Recently, there has been an inflow of funds into science and technology innovation board ETFs. On June 19th, the net inflow of funds for E Fund SSE STAR 50 ETF was 259 million yuan, and the net inflow of funds for Huaxia SSE STAR 50 ETF was 241 million yuan.

As of June 19th, over 5 billion yuan has flowed into science and technology innovation board ETFs since June. The most popular products are: Huaxia Fund Science and Technology Innovation Board 50 ETF, E Fund Science and Technology Innovation Board 50 ETF, Harvest Fund Science and Technology Innovation Board Semiconductor ETF, Industrial Bank Rexi Fund Science and Technology Innovation Board ETF, Yinhe Fund Science and Technology Innovation Board 100 ETF, Bosera Fund Science and Technology Innovation Board 100 Index ETF, and Penghua Fund Science and Technology Innovation Board 100 ETF.

Recently, two new science and technology innovation board ETFs have been added: Penghua Science and Technology Innovation Board New Energy ETF and Harvest Science and Technology Innovation Board Industrial Machinery ETF have been reported and accepted, becoming the first ETF products in China to track the science and technology innovation board new energy index and the science and technology innovation board industrial machinery index.

The science and technology innovation board new energy index selects securities of science and technology innovation board listed companies with a relatively large market capitalization in fields such as photovoltaics, wind power, and new energy vehicles as index samples, reflecting the overall performance of the representational new energy industry of listed companies in the science and technology innovation board.

Companies in the science and technology innovation board industrial machinery sector are mainly distributed in industries such as electric motors and industrial control automation, urban rail transit, machining machinery, and instrumentation.

