Bruck wants to use the 'Ultraman' light to knock on the door of the capital markets.

Recently, China's tower-building toy giant BrickCo formally submitted an IPO application to the Hong Kong Stock Exchange.

This toy company, known as the "Chinese version of Lego," wants to use the light of "Ultraman" to knock on the door of the capital market.

However, BrickCo has lost more than 1.1 billion yuan in the past three years. Its profit pillar, the licensed intellectual property (IP) of "Ultraman" and other IPs, is about to expire. At the same time, the founder conducted a "surprise" cashing out before the IPO, which inevitably makes people speculate.

Faced with high uncertainty, will the capital believe in the light of BrickCo?

Lost 1.1 billion in three years! BrickCo claims to be "global No. 3"

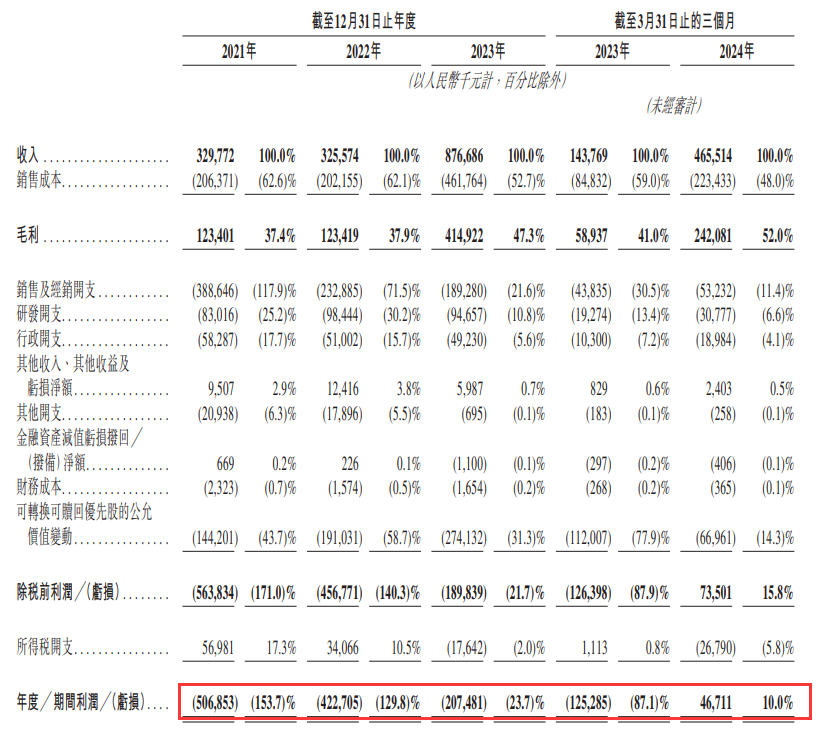

In terms of performance, BrickCo has been in a state of loss in recent years. From 2021 to 2023, the losses were 510 million yuan, 420 million yuan and 210 million yuan, respectively.

The accumulated losses in three years amount to 1.14 billion yuan.

It was not until the first quarter of this year that BrickCo turned losses into profits.

However, it must be admitted that BrickCo's expansion speed in recent years is indeed very fast.

From 2022 to 2023, BrickCo achieved revenues of 330 million yuan and 880 million yuan, respectively, nearly doubling its growth. In 2024, only in the first quarter, it achieved revenue of 470 million yuan.

In terms of scale, BrickCo claims to be the "largest in China and the third largest in the world" in the construction toy industry.

BrickCo also cited Foster Sullivan third-party data, showing that the company achieved a GMV of 1.8 billion yuan in 2023, with a year-on-year growth rate of over 170%, making it the fastest-growing large-scale toy enterprise in the world.

However, data from Foster Sullivan shows that the top two players in the global construction toy market, Bandai and Lego, have market shares of more than 35% in 2023, while BrickCo's market share is only slightly higher than 6%. There is also a big gap in original IPs.

It is visible to the naked eye that BrickCo still has a long way to go before it becomes a global tower-building toy giant.

Gaming giant cross-border into toys.

BrickCo founder, Zhu Weisong, is an entrepreneur who switched from the gaming circle to the toy industry.

Ten years ago, when he left Yoozoo Interactive, which he co-founded, to incubate BrickCo, perhaps he did not expect to one day sprint to the capital market with the light of "Ultraman".

