Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Shanghai Baolong Automotive Corporation (SHSE:603197) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

How Much Debt Does Shanghai Baolong Automotive Carry?

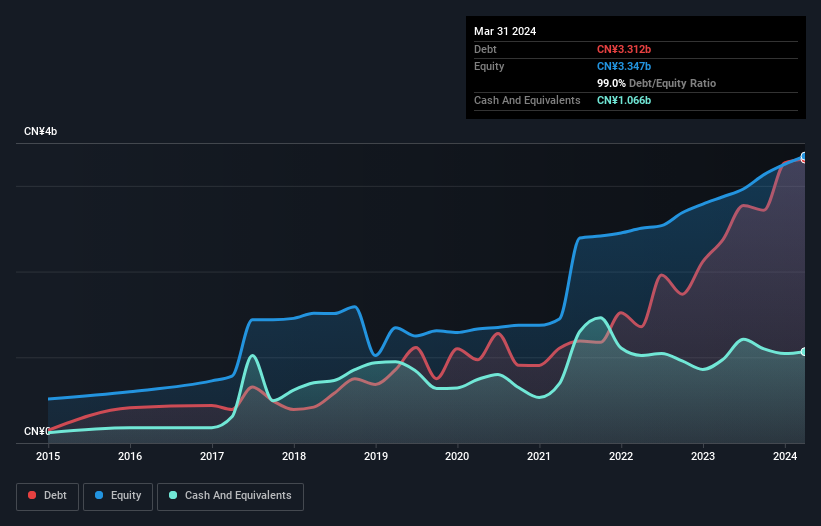

As you can see below, at the end of March 2024, Shanghai Baolong Automotive had CN¥3.31b of debt, up from CN¥2.37b a year ago. Click the image for more detail. However, it does have CN¥1.07b in cash offsetting this, leading to net debt of about CN¥2.25b.

How Strong Is Shanghai Baolong Automotive's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Shanghai Baolong Automotive had liabilities of CN¥2.91b due within 12 months and liabilities of CN¥2.34b due beyond that. Offsetting this, it had CN¥1.07b in cash and CN¥1.67b in receivables that were due within 12 months. So its liabilities total CN¥2.51b more than the combination of its cash and short-term receivables.

Shanghai Baolong Automotive has a market capitalization of CN¥7.17b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Shanghai Baolong Automotive's net debt is 3.2 times its EBITDA, which is a significant but still reasonable amount of leverage. But its EBIT was about 16.6 times its interest expense, implying the company isn't really paying a high cost to maintain that level of debt. Even were the low cost to prove unsustainable, that is a good sign. One way Shanghai Baolong Automotive could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 18%, as it did over the last year. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Shanghai Baolong Automotive can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Shanghai Baolong Automotive burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Neither Shanghai Baolong Automotive's ability to convert EBIT to free cash flow nor its net debt to EBITDA gave us confidence in its ability to take on more debt. But the good news is it seems to be able to cover its interest expense with its EBIT with ease. We think that Shanghai Baolong Automotive's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Shanghai Baolong Automotive (1 shouldn't be ignored!) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com