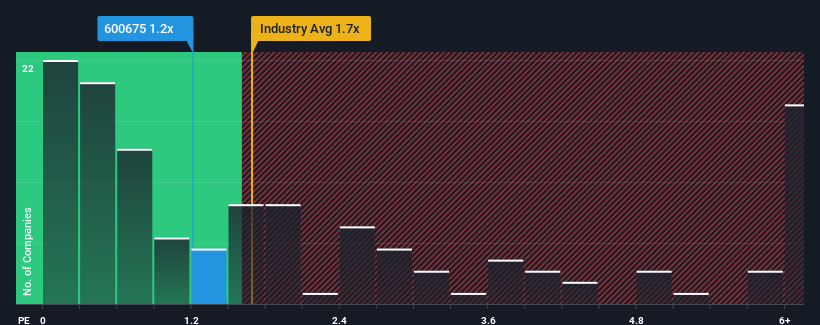

With a median price-to-sales (or "P/S") ratio of close to 1.7x in the Real Estate industry in China, you could be forgiven for feeling indifferent about China Enterprise Company Limited's (SHSE:600675) P/S ratio of 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does China Enterprise's P/S Mean For Shareholders?

China Enterprise certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on China Enterprise will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China Enterprise's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For China Enterprise?

The only time you'd be comfortable seeing a P/S like China Enterprise's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The latest three year period has also seen a 20% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been quite good for the company but it has also been volatile.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The latest three year period has also seen a 20% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been quite good for the company but it has also been volatile.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 4.9% shows it's about the same on an annualised basis.

In light of this, it's understandable that China Enterprise's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What Does China Enterprise's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears to us that China Enterprise maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for China Enterprise (2 are a bit unpleasant!) that you need to take into consideration.

If you're unsure about the strength of China Enterprise's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com