Stocks Ease, Tech Rises, Bonds Eye Strongest Week Of The Year As Consumer Sentiment Sinks In June: What's Driving Markets Friday?

Stocks Ease, Tech Rises, Bonds Eye Strongest Week Of The Year As Consumer Sentiment Sinks In June: What's Driving Markets Friday?

Wall Street is set for a subdued session on Friday as risk sentiment wanes due to low U.S. consumer confidence and rising political uncertainties in Europe.

由于美国消费者信心低迷和欧洲政治不确定性加剧,风险情绪减弱,华尔街周五将保持低迷。

The University of Michigan reported the lowest U.S. consumer confidence reading since November 2023, significantly missing economists' forecasts.

密歇根大学公布的美国消费者信心指数为2023年11月以来的最低水平,大大低于经济学家的预期。

European assets experienced wild sell-offs, particularly in French equities, as investors worry about potential political and fiscal turmoil with snap elections looming in nearly two weeks.

欧洲资产遭遇了大幅抛售,尤其是法国股市,原因是投资者担心潜在的政治和财政动荡,即将在近两周内举行快速选举。

At midday trading in New York:

在纽约午盘交易中:

- The S&P 500 dipped 0.2%, pulling back slightly from a record-high close on Thursday.

- The Nasdaq 100 edged up 0.1% to over 19,600 points, aiming for its fifth consecutive record close this week.

- Both the S&P 500 and Nasdaq 100 are on track for a positive weekly finish.

- The Dow Jones Industrial Average declined by 0.2% on Friday and 0.6% for the week.

- Small-cap stocks, represented by the iShares Russell 2000 ETF (NYSE:IWM), underperformed large-cap counterparts, dropping 1.7% in their worst session since late April.

- 标准普尔500指数下跌0.2%,从周四的创纪录高位小幅回落。

- 纳斯达克100指数小幅上涨0.1%,至19,600点以上,目标是本周连续第五次创下收盘纪录。

- 标准普尔500指数和纳斯达克100指数均有望在每周收盘上涨。

- 道琼斯工业平均指数周五下跌0.2%,本周下跌0.6%。

- 以iShares Russell 2000 ETF(纽约证券交易所代码:IWM)为代表的小盘股表现低于大盘股,跌幅为1.7%,为4月下旬以来最差的交易日。

Bonds

债券

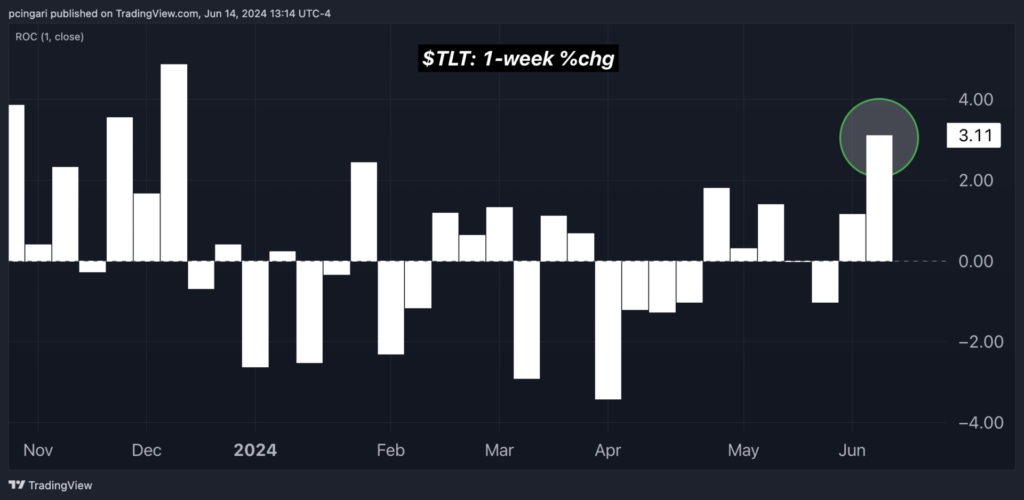

Bond yields saw their largest weekly drop since late December 2023, with the 10-year benchmark yield falling over 20 basis points this week. This led to a rally in fixed-income assets, with the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) gaining 0.6% on Friday and over 3% for the week.

债券收益率创下2023年12月下旬以来的最大单周跌幅,10年期基准收益率本周跌幅超过20个基点。这导致固定收益资产上涨,iShares 20年期以上国债ETF(纳斯达克股票代码:TLT)周五上涨0.6%,本周涨幅超过3%。

The latter could mark the strongest week for long-dated Treasury bonds year to date.

