The seven Singapore real estate investment trusts (Reits) with significant exposure to Singapore-based retail assets have observed continued improved operating metrics, supported by the tourism recovery as well as recent asset enhancement initiatives (AEIs) undertaken to maximise space and improve malls' attractiveness.

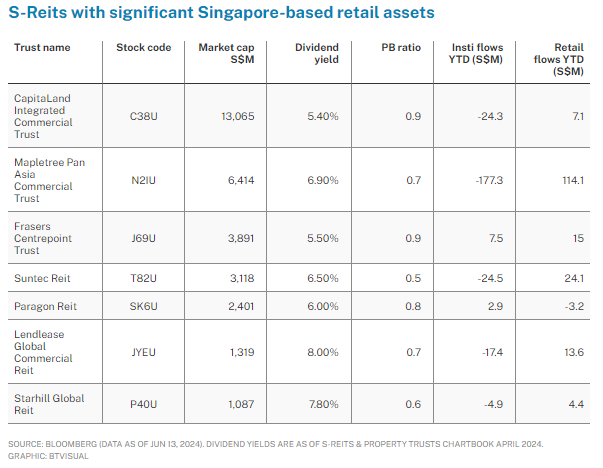

The seven are: CapitaLand Integrated Commercial Trust (CICT), Frasers Centrepoint Trust (FCT), Lendlease Global Commercial Reit (Lendlease Reit), Mapletree Pan Asia Commercial Trust : N2IU (MPACT), Paragon Reit, Starhill Global Reit and Suntec Reit. We look at their recent business updates and financials.

CICT reported improved Q1 2024 gross revenue and net property income (NPI) for its retail assets. Shopper traffic and tenant sales grew 3.6 per cent and 2.1 per cent year on year (yoy), respectively.

CICT reported improved Q1 2024 gross revenue and net property income (NPI) for its retail assets. Shopper traffic and tenant sales grew 3.6 per cent and 2.1 per cent year on year (yoy), respectively.

Downtown malls led the growth in traffic, while suburban malls saw sustained resilience from food and beverage demand. Rent reversion for both downtown and suburban malls sustained growth at over 7 per cent. CICT's committed retail occupancy increased from 98.5 per cent in the last quarter to 98.7 per cent as at Mar 31, 2024.

FCT reported lower H1 2024 gross revenue and NPI of 7.2 per cent and 8.4 per cent yoy, respectively, with declines due to lower contributions from Changi City Point, which was divested in October 2023, and Tampines 1's ongoing AEI works.

Excluding these effects, gross revenue and NPI would have risen 2.9 per cent and 2.1 per cent, respectively.

FCT's retail portfolio committed occupancy improved to 99.9 per cent as at Mar 31, 2024, and observed an 8.1 per cent and 4.3 per cent yoy growth in shopper traffic and tenant sales for Q2 2024, respectively, with overall positive rent reversion at 7.5 per cent.

Lendlease Reit noted that its retail portfolio saw tenant sales increase 2.6 per cent and shopper traffic improve 6.1 per cent yoy in Q3 2024, exceeding pre-Covid levels. Committed occupancy for both the JEM and 313@somerset malls averaged 99.4 per cent as at Mar 31, 2024.

MPACT's retail mall, VivoCity, has seen its occupancy rate improve to 100 per cent as at Mar 31, 2024, and recorded 14 per cent positive rent reversion.

VivoCity's recent sixth AEI completed in May 2023 saw over 80,000 square feet of reconfigured new retail space, and MPACT noted a return on investment of more than 20 per cent based on revenue on a stabilised basis and capital expenditure of approximately S$10 million.

Shopper traffic and tenant sales in Q4 2024 recorded increases of 10.1 per cent and 2.6 per cent yoy, respectively, and full-year tenant sales set a new record at nearly S$1.1 billion.

Paragon Reit reported 2.5 per cent yoy growth in gross revenue, driven by Paragon Mall and The Clementi Mall, which recorded higher gross revenue and visitor traffic for Q1 2024, with both malls at full occupancy rates.

The Reit plans to explore future acquisition opportunities, and has a right of first refusal on its sponsor's The Woodleigh Mall, which opened in May 2023.

Starhill Global Reit reported that tenant sales at its Wisma Atria property increased 6.5 per cent while shopper traffic grew 12.7 per cent yoy in Q3 2024, despite ongoing interior enhancement works which were completed in February 2024.

Suntec Reit's retail portfolio reported a 3 per cent yoy growth in gross revenue and 1.3 per cent growth in NPI for Q1 2024. Its Suntec City mall recorded 21.7 per cent rent reversion in Q1 2024, registering positive rent reversion for eight consecutive quarters.

The mall saw a 5 per cent yoy improvement in both tenant sales and shopper traffic for Q1 2024.

Suntec Reit expects the retail sales outlook to remain stable, with healthy demand and limited supply supporting rent growth and occupancy.

Source: SGX Research S-REITs & Property Trusts Chartbook.

REIT Watch is a regular column on The Business Times, read the original version.

Enjoying this read?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.