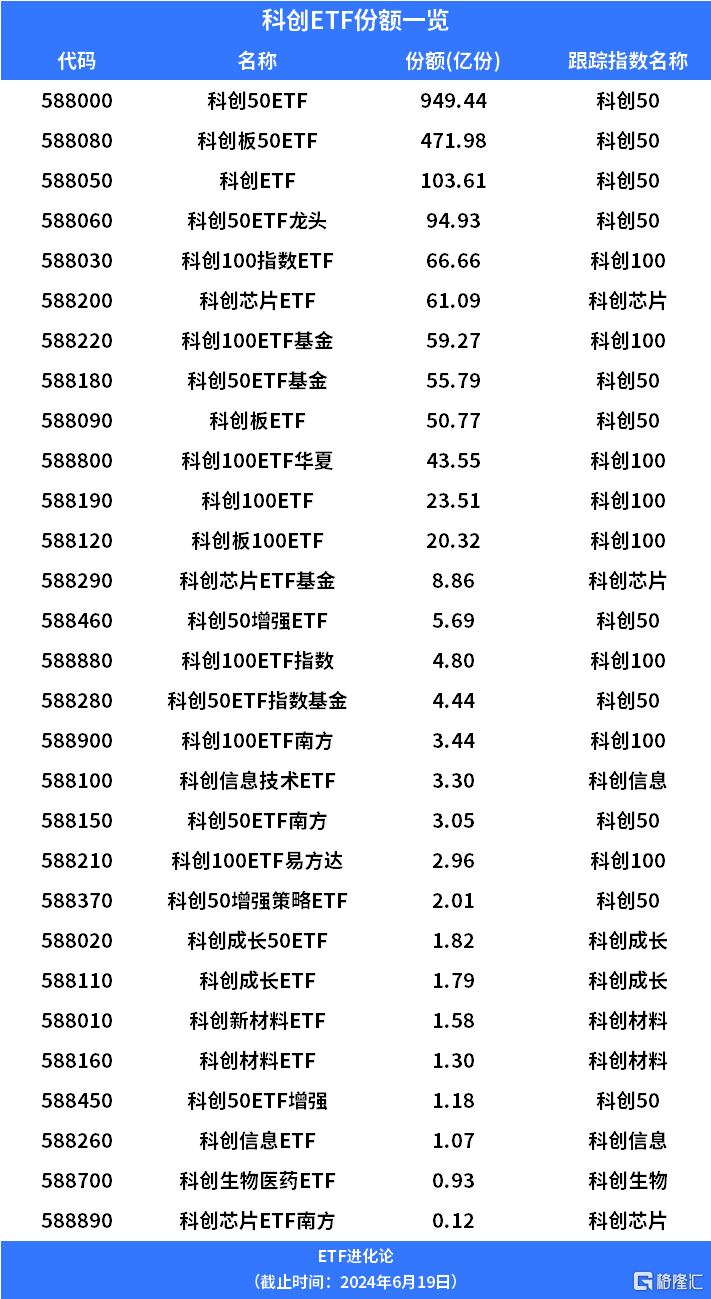

Since the first batch of science and technology innovation board 50 ETFs was established in September 2020, the scale of science and technology innovation board index products has continued to grow. As of June 19th of this year, there are a total of 29 listed ETFs on the science and technology innovation board, with a total share of over 204.9 billion shares.

Among them,The science and technology innovation board 50 ETF has become the second largest broad-based index ETF on the A-shares market, with a total of over 174.2 billion shares for the 11 science and technology innovation board 50 ETF products. The total shares of the 8 science and technology innovation board 100 ETFs exceed 22.4 billion shares. There are 10 science and technology innovation board ETFs for subdivided themes such as growth, semiconductors, biotech, and new materials, with a total share of over 8.1 billion shares.

The science and technology innovation board has received a bullish announcement, the China Securities Regulatory Commission has issued Eight Measures to Deepen the Reform of the Science and Technology Innovation Board to Serve the Development of Technological Innovation and New Productivity, supporting the listing of high-quality tech-type companies that are not yet profitable, optimizing the issuance pricing mechanism, promoting the pilot program for refinancing shelf issuance, supporting M&A and reorganization, and improving the sector trading mechanism to better serve the development of technology innovation-oriented enterprises and new productivity.

CITIC Securities research reports indicate that on June 19, 2024, the China Securities Regulatory Commission issued eight measures around serving high-level scientific and technological self-reliance and the development of new quality production forces, called the “Star Eight Measures,” aimed at strengthening the positioning of “hard technology” on the Star Market, deepening the pilot of the issuance and underwriting system, optimizing the stock and debt financing system, supporting mergers and restructuring, improving the stock-based incentive system, improving trading mechanisms, strengthening supervision throughout the entire chain, and creating a good market ecology. The anticipated reforms are gradually becoming evident, and the supporting measures are becoming clearer, releasing new policy signals in the areas of new listing systems, liquidity, and judicial fields.

Regarding the science and technology innovation board, Zheshang Securities research report pointed out:

1. There are about 572 companies on the science and technology innovation board, and the industrial distribution has a strong sense of the times. Among them, the new generation of information technology industry accounts for about 236, accounting for 41%; the biotechnology industry accounts for about 109, accounting for 19%; the high-end equipment manufacturing industry accounts for about 94, accounting for 16%; the new materials account for about 69, accounting for 12%.

2. As for the fund dynamics, as of the first quarter of 2024, the allocation of ordinary equity and equity mixed funds to the science and technology innovation board accounts for about 9.89%, and the total scale of science and technology innovation board-related ETFs has reached 161.03 billion yuan.

3. Science and technology innovation board valuation: After continuous digestion, it is at a historical low. The science and technology innovation board was launched in July 2019, and its composition is mainly new stocks. After experiencing valuation digestion, the overall PE-TTM (excluding negative values) of the science and technology innovation board is about 36.8 times, and the PE-TTM of the science and technology innovation board 50 and the science and technology innovation board 100 are 34.4 times and 38.5 times respectively, which is close to the historical bottom level of the growth enterprise market.

4. Looking forward to the third quarter, three driving factors will catalyze the science and technology innovation board market: First, the brewing of hard technology; second, the improvement of profit bottoming out; third, the peak of large non-tradable shares to be unlocked.