The decision of the Swiss National Bank this week will be another tense event, as officials decide whether to cut interest rates or maintain them. On Thursday, the decision is three weeks after the last public comments from Swiss central bank policymakers. Since then, investors have been speculating on the prospects for further action in the market turmoil and the appreciation of the Swiss franc. Economists' views on the outcome are generally different, with a few expecting Switzerland to be the first country to stop the easing cycle. Switzerland's rate cut in March made it the fastest among the top 10 trading currency jurisdictions in the world. Compared with other countries, Switzerland has a low inflation rate, but recent price growth has also slowed down, providing a rationale for the Swiss central bank to cut interest rates or maintain them.

Thursday's decision is three weeks after the last public comments from Swiss central bank policymakers. Since then, investors have been speculating on the prospects for further action in the market turmoil and the appreciation of the Swiss franc.

Economists' views on the outcome are generally different, with a few expecting Switzerland to be the first country to stop the easing cycle. Switzerland's rate cut in March made it the fastest among the top 10 trading currency jurisdictions in the world.

Compared with other countries, Switzerland has a low inflation rate, but recent price growth has also slowed down, providing a rationale for the Swiss central bank to cut interest rates or maintain them.

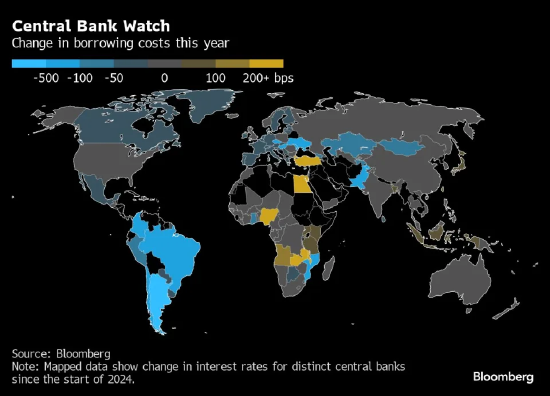

Regardless of what decision makers decide, their silence is just one factor that shadows investors' prospects. Judging the world's monetary policy is getting harder, with Canada and the euro zone's first rate cut this month contrasting sharply with the Federal Reserve's increasing reluctance to cut rates later this year or take no action at all.

For Thomas Jordan, who leads the Swiss central bank, suspense and surprise are commonplace. Under his leadership, significant impacts included abandoning the upper limit of the Swiss franc in 2015, raising interest rates by half a percentage point for the first time in 2022, and lowering interest rates by a quarter of a percentage point to 1.5% at the last meeting three months ago.

For this week's decision, traders' bets on a Swiss National Bank rate cut have fallen from about 97% in April to around 60%. Economists are less certain, with 16 of the 28 surveyed economists expecting no change. Let's take a closer look at the dilemma facing the Swiss National Bank below.

Reasons for interest rate cuts

Reasons for a rate cut include the prospect of a drop in the Swiss inflation rate and the impact of current weak exports on economic growth.

Geneva Mirabaud's chief economist, Gero Jung, said inflation is currently mainly driven by rising rents, but this is only a temporary phenomenon. "Switzerland is a small, open economy," he said last week. "The global situation suggests that rate cuts are justified."

Swiss central bank officials can find room to ease policy if necessary. On May 30, Jordan said they estimated Switzerland's actual neutral interest rate was around zero. Given its current interest rate of 1.5% and inflation rate of 1.4%, this means there is still room for adjustment.

"Jordan said the current level of interest rates is still restrictive," said Karsten Junius, chief economist at Swiss bank Safra Sarasin. "So I firmly believe that we will cut rates again."

Reasons for pause

One of the reasons for pausing the rate hike is that the inflation rate has remained in the upper half of the central bank's target range of 0-2%, and the economy has shown resilience so far.

Maeva Cousin emphasized that economic growth has been sustained for three consecutive quarters and is basically at its potential level. She also said that if officials cut rates now, the Swiss National Bank would need to raise its inflation forecast.

"Policymakers may be more willing to wait for some unexpected downside factors in price increases, so they can cut rates without raising inflation forecasts," she said in a report.

"Swiss interest rates are relatively low globally, limiting the space for further cuts by the Swiss National Bank. This may be particularly important for the Swiss franc, with some believing that the impact of the Swiss franc on the economy is even greater than the cost of borrowing."

"It makes sense to keep some leeway in case of geopolitical events that lead to the appreciation of the Swiss franc again," said David Marmet, chief economist at Zurich State Bank. He added that if the Swiss National Bank exploits this possibility, "there would be no need for negative values again."

The Swiss franc dilemma

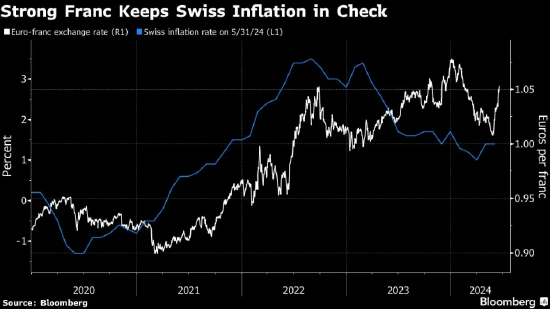

The trend of the swiss franc has also increased uncertainty. Last week, the Swiss franc's euro hit its biggest gain since December, as French President Emmanuel Macron called for early elections in France, prompting investors to buy the Swiss franc as a safe haven currency.

It is unclear how Swiss central bank officials will determine this change. They have long used intervention measures to suppress the Swiss franc's exchange rate, but cutting interest rates is also an option if they want to depreciate the Swiss franc. On the other hand, avoiding any loose policies may also limit imported inflation.

Strategists note that in Jordan's recent speech, he said that a weak currency was most likely to lead to Swiss inflation. Goldman Sachs' Kamakshya Trivedi said the central bank may even reintroduce wording in its statement indicating that it is ready to sell foreign exchange at any time, a clause that was cancelled last December.

Meanwhile, the overnight volatility of the euro against the Swiss franc has risen to 18.27%, the highest level since March 2023, when concerns about the global banking industry dominated market sentiment.

Regardless of the outcome of Thursday's meeting, the controversy over whether to cut interest rates is relatively unimportant. EFG Bank's senior economist GianLuigi Mandruzzato said last week that maintaining a loose trajectory is unlikely to have a significant impact on the economy and the market.

He said such a choice "will not have a significant impact on the economy and the market".