Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Wingtech Technology Co.,Ltd (SHSE:600745) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is Wingtech TechnologyLtd's Net Debt?

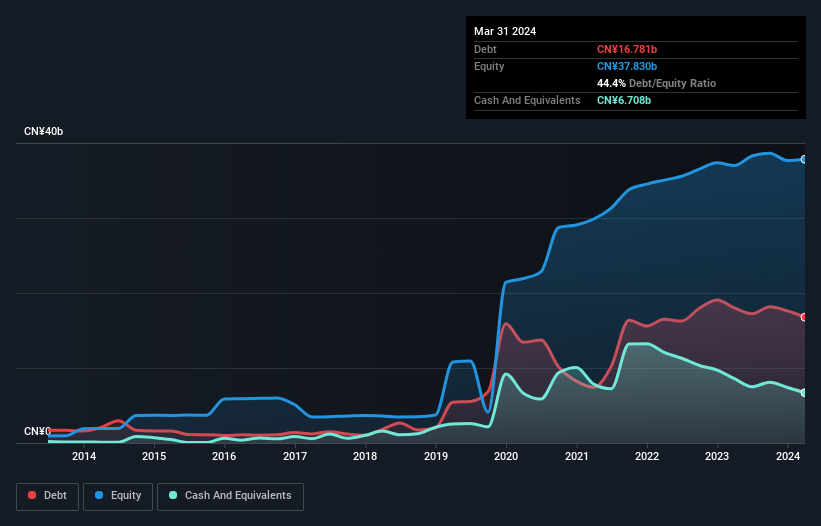

The image below, which you can click on for greater detail, shows that Wingtech TechnologyLtd had debt of CN¥16.8b at the end of March 2024, a reduction from CN¥18.0b over a year. However, because it has a cash reserve of CN¥6.71b, its net debt is less, at about CN¥10.1b.

A Look At Wingtech TechnologyLtd's Liabilities

According to the last reported balance sheet, Wingtech TechnologyLtd had liabilities of CN¥25.5b due within 12 months, and liabilities of CN¥11.9b due beyond 12 months. On the other hand, it had cash of CN¥6.71b and CN¥10.4b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥20.3b.

This deficit isn't so bad because Wingtech TechnologyLtd is worth CN¥36.0b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Wingtech TechnologyLtd has net debt worth 2.0 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 6.2 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Importantly, Wingtech TechnologyLtd's EBIT fell a jaw-dropping 20% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Wingtech TechnologyLtd's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Wingtech TechnologyLtd burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Wingtech TechnologyLtd's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But at least its interest cover is not so bad. We're quite clear that we consider Wingtech TechnologyLtd to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Wingtech TechnologyLtd that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.