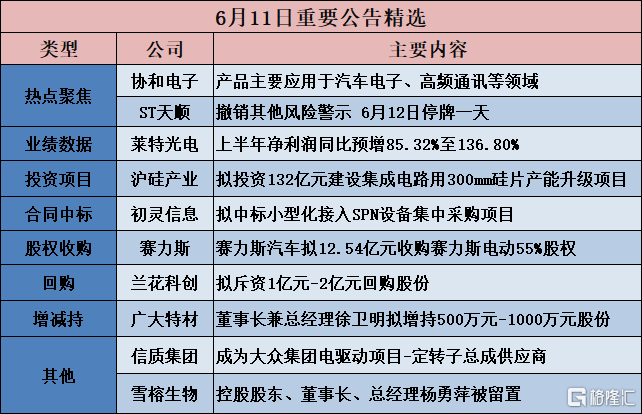

Focus on hot topics

Jiangsu Xiehe Electronic (605258.SH) has had six consecutive trading days of gains. Their products are mainly used in the fields of automotive electronics and high-frequency communications.

Jiangsu Xiehe Electronic (605258.SH) announced that there has been a significant increase in the company's stock price. The company's stock has been locked at the limit for six consecutive trading days from June 3, 2024 to June 11, 2024, with a cumulative increase of 77.21%. However, the company's fundamentals have not undergone significant changes, nor are there any significant undisclosed information that should be disclosed, which entails trading risks. The company mainly engages in the R&D, production, sales of rigid and flexible printed circuit boards, as well as the surface mount technology (SMT) of printed circuit boards, which are mainly applied in the fields of automotive electronics, high-frequency communication, and others. 100-300 billion yuan product revenues were 401/1288/60 million yuan, respectively.

Xinjiang Tianshun Supply Chain (002800.SZ): Revokes Other Risk Warning and Halts Trading for One Day on June 12th.

Xinjiang Tianshun Supply Chain (002800.SZ) announced that the company's stock trading was suspended for one day on June 12, 2024 and resumed trading on June 13, 2024. The company has cancelled other risk warnings since June 13, 2024, and changed its securities abbreviation from "ST Tianshun" to "Tianshun Stock", with the securities code remaining as "002800". After cancelling other risk warnings, the daily price limit of the company's stock trading has changed from 5% to 10%.

Investment project:

Investment project:

Jinghua Pharmaceutical Group (002349.SZ) intends to invest about 1 billion yuan to build a modern production base for Chinese patent medicines and chemical preparations.

Jinghua Pharmaceutical Group (002349.SZ) announced that, according to its own development needs, it plans to build a modern production base for Chinese patent medicines and chemical preparation. Recently, the company signed the "Jinghua Pharmaceutical Modern Production Base Construction Project Cooperation Framework Agreement" with the management committee of Shibei Hi-Tech Industrial Development Zone, Nantong City, Jiangsu Province. The proposed production base covers an area of about 160 acres on the land located in Changtai Road West, Xinning Road South, Changtai Road West, and Xinning Road North of Chongchuan District, Nantong City. The project volume ratio is greater than 1.6. The planned construction area is about 180,000 square meters, and the land is for industrial use. The total investment of the project is about 1 billion yuan (the specific investment amount shall be subject to the formal agreement signed by both parties).

National Silicon Industry Group (688126.SH): plans to invest 13.2 billion yuan to build a new integrated circuit 300mm silicon wafer production capacity upgrade project.

National Silicon Industry Group (688126.SH) announced that to actively respond to the national strategy for the development of the semiconductor industry, to accelerate the implementation of the company's long-term development strategy and seize the development opportunities of the semiconductor industry, and to continuously expand the production scale of the company's integrated circuit 300mm silicon wafer, and enhance the company's global market share and competitive advantages, the company plans to invest in the new integrated circuit 300mm silicon wafer production capacity upgrade project. After the project is completed, the company's 300mm silicon wafer production capacity will increase by 600,000 pieces per month on the basis of the existing capacity, reaching 1.2 million pieces per month. The total investment of this project is estimated to be 13.2 billion yuan, which will be used for land acquisition, plant and supporting facilities construction, equipment procurement and installation, etc. Actual investment amount will be determined according to the progress of the project.

Guizhou Space Appliance (002025.SZ): Taizhou Aviation plans to invest 180 million yuan to build a new plant area project.

