The market on Wednesday was very exciting.

Wall Street giants have issued warnings, and there may be big movements in the US stock market this week! In accordance with product structure, the operating income of 10-30 billion yuan products was 4.01/12.88/0.06 billion yuan, respectively, and the company's overall sales volume was 18,000 kiloliters in 2023, with a significant growth of 28.10% YoY.

From JPMorgan to Citigroup, the most famous trading departments on Wall Street are urging investors to prepare for the volatility of the US stock market this week. The latest CPI data and the Fed's interest rate decision will be released on Wednesday, which may become the key factors that trigger market turbulence.

Andrew Tyler, head of Morgan Stanley's US market intelligence division, said that the options market is betting that the S&P 500 index will fluctuate by 1.3%-1.4% before this Friday. This will happen after the release of the Consumer Price Index (CPI) report on Wednesday and the Federal Reserve's interest rate decision in the afternoon on the same day.

Tyler and his team wrote to clients in a report on Monday: "As CPI data and the Federal Reserve decisions are released on the same day, Powell's press conference may reverse the CPI data."

At the same time, Stuart Kaiser, head of US stock trading strategy at Citigroup, said that investors are preparing for the largest Fed decision day stock market volatility since March 2023.

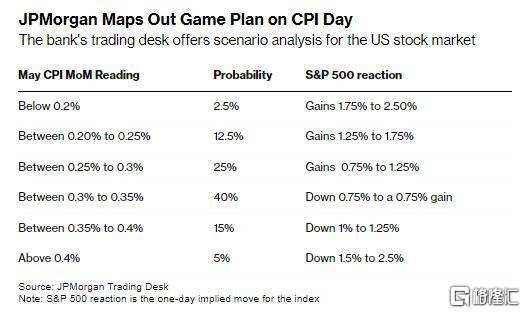

At the same time, JPMorgan predicts that based on the CPI index report, the S&P 500 index may fluctuate up to 2.5%.

Andrew Taylor said that if the core CPI monthly growth rate exceeds 0.4%, it may trigger the selling of all risk assets, and the S&P 500 index is expected to drop by 1.5%-2.5%. However, he believes that the probability of this situation occurring is only 5%.

If the core CPI increase rate is between 0.3% and 0.35% (which is the most likely situation for Morgan Stanley's trading department), the result of the S&P 500 index will be between a 0.75% decline and a 0.75% increase, depending on housing deflation and the rise in automobile and medical prices.

If the core CPI increase rate is between 0.20% and 0.25%, the expectation of a rate cut in September may rise sharply. He explained that after the European Central Bank's first rate cut in five years last week, some traders even bet on a rate cut in July.

He added that a core CPI increase rate of less than 0.2% will be regarded as a major bullish signal for the US stock market, which may result in an increase of 1.75%-2.50% in the S&P 500 index.

In a situation where market volatility has historically been limited, the CPI report and the Federal Reserve's decision may result in significant fluctuations. The Chicago Board Options Exchange volatility index (VIX) trading price is close to a 52-week low of 13, far below the level of 20 that initially caused traders concern.

It is worth noting that US job growth soared in May, prompting traders to postpone the expected interest rate cut time when the data was released last week.