Zhu Weisong, who grew up in Xinchang County, Shaoxing, has a successful entrepreneurial experience.

In 2009, 27-year-old Zhu Weisong and Lin Qi founded Yoozoo Interactive. With products like "Junior Three Kingdoms," they quickly made a name for themselves in the gaming industry.

In just five years, they drove Yoozoo Interactive to shell out and go public, becoming a leader in the gaming industry.

However, just when Yoozoo successfully went public and was in great glory in 2014, Zhu Weisong made an unexpected decision: to leave his own game kingdom that he had created and turn to the toy industry.

In that year, he founded the predecessor of Bruco - Putao Technology.

At first, while still holding on to Yoozoo with his left hand, Zhu Weisong led Putao Technology with his right hand to explore the low-age building block toy track.

Zhu Weisong's entry point was the very niche large granular building block toys at that time. Using differentiated products to win the low-age children's market was his initial plan.

However, ideals are full, but reality is skinny.

Traditional building block toys are a kind of educational product. Players can freely construct various structures and models, such as houses, towers, and bridges, according to their imagination. The main audience is preschool children. Therefore, the market is limited, and it is difficult to form sustainable repurchases. Zhu Weisong found that the living space here is not large.

In 2016, Zhu Weisong decisively resigned from all positions in Yoozoo Network and devoted himself wholeheartedly to Bruco, embarking on a new journey of transformation.

After various trials and explorations, Zhu Weisong set his sights on the broader building block toy market.

Compared with traditional building block toys, building sets have specific construction rules. In addition to their educational attributes, because they are usually combined with various IPs, they emphasize entertainment and collectible value more. The audience is also more extensive, not only children, but also a large number of teenagers and adult players.

Years of experience in the gaming industry have made Zhu Weisong deeply understand the power of IPs.

This time, he bet on Ultraman.

Ultraman, who spreads light and hope to the world, is not only a childhood memory of 80s and 90s in China, but also captured the hearts of many post-2000 and 2010s. The audience base is evident.

This is exactly what Bruco wanted.

After lengthy negotiations, Bruco finally obtained the IP authorization of Ultraman in 2021, opening a new chapter for the company.

In 2022, Bruco launched six series of Ultraman building block products in one go, setting off a wave of enthusiasm in the market.

Data shows that the sales volume of Bruco's first Ultraman series product in the first quarter of its launch was 140,000, and by the tenth series, this number had soared to 4.227 million, an increase of more than 29 times.

"Ultraman" supports Bruco's toy empire

The launch of the Ultraman series also ignited Bruco's performance rocket.

In 2023, Bruco's revenue skyrocketed by 169.3% year-on-year, and the gross margin increased from 37.9% to 47.3%. In the first quarter of 2024, the company achieved its first profitable quarter, and the gross margin further increased to 52%.

According to Bruco's prospectus, in 2023 and the first quarter of 2024, products based on the Ultraman IP accounted for most of the company's revenue.

Moreover, Ultraman is also Bruker's largest TOWER TOYS family.

As of the first quarter of 2024, Ultraman accounts for more than 52% of the 133 SKUs (minimum inventory units) in Bruker's 255 building block toys.

After the success of Ultraman, Bruker has successively obtained popular IP authorizations such as "Transformers", "Naruto", "Marvel Infinite Legend", "Minions", "Pokemon", "Masked Rider", "Detective Conan", and "Hatsune Miku", which has caused a wave in the market.

Based on these well-known IPs, Bruker has created a product matrix for all-age groups that spans low-end, school-age, and adult, completing the transformation from a traditional building block toy company to a building and construction toy company, redefining its toy empire.

According to the prospectus, in 2023, Bruker's revenue from building block character toys was 770 million yuan, accounting for 87.7% of the total revenue; in the first quarter of 2024, this proportion increased to 97.4%.

Moreover, compared with general building block toys, building and construction toys have higher gross profit margins.

According to the prospectus, Bruker's gross profit margin for building block character toys in 2023 was 48.4%, far higher than that of building block toys at 38.7%, and it is still accelerating, reaching 52.3% in the first quarter of this year.

The market outlook is also an important concern for the capital market.

According to the prospectus, building block character toys are the fastest-growing and most promising sub-category in the global toy industry.

According to data from Foster Sullivan and other institutions, the compound annual growth rate of the building and construction character market GMV is expected to be 29% from 2023 to 2028. The market size is expected to reach 99.6 billion yuan in 2028, and the penetration rate in the global character toy market is 18.4%.