Guizhou Space Appliance (002025.SZ) announced that, to promote the construction of the TaiZhou Aerospace New Factory, the company held its fourth interim meeting of the seventh board of directors on June 11, 2024 to review and approve the "Proposal on Investment and Construction of New Factory Area Project for Subsidiary TaiZhou HangYu". The board of directors agreed that the subsidiary TaiZhou HangYu will invest 180 million yuan to build a new factory area project on the 67.185 mu land obtained by substitution. The project will generate an annual production capacity of 620,000 communication connectors and components, 1.8 million rail transit power connectors and components, 1.3 million glass sintered sealing connectors, 500,000 metal packaging shells, 50,000 ceramic packaging shells and substrates. The construction period is 36 months.

Zhejiang Xinhua Chemical (603867.SH): Plans to invest about 60 million yuan to build the “Ningxia Xinhua Chemical Co., Ltd. Synthetic Flavor Production Base New 7,155 Ton/Year Product Construction Project”.

Zhejiang Xinhua Chemical (603867.SH) announced that the company agreed to Ningxia Xinhua Chemical Industry Co., Ltd. to build a "Ningxia Xinhua Chemical Industry Co., Ltd. synthetic fragrance production base with an additional annual production capacity of 7,155 tons per year". After completion, 29 kinds of fragrance products such as 2-methylbutyl acetate, alpha-methylcinnamaldehyde, and butyl lactone will be added, with an annual production capacity of 7,155 tons. The total investment of the project is about 60 million yuan.

Jiangsu Zhengdan Chemical Industry (300641.SZ): plans to invest 350 million yuan to build an annual output of 65,000 tons of maleic anhydride green upgrade and renovation project.

Jiangsu Zhengdan Chemical Industry (300641.SZ) announced that, in order to further give full play to the company's accumulated advantages in TMA products such as technology, market, management, brand and other aspects over the years, expand production capacity, combine with the company's actual situation, the company plans to invest 350 million yuan to build an annual output of 65,000 tons of maleic anhydride green upgrade and renovation project. After the project is completed, it will effectively solve the current TMA production capacity shortage of the company, fill the market gap, better meet the downstream customer demand, and have important significance for further consolidating and improving the company's industry status and creating the leading global TMA brand, in line with the company's strategic development plan.

Contracts awarded:

Hangzhou CNCr-IT (300250.SZ): Intends to win the centralized procurement project for small-scale access SPN equipment.

Hangzhou CNCR-IT (300250.SZ) announced that recently, China Mobile Procurement and Tendering Network released the "China Mobile 2024-2025 Small-scale Access SPN Equipment Centralized Procurement-Winners and Candidates Announcement". Hangzhou CNCR-IT Co., Ltd. is one of the candidates for the above-mentioned project. The winning bid ratio: 17.39% in package 1 and 10.87% in package 2 (according to the total bidding amount, the estimated winning amount including tax for this time is about 9.8 million yuan. The specifics shall be subject to the winning notice or the final framework contract).

Silvery Dragon Prestressed Materials (603969.SH): Signed a steel sales contract worth 119 million yuan.

Silvery dragon prestressed materials (603969.SH) announced that the company has signed steel selling contracts numbered WZHT-20240603-0290 (hereinafter referred to as "Contract 1") and WZHT-20240603-0251 (hereinafter referred to as "Contract 2") respectively with China Railway Beijing Engineering Group Co., Ltd. These contracts provide steel purchasing and selling for the JWZQ-2 project of the Tianjin-Weifang high-speed railway station construction, with a total amount of 119 million yuan (RMB) for both contracts. The amount of Contract 1 is 60.1798 million yuan (RMB), and the amount of Contract 2 is 58.8468 million yuan (RMB).

[Equity Acquisition]

Zhejiang supcon technology co., ltd. (688777.SH): planning to sell 100% equity of the control system engineering to focus on main business.

Zhejiang supcon technology co., ltd. (688777.SH) announced that, in order to focus on its main business and highlight its scientific and technological innovation attributes, the company plans to transfer 100% equity of Zhejiang supcon control system engineering co., ltd. ("Control System Engineering") held by the company to Zhejiang supcon Xizi technology co., ltd. ("Supcon Xizi") for a transaction consideration of 52.161 million yuan. After this transaction is completed, the company will no longer hold the equity of Control System Engineering directly, and Control System Engineering will no longer be included in the company's consolidated financial statements.

Chongqing sokon industry group stock (601127.SH): planning to acquire 55% equity of sokon electric for about 1.254 billion yuan.

