Many banks are selling assets and are turning to the rapidly growing area of the bond market. In 2023, the latest round of global capital rules known as "Basel III" is expected to raise the cost of owning large amounts of loans for banks. In response, lending institutions are bundling more auto loans, equipment leasing, and other types of debt into asset-backed securities.

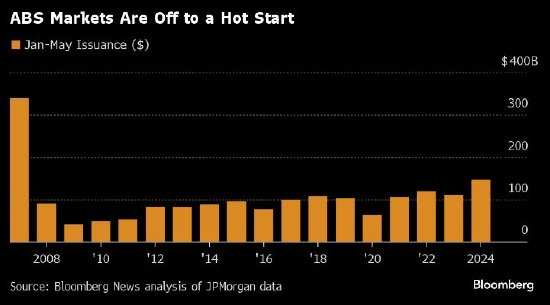

Compiled data shows that only in the United States, ABS sales this year have exceeded $170 billion, an increase of about 38% from this time in 2023. Europe has also seen similar growth: compiled data not including mortgage-backed securities shows that this year's issuance was about €21 billion (~$22.9 billion), an increase of about 35% from the same period last year.

And the issuance wave seems to be unabated. Bank of America strategists raised their annual US sales forecast for these securities from the previous $270 billion to about $310 billion on May 31, mainly due to car loan securitization. These bonds have found ready buyers among credit investors, and attendees at this week's global ABS conference in Barcelona expressed cautiously optimistic attitudes towards the market.

Kay Herr, CIO of JPMorgan Asset Management's US Fixed Income Business, said in the podcast Credit Edge: "We're seeing attractive opportunities in asset-certificate securities," especially securities related to US households." We absolutely see the opportunity for higher yields there."

Banks' use of significant risk transfer (similar to ABS) is also driving bond issuance to the highest level since market was hit hard by the 2008 financial crisis. S&P Ratings Structured Finance Research Chief Andrew South said at a conference this week: "So far, many SRT transactions have occurred in the US." He added, "With the significant regulatory changes in Basel 3.1, banks may have more incentives to use securitization to ease capital pressures."

A strong sign of demand is that investors are snapping up assets backed by increasingly esoteric assets when seeking securities that are rated relatively high and have relatively high yields, including art by Rembrandt van Rijn and Andy Warhol, as well as internet protocol addresses.

South said: "We received a lot of questions about sophisticated securitization." He cited data center and solar cell panel securitization as two examples.

Strategists say that it is certain that issuers may sell in advance to avoid any fluctuations from the US presidential election or a shift in Federal Reserve (Federal Reserve) monetary policy. This dynamic may lead to significant slowing of economic growth in the second half of this year.

CECEP Solar Energy and institutional investors signed a strategic cooperation agreement for "Internet Plus" technologies, aiming to jointly establish an Internet plus related operating system of energy assets by combining their respective resources and advantages in the data center and photovoltaic industries.

CECEP Solar Energy and asset investment institutions signed strategic cooperation agreements for the development of photovoltaic power stations and distributed energy projects in Europe.

Wall Street's CEOs have been frank about their dislike of the final rules of "Basel III". Jamie Dimon, CEO of JPMorgan Chase & Co., said hedge funds and companies outside the banking system are excited about their business that would benefit from those regulatory requirements. "They're having a party," Dimon said last year.

But even so, preparations by banks for stricter new capital requirements can be seen from the increasing number of ABS issuances. In the past few days, banks have prepared to sell a new batch of bonds next week, including Banco Santander and Toyota's auto bonds.

Regulatory agencies seem to be listening. In March of this year, Federal Reserve Chairman Jerome Powell said that the central bank is planning to make "broad and substantive changes" to how it implements these rules, and may undertake a comprehensive reform.

Despite everything, the issuance of securities backed by esoteric assets is driving up this year's bond sales to the highest levels since the market was hit hard by the 2008 financial crisis.