Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is for those who would like to learn about Return On Equity (ROE). By way of learning-by-doing, we'll look at ROE to gain a better understanding of CITIC Metal Co., Ltd (SHSE:601061).

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors' money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for CITIC Metal is:

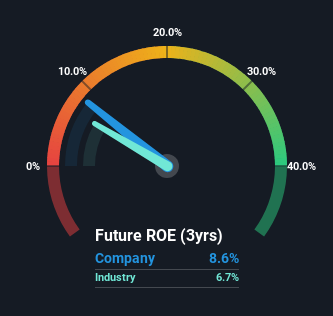

8.6% = CN¥1.7b ÷ CN¥19b (Based on the trailing twelve months to March 2024).

The 'return' is the income the business earned over the last year. One way to conceptualize this is that for each CN¥1 of shareholders' capital it has, the company made CN¥0.09 in profit.

Does CITIC Metal Have A Good ROE?

Arguably the easiest way to assess company's ROE is to compare it with the average in its industry. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. Pleasingly, CITIC Metal has a superior ROE than the average (6.7%) in the Trade Distributors industry.

That is a good sign. However, bear in mind that a high ROE doesn't necessarily indicate efficient profit generation. A higher proportion of debt in a company's capital structure may also result in a high ROE, where the high debt levels could be a huge risk . Our risks dashboardshould have the 3 risks we have identified for CITIC Metal.

Why You Should Consider Debt When Looking At ROE

Virtually all companies need money to invest in the business, to grow profits. That cash can come from retained earnings, issuing new shares (equity), or debt. In the first and second cases, the ROE will reflect this use of cash for investment in the business. In the latter case, the use of debt will improve the returns, but will not change the equity. That will make the ROE look better than if no debt was used.

Combining CITIC Metal's Debt And Its 8.6% Return On Equity

CITIC Metal clearly uses a high amount of debt to boost returns, as it has a debt to equity ratio of 1.04. The combination of a rather low ROE and significant use of debt is not particularly appealing. Debt does bring extra risk, so it's only really worthwhile when a company generates some decent returns from it.

Conclusion

Return on equity is a useful indicator of the ability of a business to generate profits and return them to shareholders. In our books, the highest quality companies have high return on equity, despite low debt. If two companies have around the same level of debt to equity, and one has a higher ROE, I'd generally prefer the one with higher ROE.

Having said that, while ROE is a useful indicator of business quality, you'll have to look at a whole range of factors to determine the right price to buy a stock. The rate at which profits are likely to grow, relative to the expectations of profit growth reflected in the current price, must be considered, too. You can see how the company has grow in the past by looking at this FREE detailed graph of past earnings, revenue and cash flow.

Of course CITIC Metal may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.