Focus on hot topics

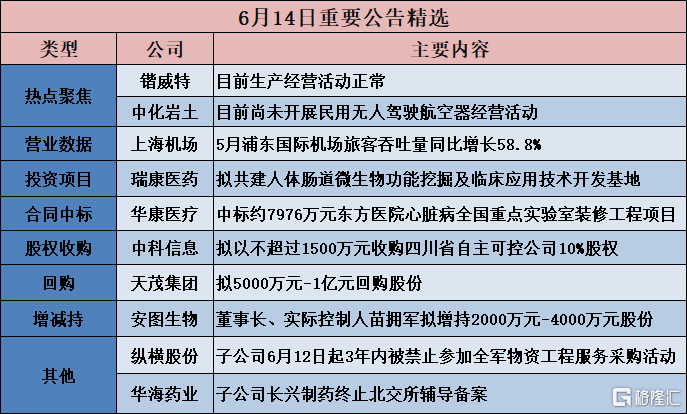

Kaiweite (688693.SH): Current production and operation activities are normal.

Kaiweite (688693.SH) announced that the cumulative deviation of the closing price of the company's stock for three consecutive trading days on June 12, 13, and 14, 2024 reached 30%, which belongs to abnormal volatility in stock trading. After self-inspection, the company's production and operation activities are normal, and the daily operating situation has not changed significantly. The company's operating income and profit level in 2023 have declined to varying degrees from the same period of 2022. In the first quarter of 2024, the net profit attributed to the owner of the parent company changed from profit to loss. The company's operating performance is greatly affected by the prosperity of the power semiconductor industry and has the risk of cyclical fluctuations.

China Zhonghua Geotechnical Engineering Group (002542.SZ): Currently, self-driving cars in aviation for civilian use are not yet being operated.

Zhonghua Geotechnical Engineering Group (002542.SZ) announced that Zhejiang Zhongqing International Aviation Club Co., Ltd. (hereinafter referred to as 'Zhejiang Zhongqing') recently received the 'Civilian Unmanned Aerial Vehicle Operation Certificate' issued by the Civil Aviation Administration of China, marking Zhejiang Zhongqing's formal establishment of a general aviation enterprise engaged in civilian unmanned aerial vehicle business. At present, the company has not yet carried out civilian unmanned aerial vehicle business operations, and it still needs to develop the market and cultivate relevant business technical personnel. The normal revenue-generating business still needs corresponding cultivation process. The impact of civilian unmanned aerial vehicle-related business on the company's future performance cannot be predicted for the time being.

Investment project:

Realcan Pharmaceutical Group (002589.SZ) plans to establish a joint venture with Mayiti to jointly build a human intestinal microbiota function excavation and clinical application technology development base.

Realcan Pharmaceutical Group (002589.SZ) announced that based on the strategic needs of business expansion and market deepening, the company intends to jointly invest with the United States Yitianbi Biological Medicine (Wuhan) Co., Ltd. (hereinafter referred to as 'Yitianbi') to establish a joint venture. They will build a base for mining and clinical application of human gut microbiota functional and technology development. The patented technology of intestinal flora transplantation held by the company will be authorized to the company and/or its affiliated companies exclusively for cooperation in the cooperation area and channel range agreed by both parties, including but not limited to distribution, sales, and promotion, to promote the deep integration of medical institution service areas and probiotic research and development technology. The total investment of the joint venture is expected to be RMB 10 million.

Shenzhen MTC (002429.SZ) intends to increase its investment in MTC Hong Kong by USD 24 million and invest in the establishment of MTC Vietnam and the construction of a production base.

Shenzhen MTC (002429.SZ) announced that in order to implement the company's medium and long-term global development strategy, better meet the needs of overseas markets, and enhance its global market competitiveness, the company plans to increase Hong Kong Zoomlion Co., Ltd. (hereinafter referred to as 'Hong Kong Zoomlion') with its own funds by US$24 million (approximately RMB 170.3856 million at the exchange rate on May 6, 2024); At the same time, Hong Kong Zoomlion plans to invest US$24 million to establish MTC Technology (Vietnam) Co., Ltd. (provisional name, subject to the name registered and approved by the relevant local department), which invests in Vietnam to build a production base. After the establishment of MTC Technology (Vietnam), it will become a wholly-owned subsidiary of Hong Kong Zoomlion and be included in the company's consolidated financial statements.

Contracts awarded:

Zhonglan Eco (300854.SZ): The consortium plans to win the general contracting for the environmental repair project of the Yulong landfill site construction.

