Central New Energy Holding Group Limited (HKG:1735) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 56%.

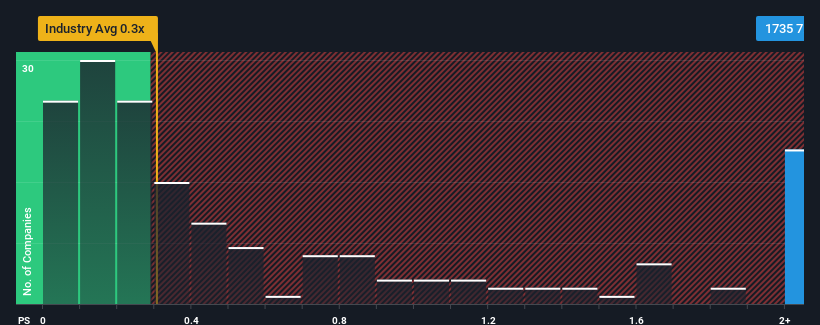

After such a large jump in price, when almost half of the companies in Hong Kong's Construction industry have price-to-sales ratios (or "P/S") below 0.3x, you may consider Central New Energy Holding Group as a stock not worth researching with its 7.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has Central New Energy Holding Group Performed Recently?

With revenue growth that's exceedingly strong of late, Central New Energy Holding Group has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Central New Energy Holding Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Central New Energy Holding Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 150%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 11% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Central New Energy Holding Group is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Central New Energy Holding Group's P/S

Central New Energy Holding Group's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Central New Energy Holding Group can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Central New Energy Holding Group you should be aware of, and 1 of them is significant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com