Chongqing sokon industry group stock (601127.SH) announced that the company's holding subsidiary, Sokon automobile co., ltd. ("Sokon automobile"), plans to acquire 55% equity of Chongqing siles electric vehicle co., ltd. ("Siles electric") held by Chongqing Jingyun Chuangfu Enterprise Management Co., Ltd. ("Jingyun Chuangfu") and Chongqing sasin private equity investment fund partnership (Limited Partnership) ("Sasin fund") at a price agreed in the agreement, which is about 1.254 billion yuan. Prior to the transaction, based on the agreement on the sale of shares under the investment agreement, Sokon electric was accounted for as a wholly-owned subsidiary in the company's consolidated financial statements. This transaction is conducive to reducing the company's financing costs and will not harm the interests of the company and all shareholders. This transaction will not cause change to the scope of the company's consolidated financial statements.

Shanghai hile bio-technology co., ltd. (603718.SH): planning to acquire 55% equity of ruisheng biology.

Shanghai hile bio-technology co., ltd. (603718.SH) announced that the company plans to purchase 55% equity of Ruisheng biology from Merrimack Management Co., Ltd. by paying cash. The estimated value of this transaction is RMB 880 million to RMB 960 million. This transaction is still in the preliminary planning stage, and the final transaction price needs to be further negotiated by the parties after auditing and evaluation are completed, and shall be subject to the formal agreement signed by the parties. Therefore, there are uncertainties. This transaction is planned to be settled in cash, and does not involve the issuance of shares by the listed company, and the transaction does not constitute a related transaction, nor will it result in a change in the control of the listed company.

Shaanxi ruisheng biological technology co., ltd. was established in 2008, aiming to promote the scientific development of the oral regeneration medicine field, mainly including natural calcined bone repair materials, oral absorbable biofilm, and decellularized anal fistula repair matrix. Ruisheng biology adopts the operation mode of production, study, research, and sales united development and independent innovation, adhering to the development concept of market-oriented, product-oriented, technology-based, capital-based, and talent-based, which aims to build a comprehensive product system in the oral field and expand the dental industry layout.

[Performance data]

Liti optics technology co., ltd. (688150.SH): net profit is expected to increase by 85.32% to 136.80% year-on-year in the first half of the year.

Liti optics technology co., ltd. (688150.SH) announced the performance forecast for the first half of 2024, and is expected to achieve operating income of 240.8193 million yuan to 284.6046 million yuan in the first half of 2024. Compared with the same period last year, it will increase by 99.4303 million yuan to 143.2156 million yuan, a year-on-year increase of 70.32% to 101.29%.

The net profit attributed to the owners of the parent company in the first half of 2024 is expected to be 81.0647 million yuan to 103.5827 million yuan. Compared with the same period last year, it will increase by 37.3215 million yuan to 59.8395 million yuan, a year-on-year increase of 85.32% to 136.80%. The net profit attributed to the owners of the parent company after deducting non-recurring profits and losses is expected to be 70.0407 million yuan to 92.5587 million yuan in the first half of 2024. Compared with the same period last year, it will increase by 37.7380 million yuan to 60.2560 million yuan, a year-on-year increase of 116.83% to 186.54%.

[Repurchase]

Guoli shares co., ltd. (688103.SH): planning to spend 20 million yuan to 40 million yuan to repurchase company's shares.

Guoli shares co., ltd. (688103.SH) announced that the company plans to repurchase its own shares with its own funds of 20 million yuan to 40 million yuan. The repurchase price of the shares shall not exceed 45.49 yuan per share, and the repurchased shares will be used for cancellation of registration and corresponding reduction of registered capital.

West shanghai automotive service co., ltd. (605151.SH): planning to repurchase shares with 40 million yuan to 80 million yuan.

West shanghai automotive service co., ltd. (605151.SH) announced that the company plans to repurchase its own shares with its own funds through centralized bidding trading. The stock repurchase is planned to be used for employee stock ownership plan or equity incentive, with a repurchase amount not less than 40 million yuan (inclusive) and not more than 80 million yuan (inclusive), and the repurchase price of the shares shall not exceed 24.41 yuan per share (inclusive).

Tangshan sunfar silicon industries co., ltd. (603938.SH): planning to repurchase shares with 15 million yuan to 30 million yuan.

Tangshan sunfar silicon industries co., ltd. (603938.SH) announced that the company plans to repurchase its own shares through centralized bidding trading. The total amount of fund used for repurchasing shares shall not be less than RMB 15 million (inclusive) and not exceed RMB 30 million (inclusive), and the repurchase price per share shall not exceed RMB 20.00 (inclusive).

Lanhua Sci-Tech Venture (600123.SH): proposes to use 100-200 million yuan to repurchase shares.

Lanhua Sci-Tech Venture (600123.SH) announced that it plans to repurchase the company's shares through centralized bidding trading. The repurchased shares will be cancelled in accordance with the law and the company's registered capital will be reduced. The repurchase amount is no less than 100 million yuan and no more than 200 million yuan, and the repurchase price is no more than 15 yuan/share.

Henan Hengxing Science & Technology (002132.SZ) intends to use 50-60 million yuan to repurchase company shares.

Henan Hengxing Science & Technology (002132.SZ) announced that it plans to repurchase publicly traded A-shares for necessary value preservation and protection of shareholder rights. The repurchased shares will be resold in accordance with relevant regulations. The proposed repurchase amount is no less than 50 million yuan (inclusive) and no more than 60 million yuan (inclusive). The repurchase price is no more than 3.76 yuan/share (inclusive). Based on the total amount of repurchase funds and the upper limit of the repurchase price of 3.76 yuan/share, the expected number of repurchased shares is approximately 13,297,872 to 15,957,446 shares, accounting for approximately 0.95% to 1.14% of the company's total share capital. The specific number of repurchased shares will be subject to the actual repurchase quantity upon expiration of the repurchase period. The repurchase period is within three months after the board of directors approves the share repurchase plan.

【Increase and Decrease】

*Gome Telecom Equipment (600898.SH): Controlling shareholder affiliated party Gome Trust plans to increase its shareholding by RMB 2-4 million.

ST Gome Telecom Equipment (600898.SH) announced that its controlling shareholder, Gome Information Technology Co., Ltd. (hereinafter referred to as "Gome Information"), plans to increase its shareholding through centralized bidding transactions on the Shanghai Stock Exchange trading system by no less than 2 million yuan and no more than 4 million yuan from the date of this announcement for a period of 10 trading days. As of the close of trading on June 11, 2024, the company's stock price was 0.87 yuan/share. The main body of the increase will increase based on this increase plan and will not depend on whether the company is an A-share listed company or is delisted.

Healthcare Co., Ltd. (603313.SH): The controlling shareholder, Zhang Gen Ni, accumulatively increases shareholding in the company by 45.3874 million yuan.

Healthcare Co., Ltd. (603313.SH) announced that as of the date of this announcement, the company's controlling shareholder, Mr. Zhang Gen Ni, has cumulatively increased his shareholding in the company by 5.5551 million shares through the Shanghai Stock Exchange trading system, accounting for 0.97% of the company's total share capital, with a cumulative increase of 45.3874 million yuan, accounting for 56.73% of the lower limit of the increase plan.

Zhangjiagang Guangda Special Material (688186.SH): Director and General Manager Xu Weiming intends to increase shareholdings by 5-10 million yuan.

Zhangjiagang Guangda Special Material (688186.SH) announced that the company has received a notification from Mr. Xu Weiming, the actual controller and chairman of the board, that he intends to increase his shareholding in the company through the Shanghai Stock Exchange trading system within six months from June 12, 2024, by a total of no less than 5 million yuan (inclusive) and no more than 10 million yuan (inclusive) in a manner allowed by the exchange (including but not limited to centralized bidding, block trading, etc.).

【Other】

Xinzhi Group (002664.SZ): became the supplier of the Volkswagen Group's electric drive project - rotor assemblies

Xinzhi Group (002664.SZ) announced that the company recently received notice of appointment from Volkswagen Group to become its supplier of rotor assemblies for the electric drive project. Based on the commercial confidentiality of this project, the specific orders will be based on internal order data within the Volkswagen Group.

Shanghai Xuerong Bio-technology (300511.SZ): The controlling shareholder, chairman and general manager, Ms. Yang Yongping, has been taken into custody.

Shanghai Xuerong Bio-technology (300511.SZ) announced that on June 11, 2024, the company received a written notice of detention and filing from the Yongdeng County Supervision Committee. Ms. Yang Yongping, the company's controlling shareholder, legal representative, chairman and general manager, has been taken into custody. As of the date of this announcement, the company has not received any investigation or cooperation investigation documents from competent authorities with respect to the company and is not aware of the progress and conclusions of the detention investigation. The company will closely monitor the follow-up developments of the above matters and timely fulfill its information disclosure obligations in accordance with relevant laws and regulations, and investors are requested to invest rationally and pay attention to investment risks.

【投资项目】

【投资项目】