Nine Dragons Paper (Holdings) Limited (HKG:2689) shares have had a horrible month, losing 25% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 29% share price drop.

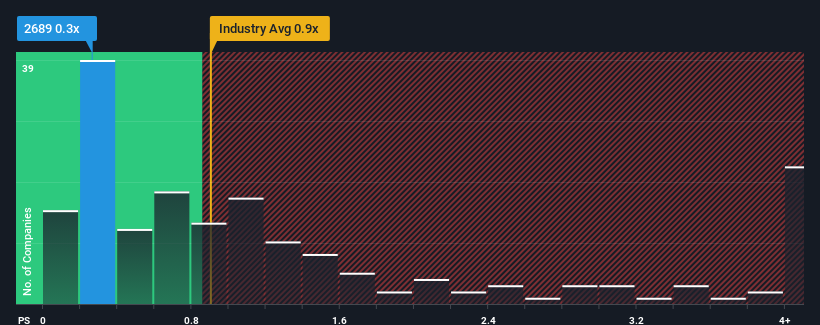

Following the heavy fall in price, Nine Dragons Paper (Holdings) may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Forestry industry in Hong Kong have P/S ratios greater than 0.9x and even P/S higher than 3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Nine Dragons Paper (Holdings)'s P/S Mean For Shareholders?

With only a limited decrease in revenue compared to most other companies of late, Nine Dragons Paper (Holdings) has been doing relatively well. One possibility is that the P/S ratio is low because investors think this relatively better revenue performance might be about to deteriorate significantly. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't pessimistic about the share price if the company's revenue continues outplaying the industry.

Keen to find out how analysts think Nine Dragons Paper (Holdings)'s future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

Nine Dragons Paper (Holdings)'s P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.3%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 5.2% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 19% during the coming year according to the twelve analysts following the company. That's shaping up to be materially higher than the 14% growth forecast for the broader industry.

In light of this, it's peculiar that Nine Dragons Paper (Holdings)'s P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Nine Dragons Paper (Holdings)'s P/S Mean For Investors?

Nine Dragons Paper (Holdings)'s recently weak share price has pulled its P/S back below other Forestry companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Nine Dragons Paper (Holdings)'s revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Plus, you should also learn about this 1 warning sign we've spotted with Nine Dragons Paper (Holdings).

If these risks are making you reconsider your opinion on Nine Dragons Paper (Holdings), explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com