China Infore Environment Technology Group (300854.S) announced that the Shenzhen public resources trading center announced the 'Yulong Landfill Environmental Restoration Project Construction General Contract Bidding Result Announcement,' and the joint venture composed of Shenzhen Energy Environmental Protection Co., Ltd., China State Construction Fifth Engineering Bureau Co., Ltd., and Infore Environment Technology Group Co., Ltd. became the candidate for the winning bid of the project, with a total bid price of RMB 15,3803.929691 million.

Huakang Medical (301235.SZ): won the bid for the renovation project of the national key laboratory for heart disease at Dongfang Hospital for about RMB 79.76 million.

Haokang Medical (301235.SZ) announced that on June 14, 2024, the company received the 'Award Notification' issued by the Oriental Hospital of Shanghai (affiliated to Tongji University Oriental Hospital), confirming the company as the winning supplier of the 'Oriental Hospital Cardiovascular National Key Laboratory Decoration Engineering' project, with a winning bid price of RMB 79.760026 million.

Huakang Medical (301235.SZ): won the bid for the procurement and installation project of medical special equipment and materials for the Traditional Chinese Medicine Inheritance and Innovation Project of Jiangxi Traditional Chinese Medicine University Affiliated Hospital.

Haokang Medical (301235.SZ) announced that the company recently participated in the bidding of the 'Medical Special Equipment and Materials Procurement and Installation Project of TCM Inheritance Innovation Project of Jiangxi University of Traditional Chinese Medicine Affiliated Hospital.' The bidding unit was Jiangxi University of Traditional Chinese Medicine Affiliated Hospital. On June 14, 2024, the Jiangxi Provincial Public Resource Trading Platform released the relevant bid candidate announcement. The bid price was RMB 73,999.964588 million.

Infore Environment Technology Group (000967.SZ): won the bid for approximately 155 million yuan integrated urban-rural environmental sanitation service government procurement project in Lingling District, Hunan Province.

Infore Environment Technology Group (000967.SZ) announced that Changsha Zoomlion Heavy Industry Environmental Industry Co., Ltd., a wholly-owned subsidiary of the company, recently received the 'Winning Bid Notice' of the integrated urban and rural sanitation service government procurement project in Lingling District, Yongzhou City, Hunan Province, The total amount of the winning bid contract is RMB 155,064.2 million.

Shanghai Tongji Science & Technology Industrial (600846.SH): The subsidiary Shanghai Tongji won the bid for the construction project of the G1-02A plot school in Xinjiangwan City with a total amount of RMB 714 million.

Tongji Technology (600846.SH) announced that its wholly-owned subsidiary Shanghai Tongji Construction Co., Ltd. received the bid-winning notice issued by the Education Bureau of Yangpu District, Shanghai. Shanghai Tongji Construction Co., Ltd. won the bid for the school construction project (excluding pile foundation works) of Xinjiangwan City G1-02A land parcel. The project is located in Xinjiangwan City G1-02A land parcel, Yangpu District, Shanghai. To the east it borders Jing San River (waterfront landscape belt), to the south it borders G1-02C land parcel (planned for kindergarten), Wei San River (waterfront landscape belt), to the west it borders Jiangwan City Road, and to the north it borders Shanghai Yangpu Defa School. The project covers a planned total construction area of 94,716 square meters, including 67,766 square meters of above-ground construction and 26,950 square meters of underground construction. The project plans to build three main buildings: the 1# teaching and comprehensive building, the 2# high school student dormitory building, the 3# garbage room, and facilities such as a 400-meter stadium, a 200-meter stadium, a basketball court, and a tennis court. The bid-winning price of the project is 714,362,001 yuan, and the bid-winning period is 900 calendar days.

[Equity Acquisition]

Qiaoyin City Management (002973.SZ): Subsidiary intends to transfer 49% equity of Yinli Environment.

Qiaoyin City Management (002973.SZ) announced that in order to focus on its main business, further optimize resource allocation and business structure, its wholly-owned subsidiary Guangzhou Qiaoyin Environmental Investment Co., Ltd. (Qiaoyin Environment) intends to transfer 49% equity of its holding subsidiary Guangzhou Yinli Environment Service Co., Ltd. (Yinli Environment) to China Water Investment Group Co., Ltd. (China Water HHO) for RMB 107.8 million. After the completion of the equity transfer, Qiaoyin Environment will hold 16% equity of Yinli Environment, and will additionally grant 2% of the voting rights from the remaining equity to China Water HHO. After the completion of the equity transfer, China Water HHO will hold 49% equity and enjoy 51% shareholder voting rights in the target company, and Yinli Environment will no longer be included in the company's consolidated financial statements, but instead be changed from a holding subsidiary to an associate company. The board of directors has authorized the management team to handle the relevant matters regarding the equity transfer.

