From solar energy stocks to datacenters, legendary investor Jim Chanos believes there are many opportunities for short selling. The problem is that fund managers like him, who take bearish positions, still struggle to raise funds. Chanos, who is famous for predicting the Enron tragedy, bemoans that we are now in a 'fraudulent gold rush' era, where skyrocketing valuations plague many companies. He points out that residential solar energy stocks are now 'burning through millions of dollars every quarter', and traditional datacenters are at risk of becoming big losers in the artificial intelligence (AI) revolution, as their infrastructure may not be compatible with new technology. Chanos said, 'So many companies are playing games and trying to take advantage of investors, so we need short sellers more than ever.' Despite the ample opportunity to short, institutional investors are not interested in funding bearish strategies, which is one reason why bears, including Chanos himself, are struggling.

Jim Chanos, famous for predicting the Enron tragedy, laments again that it is now the 'fraudulent gold rush' era, where an unstoppable bull market has led to many company valuation overestimations. He points out that residential solar energy stocks are now burning through millions of dollars every quarter, and traditional datacenters are at risk of becoming big losers in the artificial intelligence (AI) revolution, as their infrastructure may not be compatible with new technology. Chanos has said, 'There are so many companies playing games and trying to take advantage of investors, so we need short sellers more than ever.'

Chanos said, 'There are so many companies playing games and trying to take advantage of investors, so we need short sellers more than ever.'

Although there are many opportunities to short sell, one reason why bears like Chanos are struggling is because institutional investors are not interested in funding bearish strategies.

Chanos announced at the end of last year that the hedge fund he founded nearly 40 years ago is undergoing transformation into a family office. The fund's assets have decreased from over $6 billion in 2008 to less than $200 million.

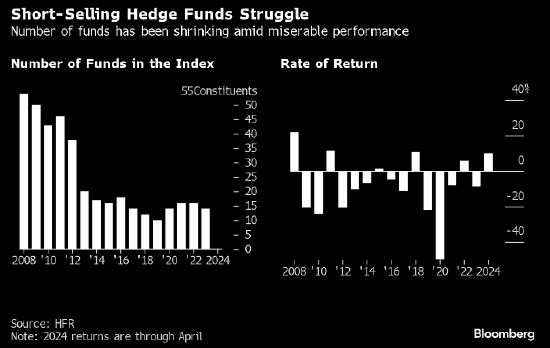

The entire short-selling world has been shrinking, with the number of members in the HFR bearish hedge fund index decreasing from 54 in 2008 to 14. This is due to a fierce bull market, global regulatory threats, and factors such as retail investors squeezing short positions in GameStop. According to Goldman Sachs, bearish interest on typical S&P 500 index component stocks is hovering at its lowest level in more than twenty years.

Although Chanos says now is a good time to expose company fraud, he believes that short selling strategies will not attract significant amounts of money in the short term.

'It's even harder now. No one wants to short,' said Chanos. He pointed out that the low interest rate era and the '15-year-old bull market' are among the main reasons why the short-selling hedge fund team has been shrinking continuously.