Hezong Sience&Technology Co.;Ltd (SZSE:300477) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

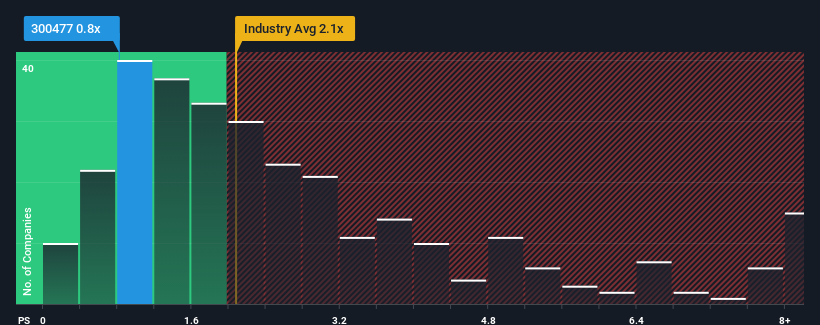

Following the heavy fall in price, given about half the companies operating in China's Electrical industry have price-to-sales ratios (or "P/S") above 2.1x, you may consider Hezong Sience&TechnologyLtd as an attractive investment with its 0.8x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Has Hezong Sience&TechnologyLtd Performed Recently?

Revenue has risen firmly for Hezong Sience&TechnologyLtd recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Hezong Sience&TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Hezong Sience&TechnologyLtd?

The only time you'd be truly comfortable seeing a P/S as low as Hezong Sience&TechnologyLtd's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. The latest three year period has also seen an excellent 88% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 24% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that Hezong Sience&TechnologyLtd is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What We Can Learn From Hezong Sience&TechnologyLtd's P/S?

Hezong Sience&TechnologyLtd's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Hezong Sience&TechnologyLtd currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. While recent

Having said that, be aware Hezong Sience&TechnologyLtd is showing 3 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Hezong Sience&TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com