后者可能是今年迄今为止长期国债表现最强劲的一周。

Commodities performed well, with gold and crude oil prices rising by 1.2% and 1.1%, respectively. Bitcoin (CRYPTO: BTC) fell 2.2% for the day and 6% for the week, marking its second consecutive session decline and worst week since August 2023.

大宗商品表现良好,黄金和原油价格分别上涨1.2%和1.1%。比特币(加密货币:BTC)当天下跌2.2%,本周下跌6%,这是其连续第二个交易日下跌,也是自2023年8月以来最糟糕的一周。

Chart of The Week: Bonds Set For Best Week In Six Months

本周走势图:债券将创六个月来最佳一周

Friday's Performance In Major US Indices, ETFs

周五美国主要指数、ETF的表现

| Major Indices | Price | 1-day %chg |

| Nasdaq 100 | 19,626.32 | 0.3% |

| S&P 500 | 5,424.43 | -0.2% |

| Dow Jones | 38,554.32 | -0.2% |

| Russell 2000 | 2,018.50 | -1.7% |

| 主要指数 | 价格 | 1 天 %chg |

| 纳斯达克 100 | 19,626.32 | 0.3% |

| 标准普尔 500 | 5,424.43 | -0.2% |

| 道琼斯 | 38,554.32 | -0.2% |

| 罗素 2000 | 2,018.50 | -1.7% |

According to Benzinga Pro data:

根据 Benzinga Pro 的数据:

- The SPDR S&P 500 ETF Trust (NYSE:SPY) was 0.1% lower to $541.88.

- The SPDR Dow Jones Industrial Average (NYSE:DIA) was 0.1% lower to $386.39.

- The tech-heavy Invesco QQQ Trust (ARCA: QQQ) was 0.3% higher to $477.88.

- Sector-wise, the Technology Select Sector SPDR Fund (NYSE:XLK) outperformed, up by 0.2%, while the Industrials Select Sector SPDR Fund (NYSE:XLI) lagged, down 1.3%.

- SPDR标准普尔500指数ETF信托(纽约证券交易所代码:SPY)下跌0.1%,至541.88美元。

- SPDR道琼斯工业平均指数(纽约证券交易所代码:DIA)下跌0.1%,至386.39美元。

- 以科技股为主的景顺QQ信托(ARCA:QQQ)上涨0.3%,至477.88美元。

- 板块方面,科技精选板块SPDR基金(纽约证券交易所代码:XLK)跑赢大盘,上涨0.2%,而工业精选板块SPDR基金(纽约证券交易所代码:XLI)则落后,下跌1.3%。

Friday's Stock Movers

周五的股票走势

- Cruise stocks fell substantially after Bank of America warned about softer pricing heading into the summer. Shares of Royal Caribbean Cruise Ltd. (NYSE:RCL), Carnival Cruise Corp. (NYSE:CCL) and Norwegian Cruise Holdings Ltd. (NYSE:NCLH) fell 5.4%, 7.8% and 7.8%, respectively.

- Adobe Inc. (NASDAQ:ADBE) rose over 14%, amid stronger-than-expected results last quarter, eyeing the strongest session since March 2020.

- RH (NYSE:RH) fell over 17% following a sharp earnings miss.

- Hasbro Inc. (NASDAQ:HAS) rose 4.9% after Bank of America upgraded the company to 'Buy' and raised its price target from $70 to $80.

- 在美国银行警告说,夏季将出现更疲软的定价之后,邮轮股大幅下跌。皇家加勒比邮轮有限公司(纽约证券交易所代码:RCL)、嘉年华邮轮公司(纽约证券交易所代码:CCL)和挪威邮轮控股有限公司(纽约证券交易所代码:NCLH)的股价分别下跌了5.4%、7.8%和7.8%。

- Adobe公司(纳斯达克股票代码:ADBE)上涨了14%以上,原因是上个季度的业绩强于预期,这是自2020年3月以来最强劲的交易日。

- 在盈利大幅下跌之后,RH(纽约证券交易所代码:RH)下跌了17%以上。

- 孩之宝公司(纳斯达克股票代码:HAS)上涨4.9%,此前美国银行将该公司上调至 “买入”,并将目标股价从70美元上调至80美元。

Now Read: Elon Musk's $56B Payday Wins In Landslide: 'Next Chapter In The Tesla Growth Story'

现在阅读: 埃隆·马斯克的560亿美元发薪日以压倒性优势获胜:“特斯拉增长故事的下一章”

Image: Shutterstock

图片: Shutterstoc

At midday trading in New York:

At midday trading in New York: