Revenue depends on five major customers.

According to Glonhoo, YX Technology Holding Co., Ltd. (referred to as "YX Technology") has launched its IPO. The subscription period is from today (June 21) to next Wednesday (June 26). It is expected to be listed on the Growth Enterprise Market (GEM) of the Hong Kong Stock Exchange on July 2 this year. The exclusive sponsor of the company is Dahua Jixian.

YX Technology (08637.HK) plans to globally issue 27 million shares (18% of the total share capital after the issuance), with 90% for international sales and 10% for public sales. The sale price per share is between HKD2.38 and HKD3.00, with a minimum purchase of 1000 shares.

Founded in 2000, YX Technology is a precision engineering service provider from Singapore, specializing in providing complex precision machining and precision welding services for semiconductor and other international companies in the industry.

According to the report from zhuoShi consulting, in 2023, YX Technology is ranked fifth in the semiconductor industry in the Singaporean precision components engineering industry in terms of revenue, with a market share of 3.3%. The company's customers are involved in multiple industries, such as semiconductors, aircraft, data storage, oil and gas, etc., and its customers are mostly internationally renowned companies recognized within the industry.

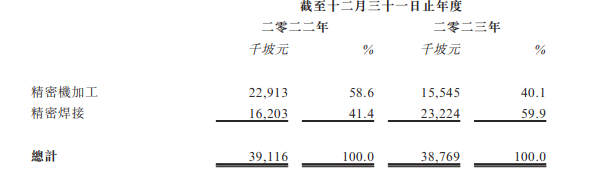

According to the prospectus, YX Technology derives most of its revenue from two types of services. The first is precision machining services, which remove high-precision materials to manufacture high-precision parts. They accounted for 58.6% and 40.1% of the company's total revenue in 2022 and 2023 respectively. The second is precision welding services, with precise control of welding technology, accounting for 41.4% and 59.9% of the company's total revenue during the same period.

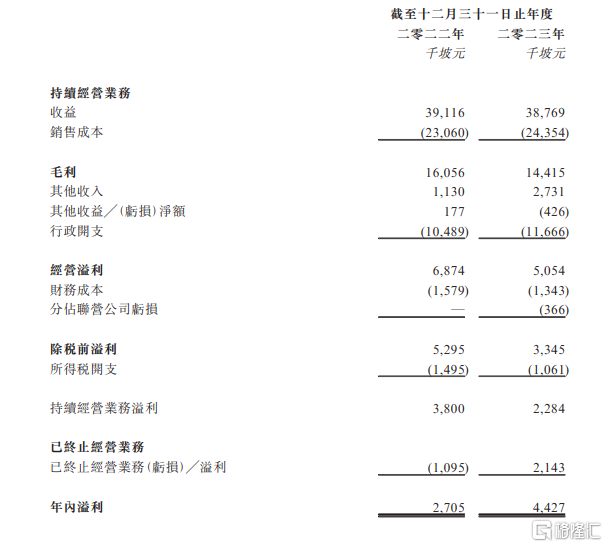

In terms of performance, according to the prospectus, the revenue of the company is approximately SGD 39.116 million and SGD 38.769 million in 2022 and 2023 respectively, and the net profits for the same periods are approximately SGD 2.705 million and SGD 4.427 million.

In 2022 and 2023, YX Technology's overall gross margin is approximately 41.0% and 37.2% respectively. Therefore, the company's gross margin showed a year-on-year downward trend last year.

YX Technology stated in the prospectus that in 2022 and 2023, the income from the top five customers will account for 76.0% and 80.0% of the company's total revenue respectively. The company cannot guarantee that it will be able to maintain business relationships with its major customers in the future. If any of these five major customers terminates their cooperation for any reason in the future, the company's business and operating performance may be adversely affected.

As for the equity structure, in the post-listing shareholder structure of YX Technology, Datuk Sri Chai Suileng, through SGP BVI, holds 39.10% of the shares, and his spouse holds 16.50% of the shares through Baccini.

In the prospectus, YX Technology stated that the net proceeds from the fundraising will be approximately HKD 20.6 million (calculated based on the median issue price), of which approximately 60.1% will be used to expand its operational scale and improve production capacity; approximately 15.4% will be used to strengthen the quality control capabilities of precision machining services; approximately 4.7% will be used to strengthen marketing activities to maintain and diversify its customer base; approximately 9.8% will be used to repay bank loans; and approximately 10.0% will be used for operating capital and other general corporate purposes.