Zhongke Information (300678.SZ): Plans to acquire 10% equity of an autonomous and controllable company in Sichuan Province for no more than RMB 15 million.

Zhongke Information (300678.SZ) announced that on June 14, 2024, it held the thirteenth meeting of the fourth board of directors and passed the Proposal on Acquiring Part of Equity of Sichuan Autonomous and Controllable Electronic Information Industry Co., Ltd. To strengthen strategic links with the industry and localities, integrate into the local information and creative industry ecology, and further enhance the company's market competitiveness, the company intends to acquire 10% equity of Sichuan Autonomous and Controllable Electronic Information Industry Co., Ltd. (the target company) held by Beijing Wanlihong Technology Co., Ltd. (Wanlihong) for RMB 10 million. The total transaction amount is expected to be no more than RMB 15 million, and the specific transaction price is based on the net asset appraisal value of the target company as of December 31, 2023, as issued and filed by the appraisal agency with the state-owned assets regulatory authority. After the completion of the transaction, Sichuan Development Assets Operation Investment Management Co., Ltd. (Chuanfa Asset) will hold 90.00% equity of the target company, the company will hold 10.00% equity of the target company, and Wanlihong will no longer hold any equity of the target company.

Sanbo Brain Science (301293.SZ): Acquires 34% equity of Luoyang Sanbo for RMB 51.64 million.

Sanbo Brain Science (301293.SZ) announced that to meet the company's operational development needs, further implement the company's development strategy, optimize the company's organizational and management system, and improve operational efficiency, its wholly-owned subsidiary Sanbo Health Medical Management (Chongqing) Co., Ltd. (Chongqing Sanbo Management) signed the Agreement for the Transfer of Luoyang Wu 113 Sanbo Brain Hospital Co., Ltd. equity with Gongqingcheng Honghai Yi Hao Investment Partnership Enterprise (Limited Partnership) (Honghai Yi Hao) on June 13, 2024. According to the agreement, Chongqing Sanbo Management will acquire 34% equity of Luoyang Wu 113 Sanbo Brain Hospital Co., Ltd. (Luoyang Sanbo) held by Honghai Yi Hao for RMB 51.6426 million. Chongqing Sanbo Management has completed the payment of the equity consideration, and after the completion of this transaction, Chongqing Sanbo Management will hold 70% equity of Luoyang Sanbo, and Honghai Yi Hao will no longer hold any equity of Luoyang Sanbo.

[Business Data:]

Hainan Airport Infrastructure (600515.SH): The passenger throughput in May was 1.675 million, a year-on-year decrease of 13.57%.

Hainan Airport (600515.SH) announced the airport business production and operation data for May. The passenger throughput was 1.675 million, down by 13.57% year-on-year, and the cargo and mail throughput was 10,933 tons, down by 10.37% year-on-year.

China Merchants Port Group (001872.SZ): A total of 16.847 million TEUs of containers were handled in May, a year-on-year increase of 9.4%.

China Merchants Port Group (001872.SZ) announced that in May 2024, the total number of containers was 16.847 million TEUs, up 9.4% year-on-year, and the total bulk cargo was 105.917 million tons, down 3.6% year-on-year.

Spring Airlines (601021.SH): passenger turnover in May increased by 17.52% year-on-year.

Spring Airlines (601021.SH) announced the key operating data for May. The passenger RPK was 408,473.75 million passenger-kilometers, up 17.52% year-on-year, and the cargo and mail RPK was 12.3415 million ton-kilometers, up 26.52% year-on-year.

Shanghai International Airport (600009.SH): In May, the passenger throughput of Pudong International Airport increased by 58.8% year-on-year.

Shanghai International Airport (600009.SH) announced the transportation production situation for May. The passenger throughput of Pudong International Airport was 6.2586 million, up 58.8% year-on-year, and the passenger throughput of Hongqiao International Airport was 4.0566 million, up 9.21% year-on-year.

[Repurchase]

Hubei Biocause Pharmaceutical Co., Ltd. (000627.SZ): Plans to repurchase shares for RMB 50-100 million.

Hubei Biocause Pharmaceutical Co., Ltd. (000627.SZ) announced that the total amount of funds for the repurchase of shares will not be less than RMB 50 million and not more than RMB 100 million. The repurchase price will not exceed RMB 3.34 per share, and will be used to reduce the registered capital of the company.

【Increase and Decrease】

JD.com (京东, symbol: 京东) plans to reduce its stake in Yonghui Superstores by no more than 2%.

