Shenzhen Topway Video Communication (SZSE:002238) has had a rough three months with its share price down 41%. Given that stock prices are usually driven by a company's fundamentals over the long term, which in this case look pretty weak, we decided to study the company's key financial indicators. In this article, we decided to focus on Shenzhen Topway Video Communication's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Shenzhen Topway Video Communication is:

4.3% = CN¥103m ÷ CN¥2.4b (Based on the trailing twelve months to March 2024).

The 'return' is the profit over the last twelve months. So, this means that for every CN¥1 of its shareholder's investments, the company generates a profit of CN¥0.04.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company's earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don't share these attributes.

Shenzhen Topway Video Communication's Earnings Growth And 4.3% ROE

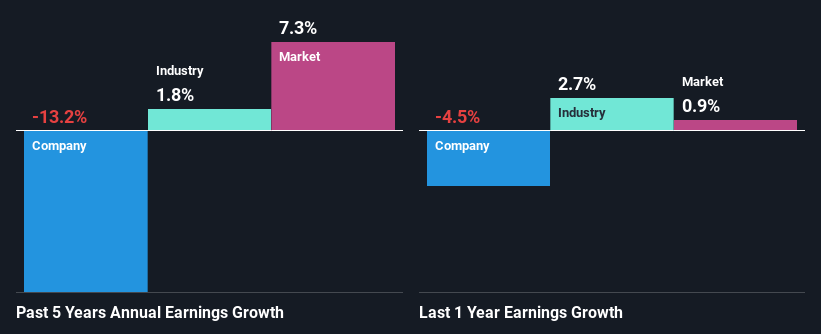

It is hard to argue that Shenzhen Topway Video Communication's ROE is much good in and of itself. An industry comparison shows that the company's ROE is not much different from the industry average of 4.9% either. Therefore, it might not be wrong to say that the five year net income decline of 13% seen by Shenzhen Topway Video Communication was possibly a result of the disappointing ROE.

That being said, we compared Shenzhen Topway Video Communication's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 1.8% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. It's important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Shenzhen Topway Video Communication is trading on a high P/E or a low P/E, relative to its industry.

Is Shenzhen Topway Video Communication Using Its Retained Earnings Effectively?

Shenzhen Topway Video Communication has a high three-year median payout ratio of 64% (that is, it is retaining 36% of its profits). This suggests that the company is paying most of its profits as dividends to its shareholders. This goes some way in explaining why its earnings have been shrinking. The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run. Our risks dashboard should have the 3 risks we have identified for Shenzhen Topway Video Communication.

Additionally, Shenzhen Topway Video Communication has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Conclusion

In total, we would have a hard think before deciding on any investment action concerning Shenzhen Topway Video Communication. As a result of its low ROE and lack of much reinvestment into the business, the company has seen a disappointing earnings growth rate. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Shenzhen Topway Video Communication's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com