When will the original IP be able to take on the important task after many authorized IPs expire?

Although Zhu Weisong's strategy seems to be effective, over-reliance on external IPs may also become Bruker's "Achilles' heel".

According to the prospectus, Bruker's existing "Ultraman" IP authorization in China will expire in 2027, and multiple IP authorizations such as "Naruto", "Marvel Infinite Legend", "Pokemon", etc. will also expire next year.

This means that in the next 2-3 years, Bruker will face pressure to renew multiple core IP authorizations.

Once it is unable to renew in time or if the renewal conditions change significantly, it may have a significant impact on Bruker's business continuity and profitability.

Bruker also admitted in the prospectus that IP authorization agreements are usually for 1-3 years and generally do not automatically renew. If it cannot guarantee to maintain or renew the authorization agreement with similar terms, the company's business, operating performance, and financial condition will all suffer significant adverse effects.

Faced with this "time bomb" of authorized IP, can Bruker's original IP bear the future of the entire toy empire?

Brook currently only has two original IPs: Varieties of Bruker for Children and Heroes Unlimited based on traditional Chinese culture.

In the past three years, the proportion of original IP business in Bruker's total revenue has increased from less than 2% in 2022 to 15.8% in 2024.

Although it has grown rapidly, there is still a huge gap in the scale of original IP compared with the total revenue.

Moreover, compared with the popular IP such as "Ultraman", there is still a considerable gap in Blukel's original IP in terms of popularity, influence, monetization ability, etc.

Of course, creating a popular original IP is not a matter of overnight success. It requires profound cultural foundation, keen market insight, exquisite design capability, efficient operation system, and a certain element of luck.

For Blukel, this is not only a long process, but also a process of constant trial and error and iteration.

On the eve of IPO, the actual controller suddenly cashed out before submitting the application, which aroused various speculations from the outside world.

Just one month before Blukel submitted its application to the Hong Kong Stock Exchange, Zhu Weisong suddenly sold a large amount of equity.

In April this year, Zhu Weisong transferred more than 2.3 million shares of Blukel's common stock, accounting for approximately 1.1% of the total share capital and cashing out more than 75 million yuan, through a wholly-owned holding company.

At the same time, external shareholder Gaorong BLK Holding Limited under Gao Rong Capital transferred 895,300 preferred shares to Gaintex, cashing out nearly 29 million yuan.

Based on the current stock trading price of Blukel in 2024 at 32.27 yuan/share and the total share capital of 223 million, the latest valuation of Blukel has reached 7.2 billion yuan.

After the equity transfer, Zhu Weisong is still the largest shareholder of Blukel.

According to the prospectus, Zhu Weisong currently holds 54.95% of Blukel's equity indirectly through his subsidiary companies, Wit Bright Limited and Playcreation Holding Limited, and is the actual controller of Blukel.

Junlian Capital, Source Code Capital, and Yunfeng Fund are also shareholders of Blukel, holding 7.03%, 5.64%, and 3.15% respectively. Blukel's stock incentive plan holds 9.81% through First Prosperity.

It is worth noting that before the IPO, Blukel obtained investment from well-known capital such as Yunfeng Fund, Junlian Capital, and Source Code Capital, with financing amounting to nearly 1.8 billion yuan.

According to regulations, if it cannot be successfully listed within 12 months after submitting the prospectus, the repurchase right will be exercised again.

Judging from Blukel's current cash flow, it is highly likely unable to afford the high price of redeeming preferred shares.

Blukel has just turned losses into profits and cashed out on the eve of the IPO. This unusual timing and pricing logic is inevitably thought-provoking.

This is not the first time that Zhu Weisong has transferred and cashed out Blukel's shares.

In 2021, Zhu Weisong transferred the equity in two rounds of angel investment for a total price of 120 million yuan.

Regarding these two transactions, Blukel stated that they were for the business negotiation of its domestic affiliated companies, to acquire Blukel's technology equity sold by Zhu Weisong, rather than to increase Blukel's technology equity.

Based on this calculation, Zhu Weisong has cashed out nearly 200 million yuan since 2021.

In addition, unlike other IPO companies that restrict the sale of shares held by investors, Blukel's shares held by investors have no sales restrictions.

In other words, once Blueco goes public successfully, these investors can reduce their shareholdings and leave at any time to cash out.