Yonghui Superstores (601933.SH) announced that Beijing JD Century Trading Co., Ltd. ('JD Century') plans to reduce its shareholding in the company by no more than 182 million shares, or no more than 2% of the total share capital of the company, through block trading.

Yongqing Environmental Protection (300187.SZ): Some directors, supervisors and senior executives plan to increase their shareholding by 32.4 million yuan to 43.1 million yuan.

Yongqing Environmental Protection (300187.SZ) announced that Chairman and General Manager Wang Feng; Director and Vice President Dai Xinxian; Director Xiao Mingzhi; Director Wang Zhenguo; Vice President and Secretary of the Board of Directors Long Qi; Chairman of the Supervisory Board Chen Kai; Supervisor Li Rong; and Yu Bo, spouse of the employee supervisor, Xia Haiyan, plan to increase their shareholdings by centralized bidding through the trading system of the Shenzhen Stock Exchange from June 17, 2024 to December 16, 2024, with a total amount of not less than RMB 32.4 million and not more than RMB 43.1 million.

Boen Group (001366.SZ): Aitechwei Investment and Sima Investment plan to reduce their shareholdings by no more than 4.384% in total.

Boen Group (001366.SZ) announced that it has recently received a letter of notification on the plan for shareholding reduction from shareholder Atwei Investment and Sima Investment. Atwei Investment plans to reduce its shareholding by no more than 3,566,062 shares, or no more than 2.2194% of the company's total share capital, within three months after 15 trading days from the date of the announcement of the reduction plan. Sima Investment plans to reduce its shareholding by no more than 3,478,125 shares, or no more than 2.1646% of the company's total share capital, within three months after three trading days from the date of the announcement of the reduction plan. The reduction will be made through centralized bidding or block trading.

Autobio Diagnostics (603658.SH): Chairman and actual controller Miao Yongjun plans to increase his shareholding by 20 million yuan to 40 million yuan.

Autobio Diagnostics (603658.SH) announced that Mr. Miao Yongjun, Chairman and actual controller of the company, purchased 8,000 shares of the company (hereinafter referred to as the 'First Share Purchase'), accounting for 0.0014% of the total share capital of the company, through centralized bidding on the Shanghai Stock Exchange trading system. The total transaction amount of this purchase was RMB 381,660.00 (excluding transaction fees). Based on his confidence in the future development prospects of the company and his recognition of its value, Mr. Miao Yongjun plans to increase his shareholding by using his own funds through centralized bidding on the Shanghai Stock Exchange trading system within six months from the date of the first share purchase (June 13, 2024), with a planned share purchase amount of no less than RMB 20 million and no more than RMB 40 million (including the amount of the first share purchase). The follow-up share purchase plan does not set a price range and will be implemented based on the fluctuation of the company's stock price and the overall trend of the capital market.

【Other】

Zongheng Group (688070.SH): Its subsidiary Zongheng Dapeng UAV Technology Co., Ltd. is prohibited from participating in the military material engineering service procurement activities of the military for three years from June 12, 2024.

Zongheng Group (688070.SH) announced that the Military Procurement Network ('CMPN') issued an announcement on June 13, 2024, stating that according to the relevant regulations on the management of military suppliers, the Logistics Supply Department of the Cyber Space Force has decided to prohibit Chengdu Zongheng Dapeng UAV Technology Co., Ltd. ('Zongheng Dapeng'), a wholly-owned subsidiary of the company, from participating in the military material engineering service procurement activities of the military for three years starting from June 12, 2024. During the prohibition period, any other enterprise controlled or managed by Ren Bin, the legal representative, is prohibited from participating in the above scope of military procurement activities, and Li Qiong, the bidding agent, is prohibited from acting as an agent for other suppliers to participate in the above scope of military procurement activities. According to preliminary statistics, in 2023, the business income generated by the direct sales of national military materials and equipment by the company accounted for about 7.2% of the revenue. After investigation, Zongheng Dapeng engaged in improper activities such as colluding in bidding in the purchase of professional virtual simulation training platforms and software (project code: 2022-JY43-W1218).

Huahai Pharmaceutical (600521.SH): Its subsidiary Changxing Pharmaceutical terminates guidance and filing with the BSE.

Huahai Pharmaceutical (600521.SH) announced that its subsidiary Changxing Pharmaceutical Co., Ltd. (referred to as 'Changxing Pharmaceutical') is a listed company on the National Equities Exchange and Quotations (stock abbreviation: Changxing Pharmaceutical, stock code: 835269). The company recently received a notice from Changxing Pharmaceutical that the Zhejiang Securities Regulatory Bureau of the China Securities Regulatory Commission confirmed on June 14, 2024 that Changxing Pharmaceutical has terminated guidance.