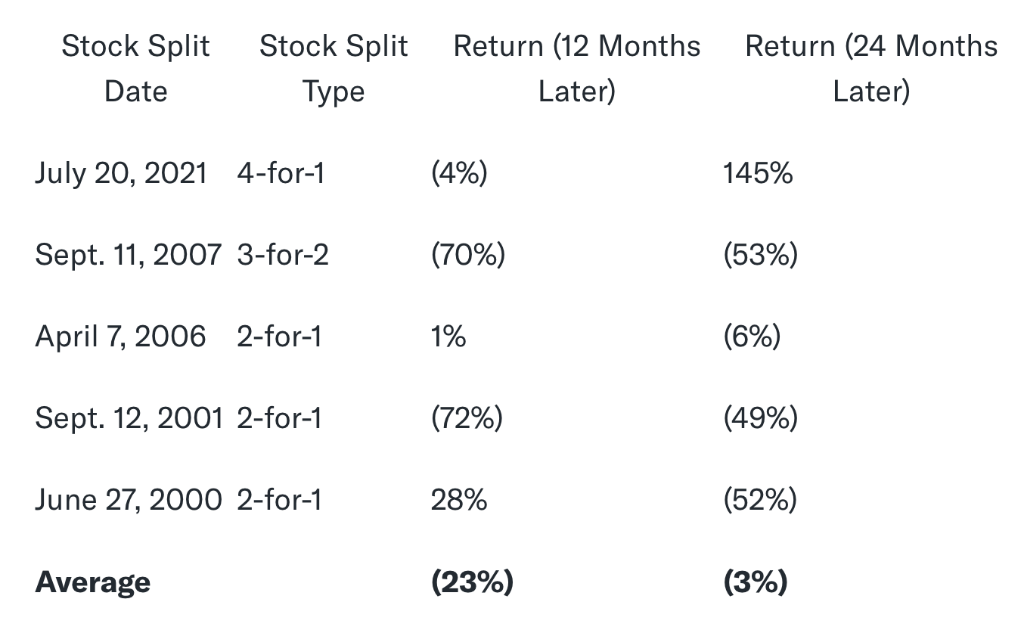

Judging from historical experience, since the 1999 IPO, Nvidia has completed five splits, and the stock price usually plummets within 12 and 24 months after the spin-off.

Within 12 months after the split, Nvidia dropped an average of 23%, and is still down an average of 3% 24 months later.

However, it should be noted that four of Nvidia's past five stock splits were near economic recession. The recession triggered a bear market, which had devastating consequences for the stock market. Naturally, Nvidia was also dragged down.

Looking at a further lengthening cycle, even though the stock price initially falls, investors often get good returns if they buy stocks during stock splits.

Apple has a similar split history with Nvidia. Take Apple as an example. At the beginning of 1987, if you only held one Apple stock (equivalent to the current 35 cents), then today's portfolio would reach 224 shares (worth about 43,500 US dollars). Moreover, after three recent stock splits, the stock's annual return is very impressive. Within a year after the stock split in 2005, the stock price rose 62%. After the 2014 stock split, the stock price rose 37%, and rose 20% in the 12 months after the 2020 stock split.

Bank of America data shows that stocks will generally return 25% in the next 12 months after the split, while the return on the general market index is 12%. Although Nvidia's performance in the past few times may not have been ideal, considering its impressive performance over the past year, traders expect Nvidia's stock price to rise further this time.

Of course nothing is absolute; if the rise in AI stock prices is a bubble, then it could burst at any time.